Panic selling crushes the entire crypto market, sending Bitcoin's price to $30,000 for the first time since February, but data shows BTC whales bought the dip.

Data from Cointelegraph Markets and TradingView shows that the initial price dump that pushed BTC below the $43,000 support level on May 18 accelerated into the overnight trading session as $110 billion worth of trading volume fueled the wick down to $30,000.

The market downturn sparked outages and other delays across a few of the top cryptocurrency exchanges, and the prices of the vast majority of altcoins cratered alongside the price of Bitcoin, with Ether (ETH) briefly plunging to $1,900 and Dogecoin (DOGE) bottoming out at $0.236.

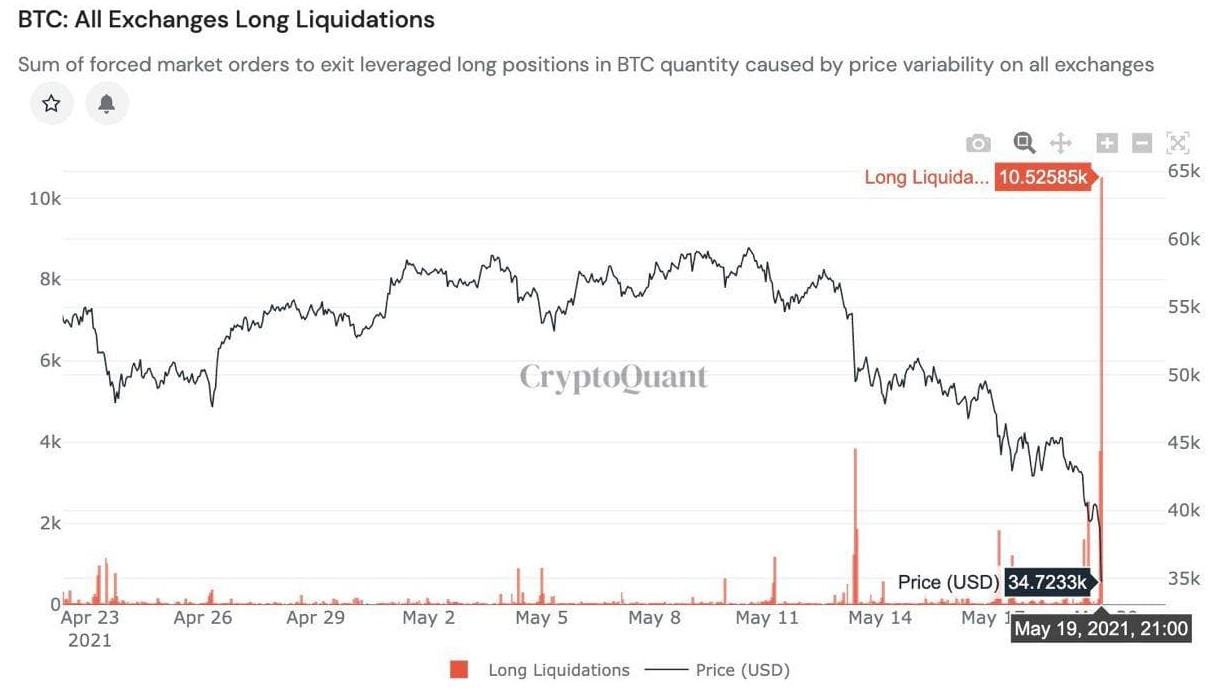

The sell-off flushed out traders using excessive leverage

As with any significant downturn in the crypto market, derivatives and leveraged traders were hit especially hard by the rapid $8,000 price drop in BTC that resulted in a record 10,525 BTC being liquidated in one hour at the peak of the market squeeze.

