Bitcoin whales rise in numbers signaling strong confidence in BTC rally or positioning for profit taking

- Bitcoin whale addresses holding over 1,000 BTC noted an uptick, reaching its highest level since August 2022.

- The massive spike in large wallet addresses either signals whales’ confidence in BTC price or an upcoming shift in Bitcoin price trend.

- Bitcoin price inches closer to the support zone where 1.62 million BTC addresses added 706,870 BTC to their holdings.

Bitcoin price noted a small uptick in its price after dipping into the support zone between $38,064 and $40,796. Bitcoin wallet addresses holding over 1,000 BTC climbed to 1,510, highest level since August 2022.

BTC price is $41,707, at the time of writing.

Bitcoin sees uptick in whales

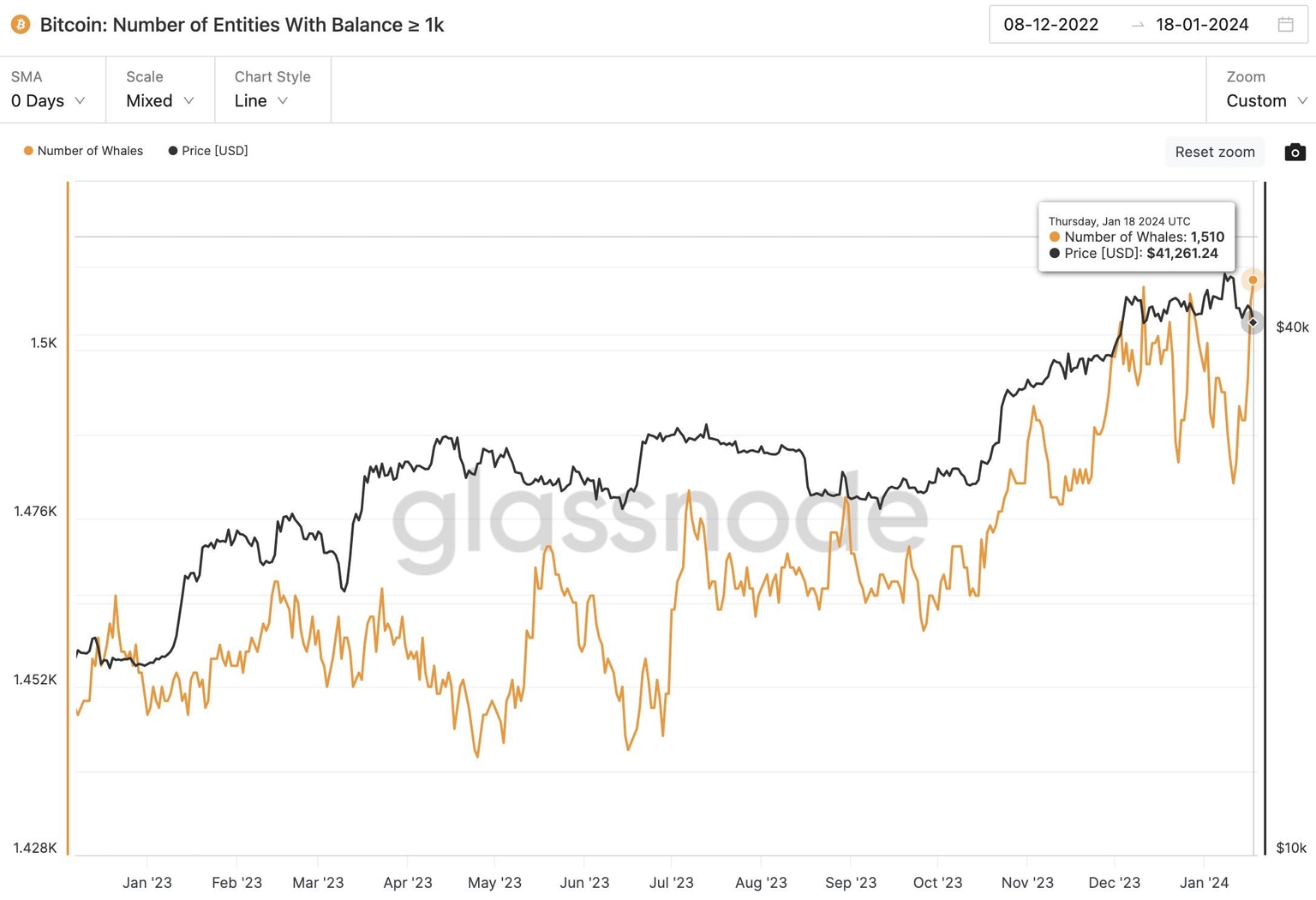

According to data from Glassnode, the number of addresses holding over 1,000 BTC has hit its highest level since August 2022. The total has reached 1,510. An increase in the number of large wallet addresses either signals a rise in traders’ confidence on Bitcoin or whales are likely positioning themselves for a shift in BTC price trend.

