Bitcoin’s ‘Puell Multiple’ flashes misleading bullish signal as China bans mining

The metric is tied to miners and may be distorted by China's mining ban.

While a key bitcoin indicator shows the currency is undervalued and ripe for a price bounce, the reading might be misleading, one observer says.

“The Puell Multiple is flashing a buy signal,” Ben Lilly, a crypto economist at Jarvis Labs, noted in a Substack post published on Monday. The metric, however, is tied to miners and may be distorted by China’s mining ban, he said.

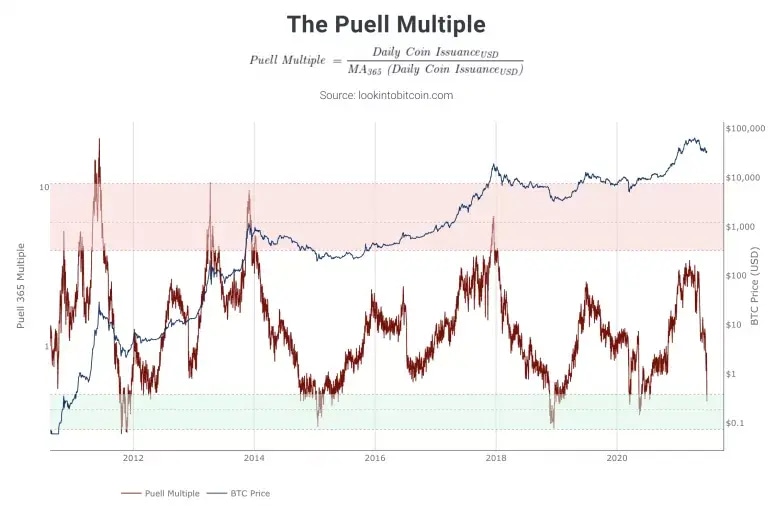

The multiple, the ratio of the daily issuance of bitcoin in U.S. dollar terms and the 365-day moving average of the daily issuance value, has dropped below 0.5. That indicates the value of the newly issued bitcoin daily is relatively low compared with historical standards.

A sub-0.5 reading on the indicator created by analyst David Puell has marked miner capitulation and bear market bottoms in the past, according to data provided by lookintobitcoin.com.

Daily issuance refers to the number of new coins supplied to the ecosystem by miners, who receive them as rewards for mining blocks and approving transactions. Miners mainly operate on cash and sell coins almost daily.

The latest reading may raise hopes for a bull market resumption. Lilly says it should be taken “with a grain of salt.”

That’s because the ratio’s drop into the green zone follows a slide in the hash rate and the daily issuance caused by China’s mining ban. It doesn’t necessarily imply miner capitulation.

China reiterated its long-held crypto mining ban in mid-May and stepped up its efforts this month, ordering miners based in Sichuan and other mining hubs to shut down their operations.

As a result, the hash rate, a measure of the computational power working to secure the bitcoin blockchain network, declined from 140 exahashes per second (EH/s) to a 14-month low of 94 EH/s.

With miners going offline, the 30-day average of the daily issuance – coins mined and supplied – has declined from more than 900 BTC to 760 BTC, according to Glassnode data. According to Lilly, the average daily issuance has nearly halved from 900 BTC. Meanwhile, the cryptocurrency has traded mainly in the range of $30,000 to $40,000 this month.

The data confirm the Puell Multiple has entered the buy zone mainly because of China-based miners going offline – a move that’s like to be temporary as there is evidence of miners shifting bases to other countries like the U.S. and Kazakhstan.

“This is a one-off event, meaning most of this mining power will return, and before you know it, MORE than 900 coins per day will be mined since the hash rate will hit the network after the difficulty of each block decreases,” Lilly noted.

Bitcoin is currently trading near $35,600, a 3% gain on the day, according to CoinDesk 20 data. While there is evidence of dip-demand for the cryptocurrency, a sustained accumulation by large investors might be needed to restore the battered market confidence and revive the bull run.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.