Bitcoin whales: Why they matter and who they are

In the cryptocurrency community, individuals or organizations that hold large amounts of Bitcoin and have the power to manipulate the value of Bitcoin are known as Bitcoin whales. The metaphor of whales is used because when these major players move on the market, they disturb the waters in which smaller fish swim.

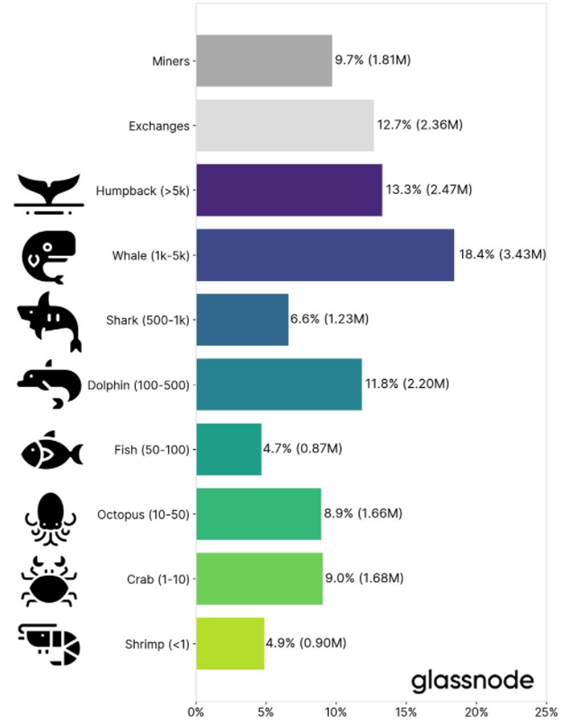

Source: Glassnode

Other players are referred to as other marine animals in crypto space depending on the amounts of Bitcoin they hold. In the above graph, Glassnode shows how much BTC is owned by each category.

Cryptocurrency whales, who own millions of dollars in Bitcoin, have the power to move markets solely on their own. They can cause a surge in volatility due to their concentration of wealth, sparking speculation among little fish, and making prices more reliant on it than on underlying fundamentals.

When a major seller sells a lot of Bitcoins for a fiat currency at once, the lack of liquidity and a large transaction size can cause great selling pressure, making other market participants also trying to sell. That’s why we at ChangeNOW.io closely follow the main whales’ moves.

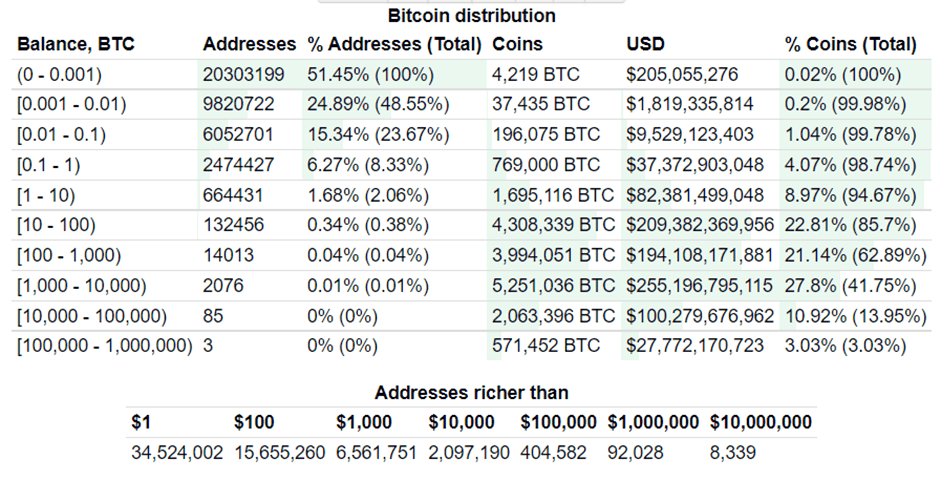

According to BitInfoCharts, just three BTC wallets own 3.03% of all the Bitcoin in circulation, and the top 100 wallets hold around 18% of all BTC.