Bitcoin: Number of Entities with Balance greater than 1,000 BTC. Source: Glassnode

Bitcoin traders recently realized $885 million in profit on BTC acquired between three and six months ago, at an average price of $26,000, according to Glassnode data. Traders netted a profit above 57%. If the profit-taking streaks of BTC traders continues, it is likely that whales take profits on their BTC holdings, increasing the selling pressure on the asset.

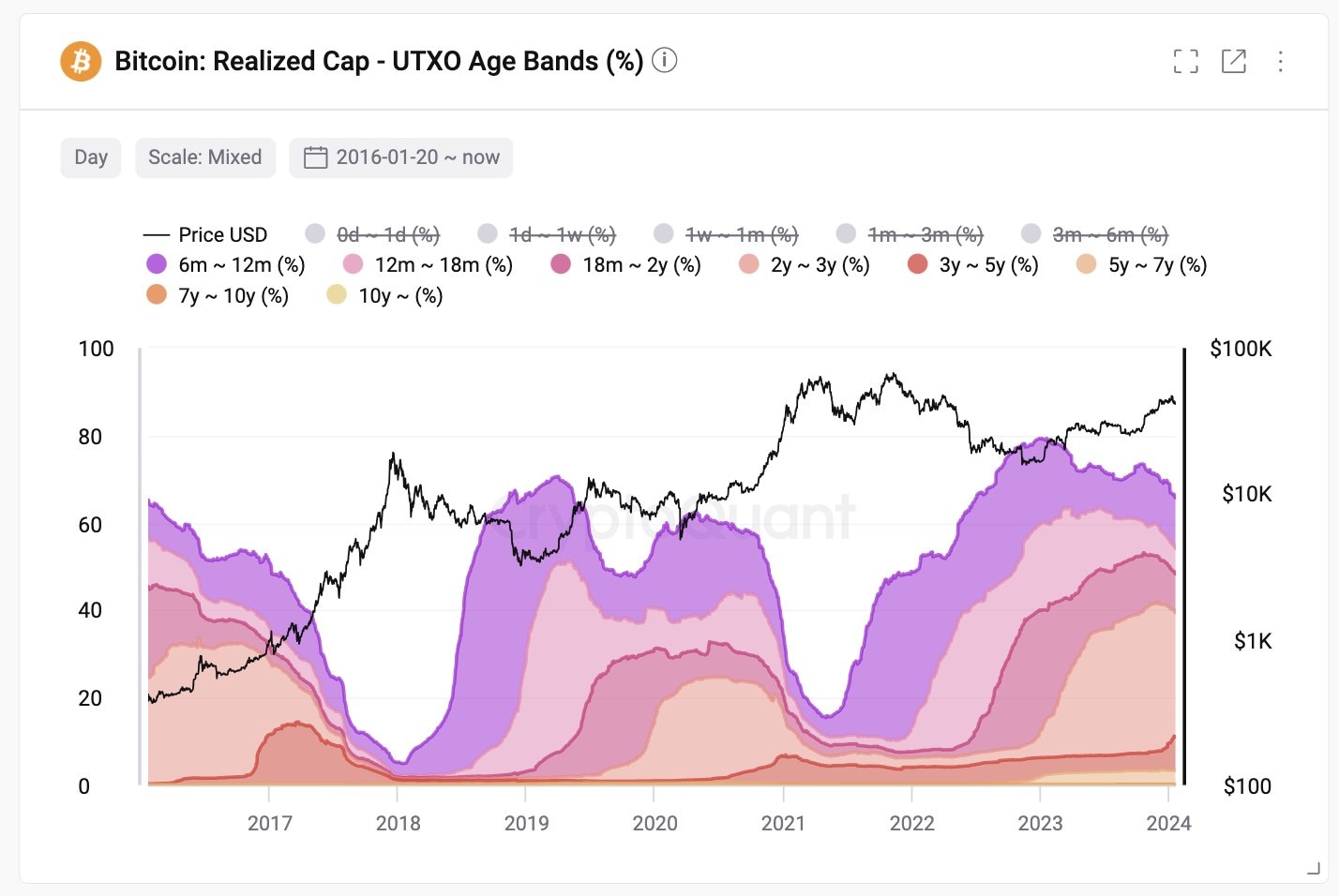

According to CryptoQuant data, Bitcoin is in the distribution phase and the asset is not distrbited to retailers fully. A short-term correction in BTC price is likely, according to CryptoQuant founder Ki Young Ju. The expert believes Bitcoin is currently in a long-term bull market cycle until there is a complete distribution of the asset.

Bitcoin realized cap and distribution. Source: CryptoQuant

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.