Rich crypto investors are turning their attention back to Bitcoin (BTC) as its price continues to eye a breakout move above $50,000.

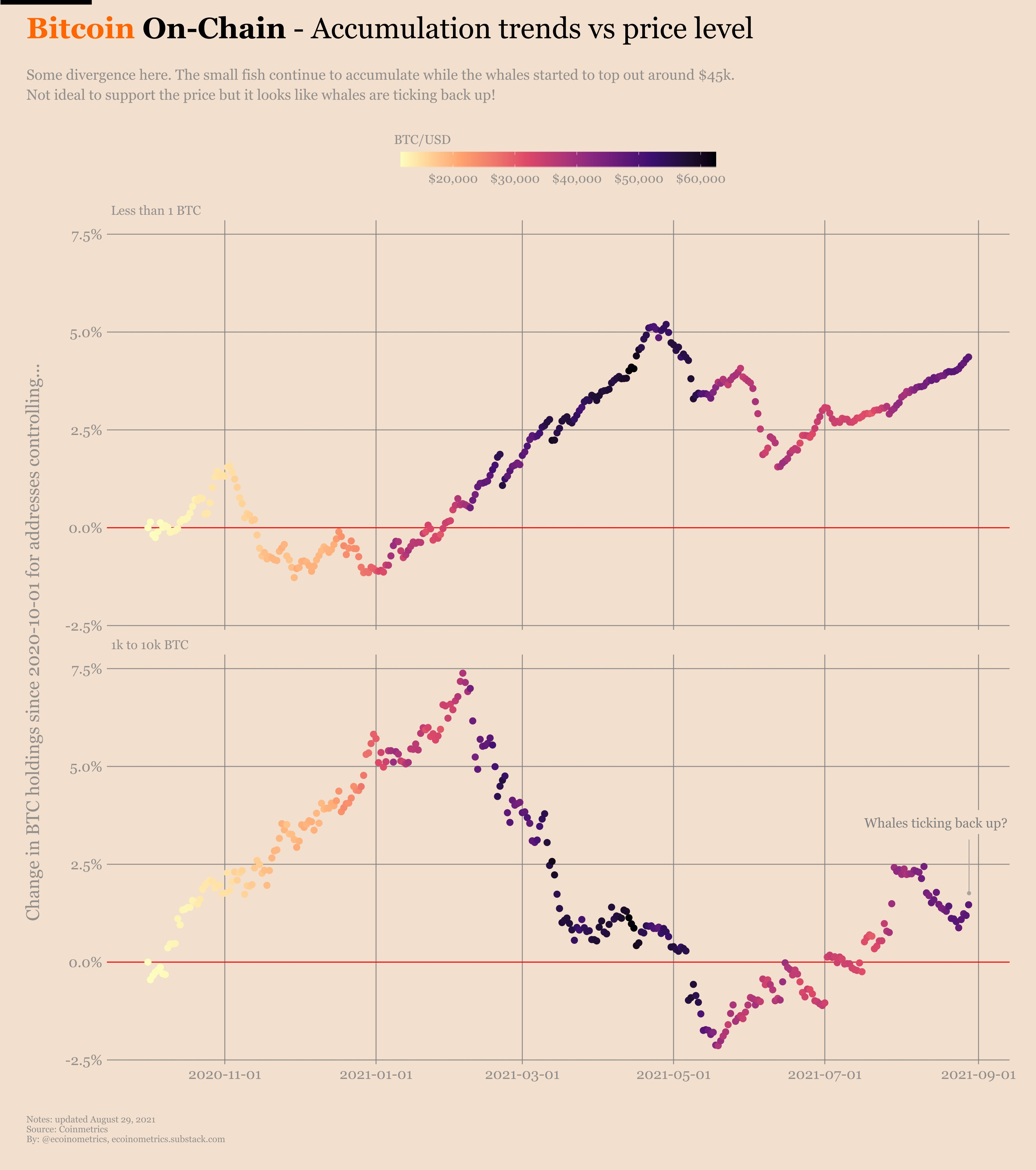

Crypto-focused newsletter Ecoinometrics reported positive changes in Bitcoin holdings for addresses controlling 1,000-10,000 BTC. So, based on their rising account balances throughout August, Ecoinometrics spotted a renewed accumulation sentiment among "whales," hinting that wealthy investors consider the current Bitcoin price levels as attractive to place bullish bets.