Source: bitinfocharts.com

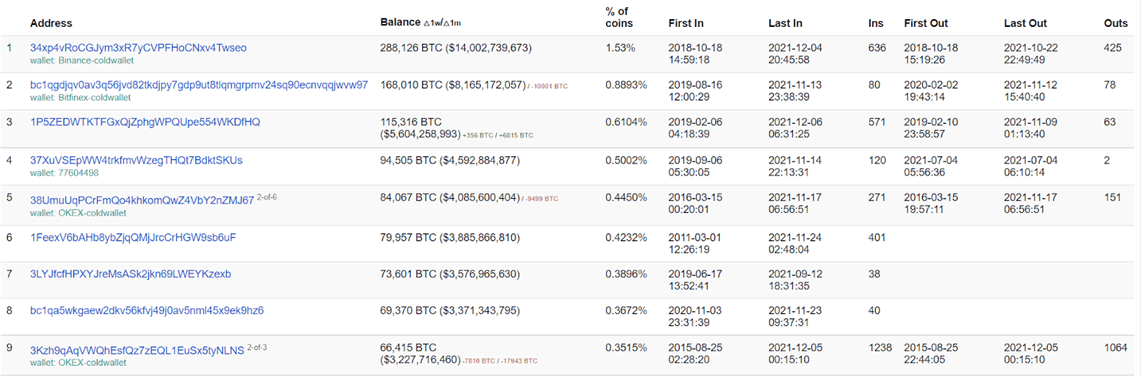

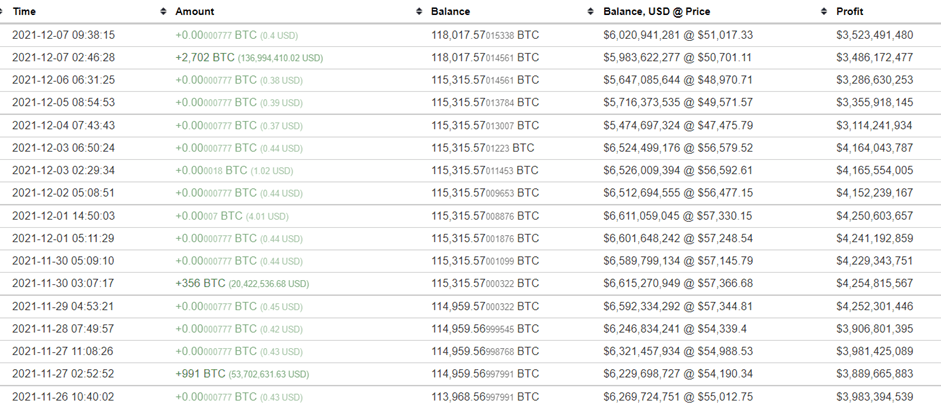

Below is the latest activity of the richest BTC wallets, according to BitInfoCharts:

Source: bitinfocharts.com

The first two wallets belong to exchanges. Yet, the third-largest is considered a non-exchange whale address, so it's interesting to investigate its activity.

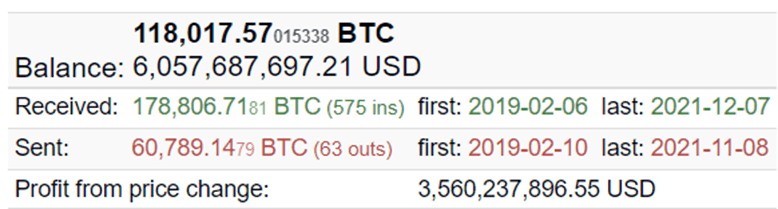

The wallet 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ currently holds 118,017.57 BTC worth at the time of writing around $6.57 billion.

It has made a jaw-dropping $3.5 billion profit from BTC price fluctuations during its entire activity since October 2019:

Source: bitinfocharts.com

Recently, the address has been accumulating BTC in small amounts, a move common among whales seeking to avoid drawing attention to themselves.

However, one of the latest transaction added a sizeable chunk of 2,702 BTC worth $136.99 million to the wallet.

Source: bitinfocharts.com

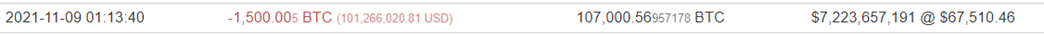

The last time it sent Bitcoin was on 9th November 2021, a day before the flagship crypto reached its all-time high. It was a 1,500 BTC transaction, with BTC valued at $67,510.

Back then, 1,500 Bitcoins were worth $110.2 million, an enormous amount.

