Bitcoin's dominance chart suggests alt season may never come

- A lot of crypto traders expect the alt season to begin soon, but they could be wrong.

- Bitcoin’s dominance continues rising and it’s on the verge of cracking a critical resistance level.

One of the most common theories and indicators of the beginning of alt seasons is the decline in Bitcoin’s dominance which currently stands at 68.4%. In 2017, Bitcoin’s dominance hit 63% right before plummeting down to 32% which paved the way for the alt season.

Bitcoin’s dominance needs to plummet for the alt season to begin

Most traders and analysts agree, Bitcoin’s dominance needs to decline or at least remain flat for an alt season to begin. So far, Bitcoin’s dominance has been rapidly rising since November 2020.

I do think there will be an alt season of sorts but this would be a real, real heartbreaker for some.

— f i l ₿ f i l ₿ (@filbfilb) January 4, 2021

As i say, i doubt it but... its there and possible. pic.twitter.com/hOuBOlmvjW

According to a popular analyst on Twitter, Bitcoin’s dominance seems to be facing a critical resistance level at around 71.5%. This point hasn’t been cracked since 2017 and would indicate that alt season will have to wait longer. It’s also important to note that Bitcoin’s dominance percentage currently cannot be directly related to the past as the cryptocurrency market has thousands of other coins and tokens that are inflating the altcoin market capitalization.

A breakout of 71.5% would be devastating for many altcoins as many investors are already worried due to the SEC. A few weeks ago, the SEC sued Ripple because it considers XRP a security. Other prominent coins like XLM could be potential targets in the future.

Alt season chart

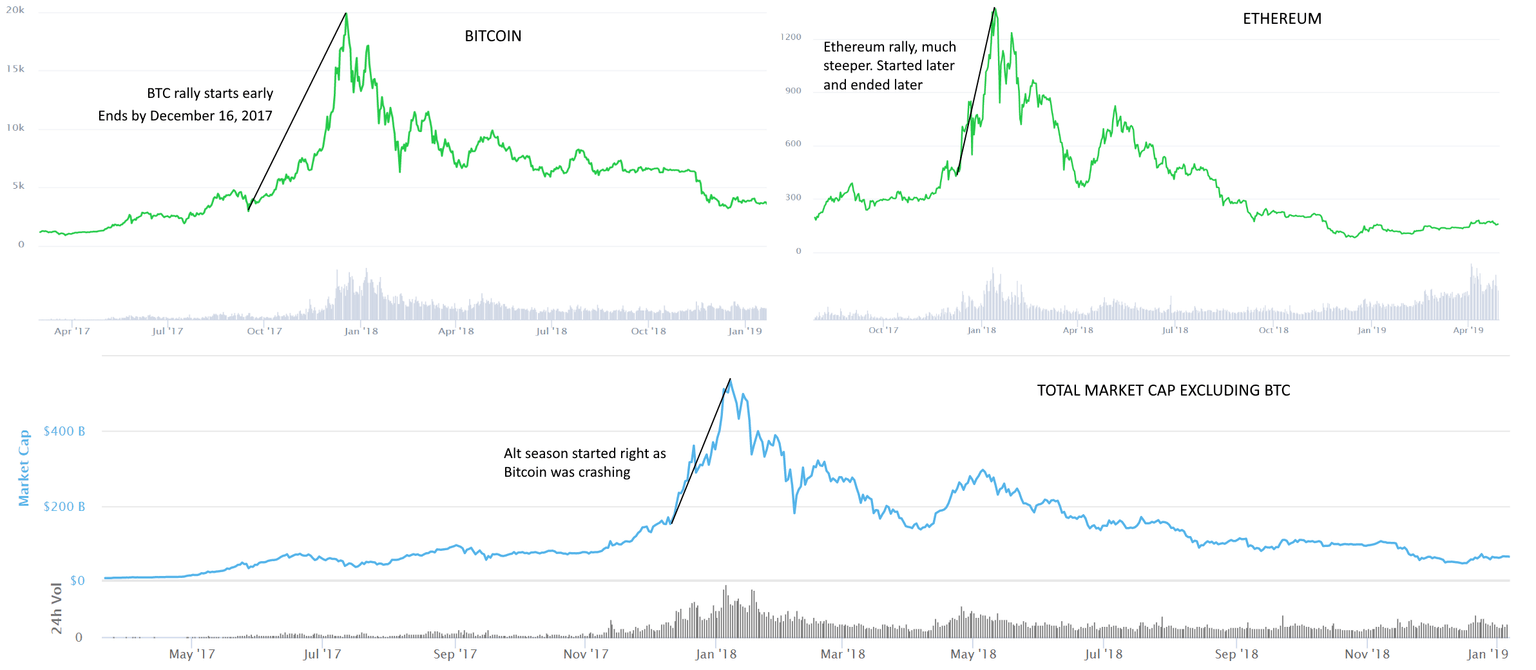

On the other hand, if Bitcoin’s dominance plummets and Ethereum continues rising, an alt season would be likely. In 2017, Bitcoin hit an all-time high of around $20,000. Ethereum price followed it but later. Bitcoin then crashed significantly while Ethereum continued surging and the alt season started.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.