-

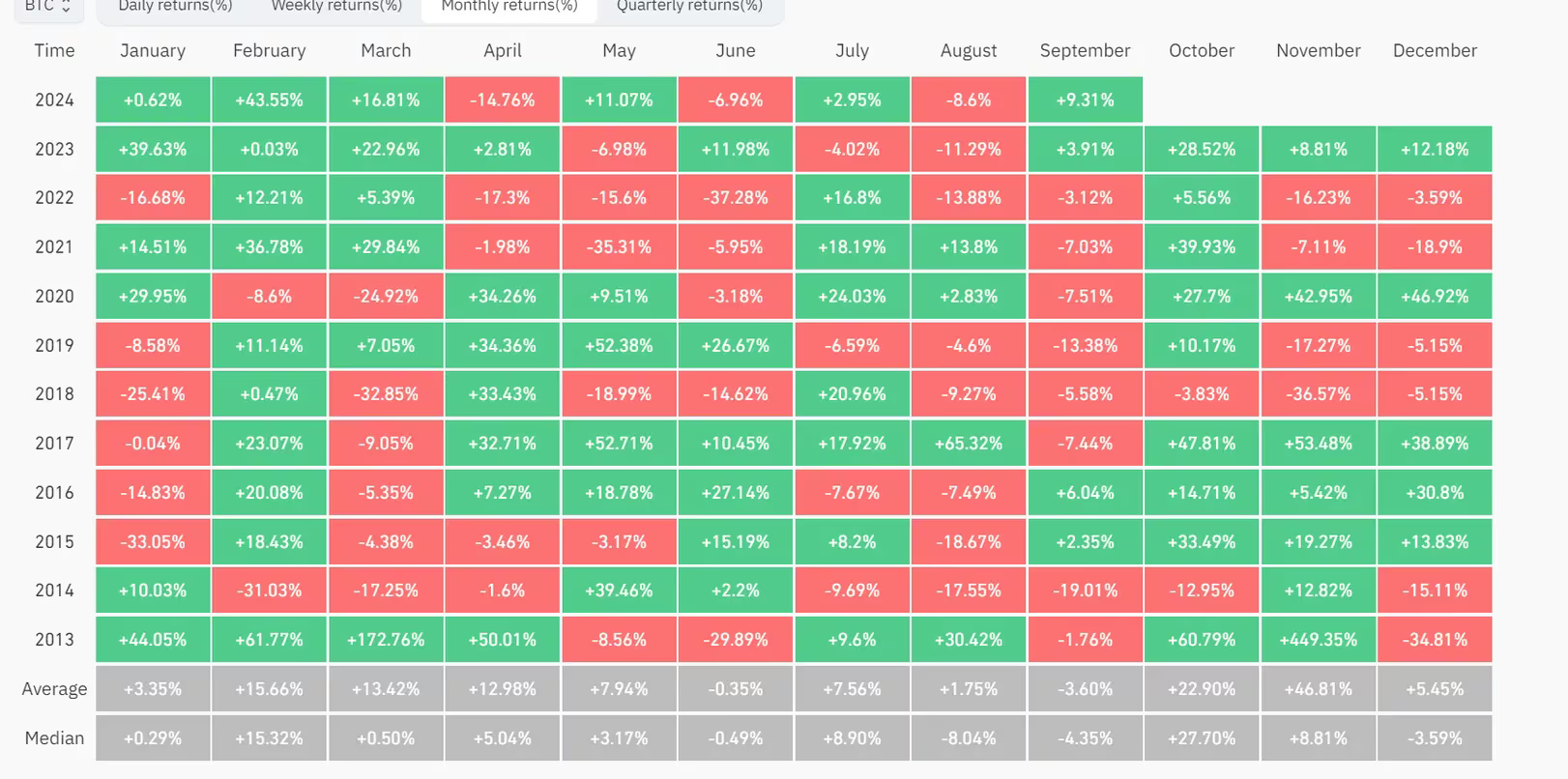

Bitcoin is set to record a gain of at least 9% this September, defying its historical trend of negative returns for the month, with only two prior instances of positive growth since 2013.

-

October traditionally favors Bitcoin with only two negative months since 2013, and current market conditions, including global monetary policies and U.S. political support, suggest a continued bullish trend potentially pushing Bitcoin toward $70,000 from around $64,000.

Bitcoin’s (BTC) historically worst month may have be its best one yet, with the asset on track to gain at least 9% this September, beating a trend that’s seen it end in the red eight times since 2013.

And that’s putting the asset on a stronger footing going into October, the start of a generally bullish period with some traders targeting a run to as much as $70,000 in the coming weeks from the current $64,000 levels. A green September has always resulted in bitcoin closing higher in October, November and December.

In contrast to September, there have just been two October months where bitcoin has ended in the red since 2013 - chalking gains of as high as 60% and an average of 22%.

(CoinGlass)

Seasonality is the tendency of assets to experience regular and predictable changes that recur during the calendar year. While it may look random, possible reasons range from profit-taking around tax season in April and May, which causes drawdowns, to the generally bullish “Santa Claus” rally in December, a sign of increased demand.

September has recorded an average value depletion rate of 6.56% in bitcoin, as previously reported, leading to traders being generally defensive about betting on higher prices.

But it gained amid a slew of global monetary easing policies, a weakening yen, increased institutional investments in bitcoin and both political parties in the U.S. - which influence market movements - showing a favorable sentiment toward the crypto market ahead of November elections.

The trend is widely expected to continue.

“With crypto correlations staying high to macro assets, particularly against the SPX, we consider the friendly macro background to remain a strong tailwind for crypto prices into Q4,” Augustine Fan, head of insights at SOFA, told CoinDesk in a Telegram message.

“Furthermore, with the Kamala camp playing lip service to crypto 'support' as part of her campaign rhetoric, we remain bullish on price action in the near term, with targeted put-selling strategies likely to be popular as investors switch into a 'buy-the-dip' mode,” he added.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin faces resistance around $66,000

Bitcoin is at a critical resistance point, and a close above this level could signal further gains. At the same time, Ethereum and Ripple are gaining momentum as they establish support and break through their key levels, hinting at potential rallies ahead.

Binance users earn Dogecoin and Bellscoin rewards through mining Litecoin

Binance Pool users can earn rewards in Bellscoin (BEL) and Dogecoin (DOGE), in addition to Litecoin (LTC) rewards through merge mining.

Top dog-theme meme coins WIF, BONK, FLOKI: Double-digit gains on the horizon

The prices of top trending dog-theme-based meme coins, Dogwifhat (WIF), Bonk (BONK) and FLOKI (FLOKI), hold gains on Monday after prices increased more than 20% last week.

FTX creditors closer to repayment, voting on payback plan begins on October 7

FTX creditors could soon receive payback of lost funds according to court documents and a call to vote that surfaced online. The official committee of unsecured creditors of FTX called upon investors who lost their funds to the FTX collapse to vote on a proposed repayment plan on October 7.

Bitcoin Weekly Forecast: $70,000 mark on sight as bulls remain strong

Bitcoin has risen around 3% so far this week, breaking above its range upper limit of $64,700. This gain was supported by increased institutional demand for ETFs, which recorded inflows of more than $612 million this week.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.