Bitcoin accumulation trend versus price levels. Source: Ecoinometrics

The sentiment appeared the same among small fishes—Bitcoin investors that hold less than 1 BTC. Ecoinometrics reported that they have been accumulating Bitcoin since June and, during a period, have also absorbed the selling pressure coming from the whales' side. Their buying sentiment coincided with a price rally to $50,000, a key psychological resistance level.

"Recently, there has been some on-chain divergence between small fish who are accumulating coins [and] whales who are offloading coins," tweeted Ecoinometrics on Sunday.

"That's not ideal [for supporting] Bitcoin's price, but it looks like things are changing! Whales are ticking back up."

Supportive data

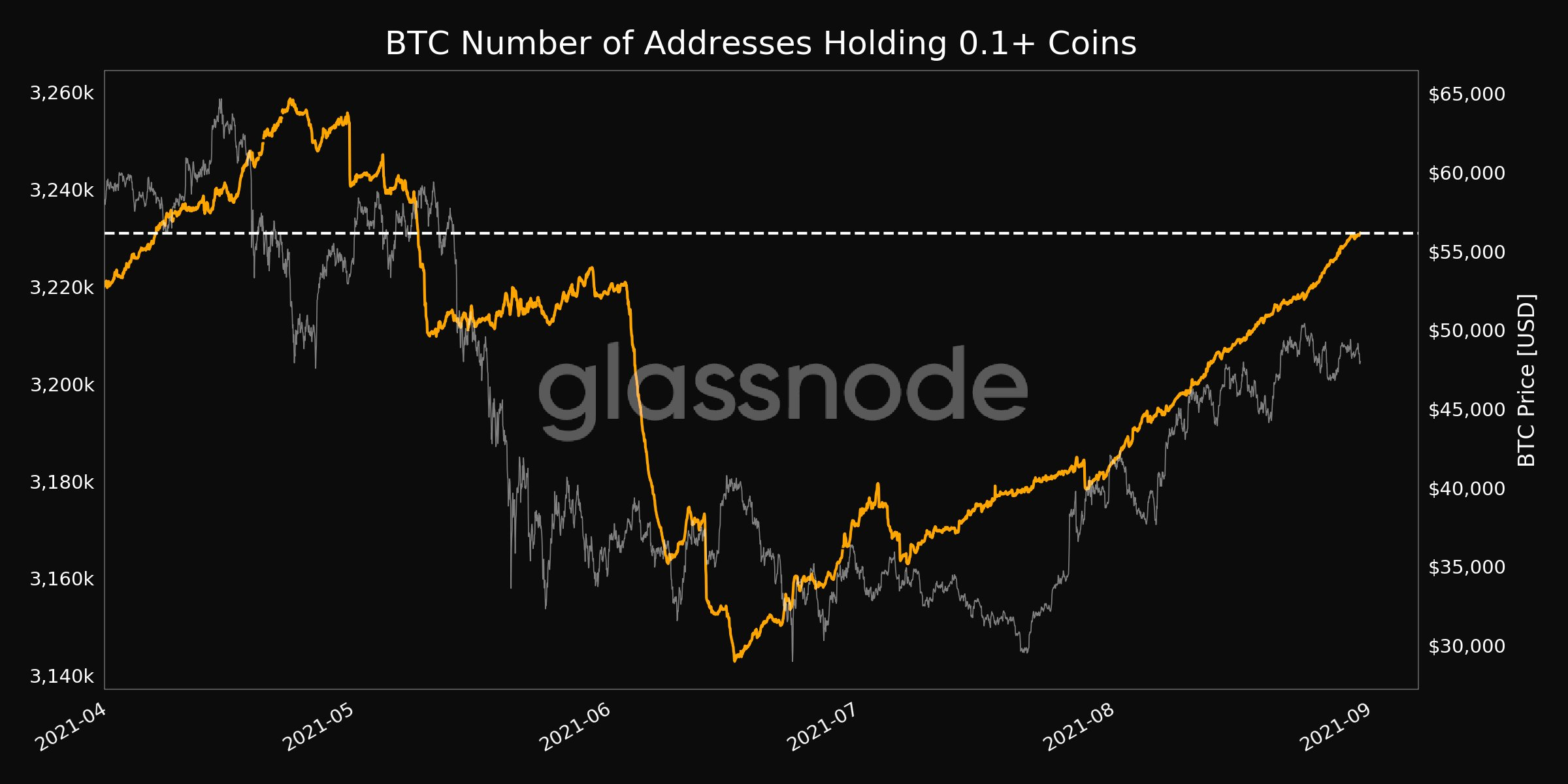

Blockchain analytics platform Glassnode also reported a spike in buying sentiment among small fishes. In detail, the number of addresses holding at least 0.1 BTC reached a 3-month high of 3,231,069 on Monday, further validating the accumulation data above.

