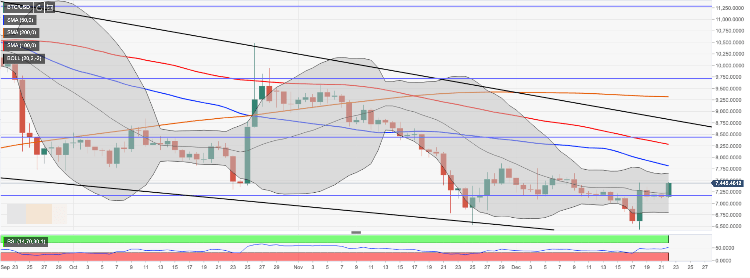

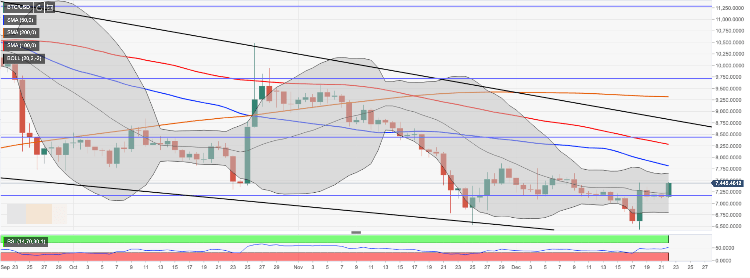

Bitcoin's rally gets traction, $8,000 within reach?

- BTC/USD bulls managed to engineer a sharp recovery.

- A move above $8,000 will be pivotal for further momentum.

Bitcoin (BTC) recovery has gained traction on Sunday. The first digital coin is changing hands at $7,435 at the time of writing; however, the upside momentum remains strong, which means Asian traders may wake up on Monday to see bitcoin and a new December high. BTC/USD has grown by 3.5% on a day-to-day basis and 4% since the beginning of the day.

All major altcoins are demonstrating similar momentum. ETH/USD has settled above $132.00, XRP/USD is exploring territory above $0.1900.

BTC/USD: technical picture

From the long-term post of view, BTC/USD used 61.8% Fibo retracement as a jumping-off ground and moved above the middle line of the daily Bollinger Band at $7,230. As the momentum gained traction, the price cleared both $7,300 and $7,400 barriers with the next hurdle located at $7,650 ( the upper line of the daily Bollinger Band) and $7,800 ( SMA50 (Simple Moving Average) daily). A sustainable move above this barrier will bring $8,000 into focus.

Meanwhile, according to a famous cryptocurrency technical analyst Joe Roger, this is a basic level for reversal.

BTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst