- Bitcoin breaks above $17,000 and is ready to retest all-time high.

- The short-term correction may precede the next bullish wave.

Now that Bitcoin broke above $17,000, there are many bets on it to hit a new all-time high by the end of the year. However, the market may be doomed for another downside correction before the next victorious wave happens. And that is something BTC investors should be aware of.

Bitcoin on-chain metrics support a bullish outlook

At the time of writing, BTC/USD is hovering around $17,000 and most likely the pioneer cryptocurrency will have its first daily candle above the mentioned threshold in many months. This development will create strong bullish momentum and anticipation of further price increase in the community.

However, there is more than just excitement about it. For instance, the open interest in Bitcoin futures market on CME reached $975 million and may hit $1 billion as early as this week, provided that the spot market retains positive bias.

BTC Futures on CME, Arcane Research

BTC supply on exchanges dropped below 700,000 coins for the first time since October 2018, signaling that the market has entered an accumulation phase. The selling pressure has been decreasing. Naturally, the reduced Bitcoin supply amid growing demand leads to a substantial price increase.

Bitcoin supply on exchanges

Macro factors lure investors to the cryptocurrency market

External factors also create a positive environment for Bitcoin as fiat currencies are debased by the money-printing habits that the global central bankers are adopting. As FXStreet recently reported, Bitcoin is now more valuable than the national currency of many large economies, including Russia, Sweden and Australia.

While this cryptocurrency is small when compared to gold, USD or euro, it will catch up quickly if governments persist in their attempts to escape recession via monetary easing.

#Bitcoin is still small when you compare it to the M1 money supply of major currencies.

— ecoinometrics (@ecoinometrics) November 16, 2020

But it might only take #BTC a couple more halving cycles to rise towards the top and compete at least with gold.

More on that here https://t.co/LNpOiA6aDU pic.twitter.com/GUUW7Yw2Ro

Joe Biden's presidency is another potentially positive factor for the cryptocurrency industry as the President-elect supports innovations and favors more aggressive stimuli. Moreover, he is expected to choose Bitcoin-friendly people to fill some top positions in his administration.

Also, institutional investors have been paying attention to the industry as big players such as Fidelity Investments, Square Inc. and MicroStrategy Inc. have recently increased their BTC exposure.

At the same time, experts emphasize that Bitcoin is far from being overhyped now. According to Guy Hirsch, eToro's Managing Director, this rally is less speculative than the one seen in 2017, which is a good thing in the long run.

Speaking in an interview with Bloomberg, he explained:

At the height of the crypto boom, he was seeing around 120,000 Bitcoin-related tweets a day. That number now oscillates between 30,000 and 60,000, according to data from eToro and The Tie.

Beware of the short-term correction; it is inevitable

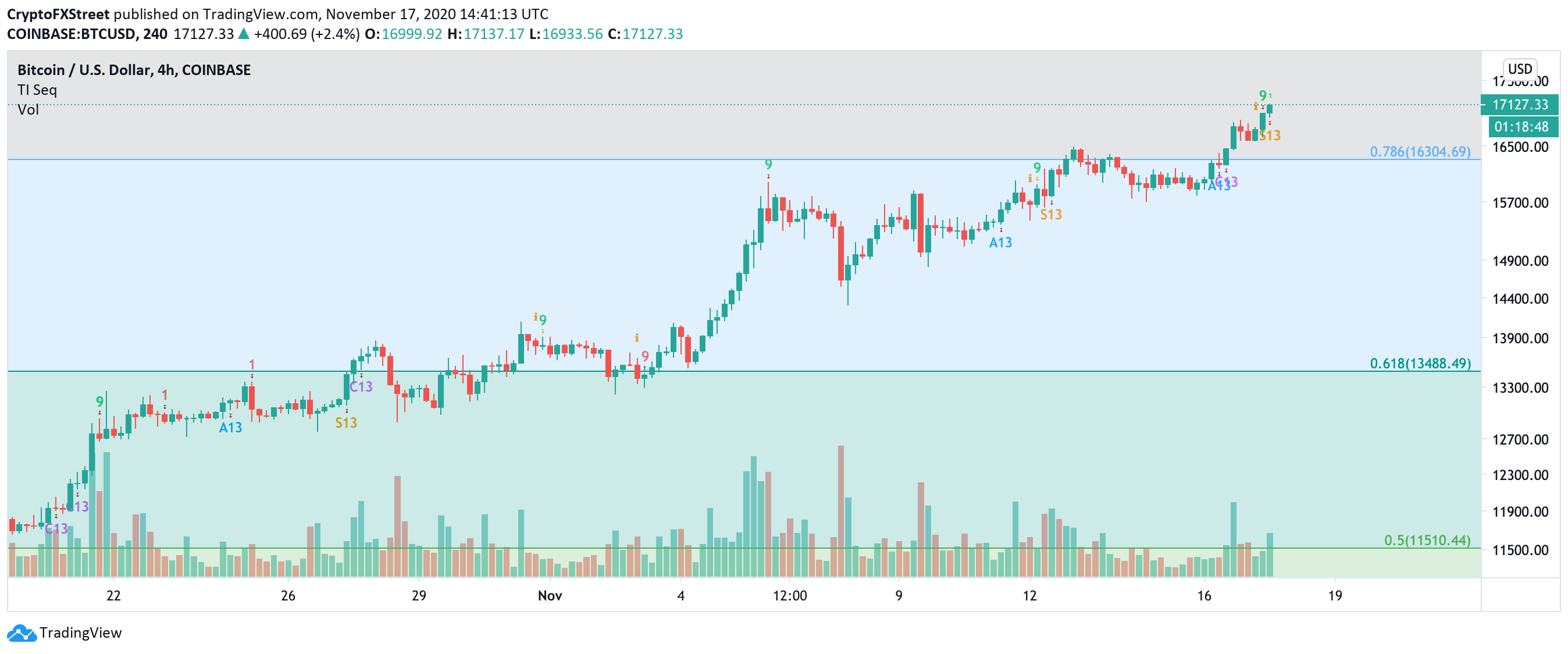

The TD Sequential indicator presented a sell signal on Bitcoin 4-hour chart, adding credence to the short-term sell-off. The bearish formation developed as a green nine candlestick anticipating a one to four three-day candlesticks correction. A red two candlestick trading below a preceding red one candle will serve as a confirmation that Bitcoin is poised to retest the local support before the upside is resumed.

The initial bearish target is created by 0.76 Fibonacci retracement level at $16,300. Once it is out of the way, the sell-off may gain traction with the next focus on $16,000.

BTC/USD 4-hour chart

On the other hand, further growth looks like the path of least resistance now as there are no technical barriers between the current price and the all-time high on approach to $20,000. A sustainable move above $17,300 will invalidate the short-term bearish scenario and increase the bullish momentum.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Lukas Enzersdorfer-Konrad, Bitpanda deputy CEO: “Crypto needs Gary Gensler gone”

Lukas Enzersdorfer-Konrad is the deputy CEO at Bitpanda, a broker based in Europe with more than five million users. At the European Blockchain Convention held in Barcelona, the executive shared with FXStreet his views on the current state of the crypto industry and its regulation.

Bitcoin still consolidates despite positive spot ETFs demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

Why is ONDO’s price outlook bullish?

DefiLlama data shows that Ondo TVL reached a new ATH of $613.75 million. Ondo’s Supply Distribution metric shows whale accumulation. On-chain data shows that ONDO’s daily trading volume is rising, and the supply of exchanges is decreasing.

Maker price eyes a rally on technicals and on-chain metrics

Maker trades above $1,500 on Thursday, suggesting a potential rally as technical indicators show bullish divergence. This positive outlook is reinforced by MKR’s Exchange Flow Balance, which shows a negative spike, indicating growing investor confidence in the platform.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.

Arcane Research-637412217732065262.png)

[17.13.07, 17 Nov, 2020]-637412217343276939.png)