Bitcoin whales make a comeback as open interest hits 15-month high ahead of CPI announcement

- Bitcoin price grazed the $30,000 psychological level on August 8 after a near 5% rally over the last 48 hours.

- This spike in open interest shows a renewed interest from high-net-worth investors ahead of the US CPI announcement on August 10.

- If the open interest sustains, BTC volatility could return from all-time lows.

Bitcoin price shows a clean push toward the $30,000 psychological level after sweeping critical lows on August 7. This uptick, while promising, could face a blockade between the $30,800 to $31,000 area, leading to a reversal followed by massive long liquidations.

Bitcoin price rises as whales come back

Bitcoin price made a strong comeback in the last 48 hours that has pushed it above the $30,000 psychological level. Currently, BTC trades just below this key barrier as it builds up steam for more upside.

BTC/USDT 4-hour chart

Taking a look at the on-chain metrics reveals that this move was sparked by whales, as pointed out by Ki Young, the founder of The CryptoQuant. In his tweet thread, the CEO explained via the Taker Buy Sell Ratio that whales opened long positions at $29,000.

The Taker Buy Sell Ratio indicator is essentially the result of dividing perpetual swap trades’ buy volume by sell volume.

#Bitcoin whales opened giga long positions at $29k.https://t.co/WulPUE47ab https://t.co/GNmIiRJ7EJ pic.twitter.com/CbJsn06plF

— Ki Young Ju (@ki_young_ju) August 8, 2023

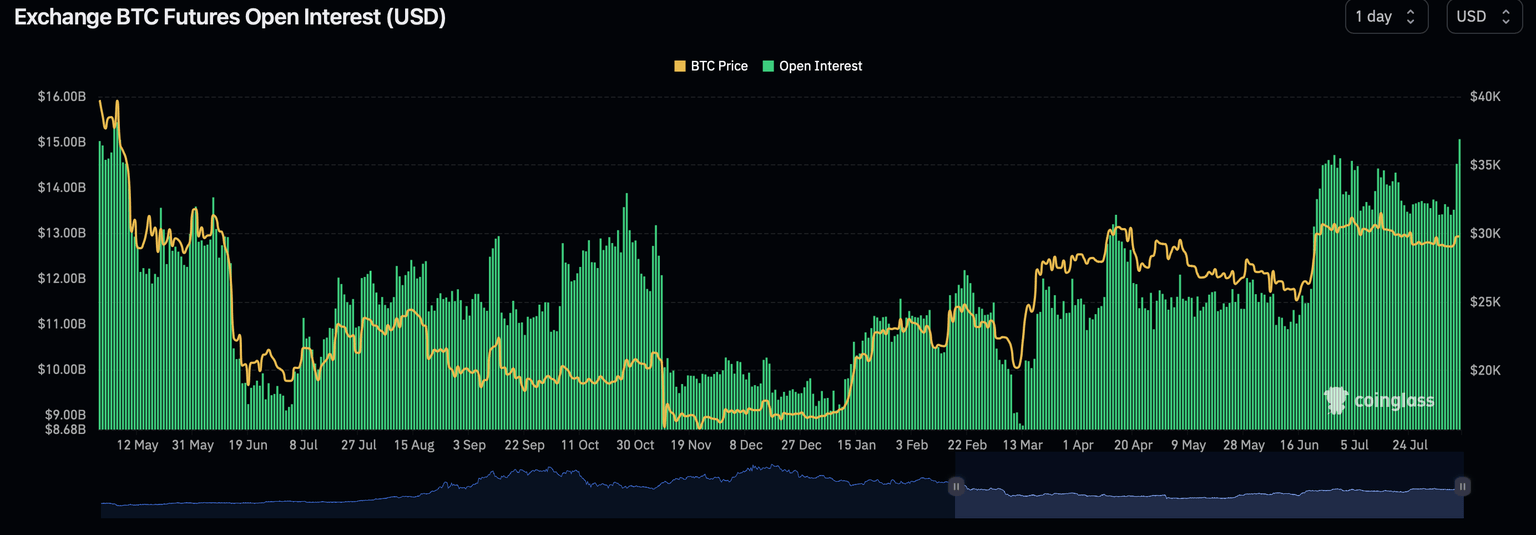

The same can be seen reflected in the open interest chart for Bitcoin price, which rose nearly 15% in under 48 hours on the Binance exchange to roughly $4 billion. Currently, the total Bitcoin open interest on all exchanges stands at a whopping $15 billion, which is a 15-month high. The last time Bitcoin’s open interest was this high was in early May 2022 when BTC price had freshly slipped below the $40,000 psychological level.

BTC open interest

Are whales preparing for Fed’s CPI announcement?

It is not uncommon for smart money or whales to capitalize on the volatility induced by macroeconomic events. The same has held true for the whole of 2022 and most of 2023. But of late, Bitcoin’s correlation with the stock market has dropped sharply.

Due to this decline, Bitcoin price failed to react to the Nonfarm Payrolls (NFP) announcement in July. But the Consumer Price Index (CPI) is a key event and could induce volatility for Bitcoin, which has been led astray and reached fresh lows.

BTC volatility

Read more: Could Bitcoin price advance amid higher US inflation rate expectations?

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.