Bitcoin number of addresses holding over 0.1 BTC. Source: Glassnode

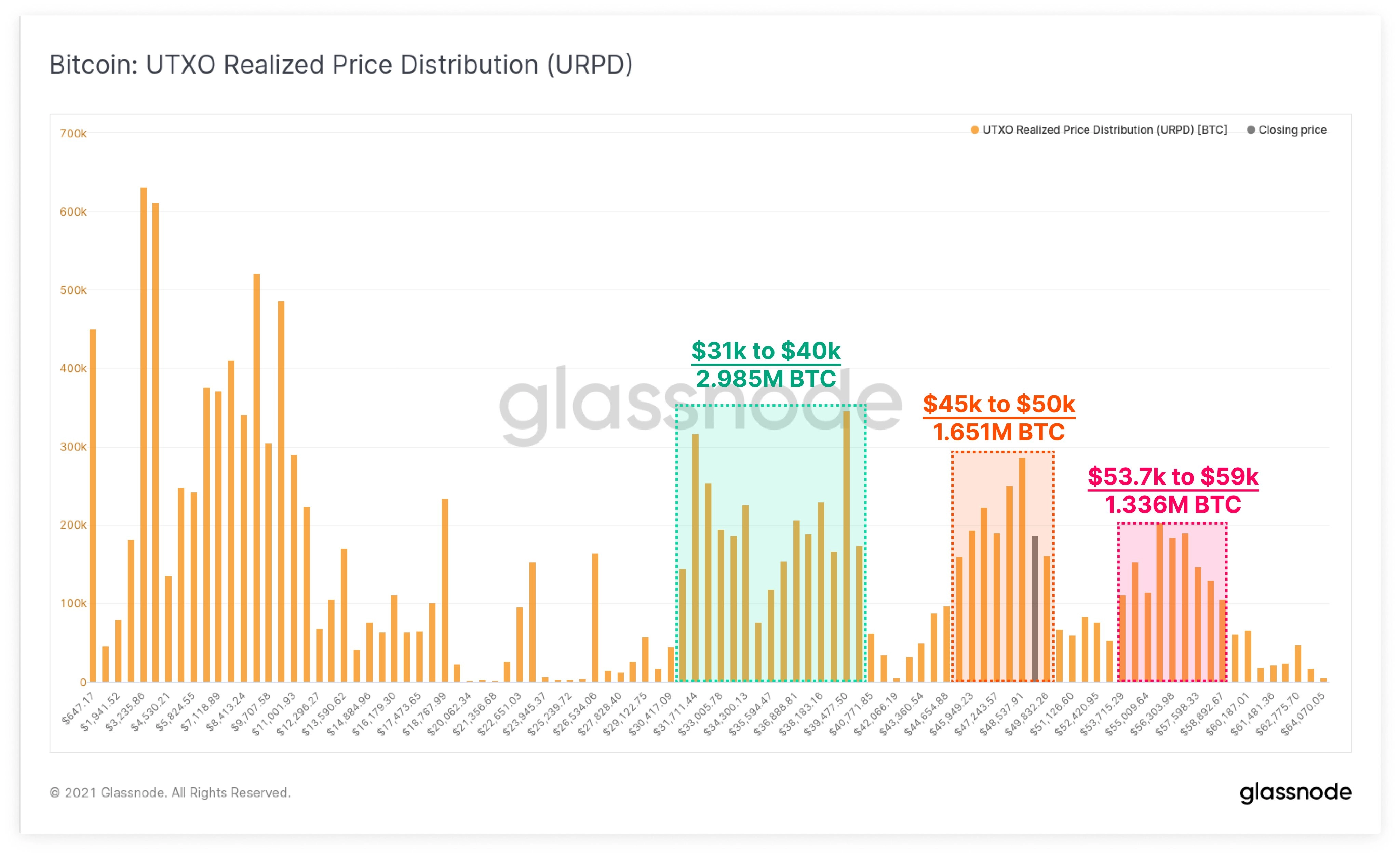

Meanwhile, Glassnode's unspent transaction output (UTXO) data alert presented the $45,000-$50,000 range, wherein whales capitulated the most recently, as a strong support area.

"Over 1.65M BTC now have an on-chain cost basis within the $45k to $50k range," the platform tweeted Monday, adding:

"The $31k to $40k zone is also home to another 2.98M BTC, indicative of large accumulation demand."

Bitcoin UTXO realized price distribution. Source: Glassnode

Bitcoin holds above the 'green wave'

The whale and fish alert surfaces as the Bitcoin market await a clear breakout move above $50,000.

As it stands, the BTC/USD exchange rate has been consolidating under the said resistance level since Aug. 27. In doing so, the pair have also found interim support above $47,000, which, more or less, has been coinciding with a 20-day exponential moving average floor (20-day EMA; the green wave in the chart below).

BTC/USD daily price chart featuring the 20-day EMA support. Source: TradingView.com

Historically, a break below the 20-day EMA prompts traders to move their downside target to the 50-day EMA (currently near $43,500). Popular market analyst Rekt Capital also presented an outlook that highlighted the levels around $43,500 as Bitcoin's next support range.