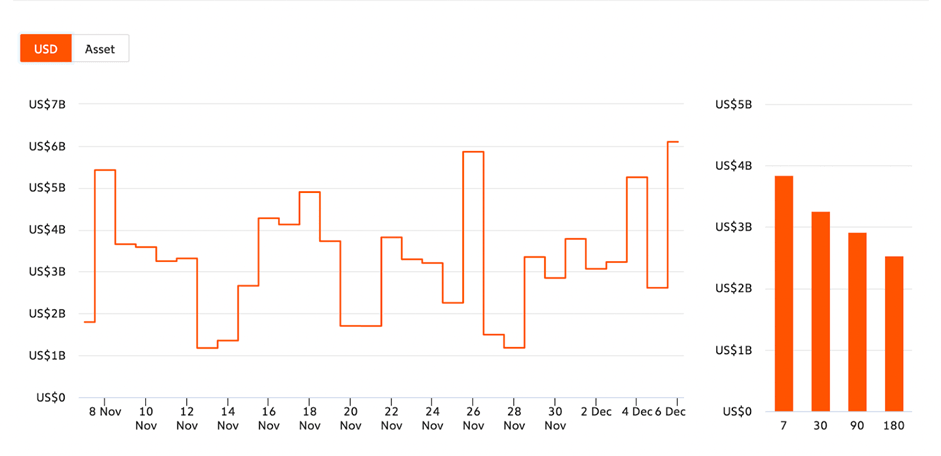

Onchain statistics indicate that whales and long-term holders have been spending recently, with blockchain parsers recording a massive amount of activity in recent days.

Chainalysis data indicates that exchanges have seen massive inflows of BTC, with the number of BTC entering exchanges as of December 6th standing at 124.38K BTC, the highest level in the last 133 days.

Source: Chainalysis

Bitcoin Whales: Who Are They?

Satoshi Nakamoto

Satoshi Nakamoto, the anonymous creator of Bitcoin, was also its first miner. Satoshi estimated to hold the largest bitcoin cache as he mined more than 22,000 blocks and earned over a million BTC as a reward. Satoshi's identity remained unknown, but recent developments took some interesting turns.

In a major US court case, an Australian businessman Craig Wright who claims to have invented Bitcoin recently won the right to avoid paying a former business partner tens of billions of dollars in Bitcoins.

The jury stated that Wright was behind the pseudonymous Bitcoin white paper author Satoshi Nakamoto. However, Wright's claims are met with skepticism in the crypto community, in part because he hasn't been able to move any of the original BTC mined by Satoshi. Personally, I still don’t believe they are the same person.

The Winklevoss twins

Cameron Winklevoss and Tyler Winklevoss, portrayed by Armie Hammer in The Social Network, were early Bitcoin enthusiasts. According to reports, they hold more than 100,000 bitcoins, placing them near the top of the list.

Matthew Roszak

Another early adopter, venture capitalist Mark Roszak bought his first Bitcoin in 2012. He's now the chairman and co-founder of Bloq, a company dedicated to blockchain innovation. Roszak is also the chair of the Chamber of Digital Commerce, the first blockchain trade organization.

Michael Saylor

Another crypto advocate is MicroStrategy's founder, entrepreneur, and CEO. Saylor owns over 17,700 Bitcoins, and MicroStrategy bought over $1 billion worth of Bitcoins last year. MicroStrategy is eager to see more businesses adopt Bitcoins. It has even published a Bitcoin corporate playbook on its website.

Tim Draper

Tim Draper is a US entrepreneur and venture capitalist who founded Draper Fisher Jurvetson, Draper Venture Network, Draper Associates, and Draper Goren Holm.

Ancestry.com, Twitch, Tesla, Hotmail, SpaceX, AngelList, Twitter, Coinbase, Robinhood, Hotmail, Skype, and Boeing have all been invested in by Draper. He is an advocate of Bitcoin and decentralization.

Micree Zhan

Micree Zhan is the co-founder of Bitmain Technologies, a Bitcoin mining company. It is rumored that Zhan owns the second largest amount of Bitcoin wealth. It was Jihan Wu, Zhan's former business partner, who translated Satoshi's inaugural Bitcoin white-paper into Mandarin.

Chris Larsen

He was one of the earliest cryptocurrency pioneers. Larsen is the founder and former CEO of Ripple and the second wealthiest bitcoin billionaire. Despite his recent criticisms of the cryptocurrency industry, Larsen is estimated to be the richest person to have built the entirety of his fortune on cryptocurrency. He is believed to be worth more than $6 billion.

Changpeng Zhao

If you have one of the largest cryptocurrency exchanges in the world, it makes sense that you'd also be a leader in the Bitcoin industry. Changpeng Zhao founded Binance in 2017. Zhao's net worth is estimated at around $1.9 billion, almost all of which comes from cryptocurrencies, primarily Bitcoin.

Author

Mike Ermolaev

Independent Analyst

Mike Ermolaev is the founder of Outset PR. The agency helps tech companies, especially blockchain and Web3 projects, get the desired recognition thanks to its wealth of media connections.