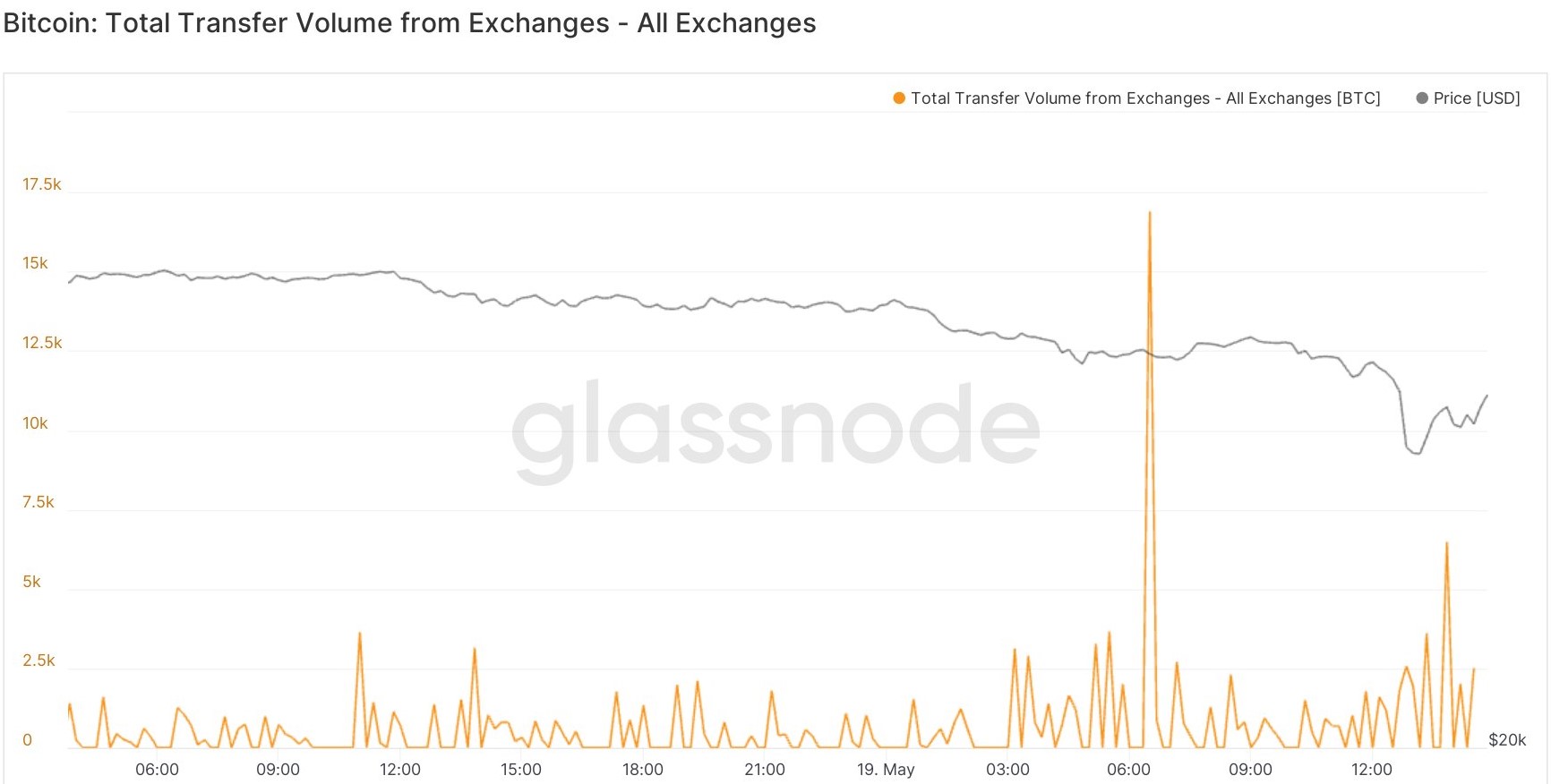

While leveraged traders were wiped out, some well-positioned traders and larger entities with dry powder used this opportunity to buy the dip and promptly put their newly acquired Bitcoin into personal wallets, as evidenced by the outflow of 16,895 BTC in a span of 10 minutes earlier on May 19.

As for what to expect next for Bitcoin, some clues have been offered by the team at Whalemap, which identified $33,000 as the new major support level for BTC, with the previous support at $46,000 now becoming a major resistance level should the price try to bounce higher.

Further analysis from the team also highlighted support levels at $37,400 and $34,200 and indicated that should the price continue to fall lower, it is crucial that the $29,000 support hold or the price could flush as low as $19,000.

While a price dip below $29,000 may seem dire to some, Whalemap instead closed its analysis by stating:

“Overall, this is a great dip buying opportunity with a clear invalidation which makes it a great risk/reward trade.”

Altcoins collapse under pressure

The saying that “As goes Bitcoin, so goes the rest of the market” held true in this most recent downturn, resulting in red across the board for altcoins.

Some of the hardest-hit coins in the top 30 include Litecoin (LTC), Polkadot's DOT and EOS, which have seen their prices fall by roughly 30% over the past 24 hours. As the market corrected, a series of price manipulations on the Binance Smart Chain-based Venus decentralized finance platform led to a 60% drop in the price of XVS.

Out of the top 200 cryptocurrency projects, the only two that managed to see positive gains amid the market turmoil were Celer Network's CELR, which gained 3.33% on the day, and Unus Sed Leo (LEO), which saw its price increase by 5.25%.

The overall cryptocurrency market capitalization now stands at $1.786 trillion, and Bitcoin’s dominance rate is 42.1%.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.