Small fishes have accumulated Bitcoin relentlessly in the $40,000-$50,000 range, with no signs of trend reversals in the previous 30 days. On the other hand, whales underwent a capitulation period when Bitcoin entered the $45,000-$50,000 range.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Bitcoin Weekly Forecast: Will the “Uptober” rally reach a fresh all-time high?

Bitcoin continues to climb this week after breaking its resistance barrier, aiming for a new all-time high. US spot Bitcoin ETFs posted $1.86 billion in inflows until Thursday, the largest streak of inflows since mid-July.

Crypto Today: Main tokens gain as Bitcoin is less than 10% away from all-time high

Bitcoin climbs above $68,000 and pulls back as market participants turn greedy, according to the indicator that checks trader sentiment. Ethereum holds gains above $2,600 and XRP hovers around $0.55 on Friday.

Solana Price Forecast: SOL gains 2% as community discusses Firedancer validator for better performance

Solana gains 2% as its community discusses performance improvements through its new validator, Firedancer. Bitcoin’s Layer 2 project Solv Protocol launched BTC staking token on the Solana blockchain.

Bitcoin Weekly Forecast: Will BTC decline further?

Bitcoin’s (BTC) price fell over 6% at some point this week until Thursday, extending losses for a second consecutive week, as it faced rejection from a key resistance barrier.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.