- It seems that Bitcoin price might continue rising as selling pressure fades away.

- The number of whales holding BTC has dropped, but the amount of small holders increased.

One of the most accurate on-chain metrics for sell-offs and increased selling pressure is the number of whales holding a specific coin. It seems that although there are fewer whales holding between 10,000 and 100,000 coins, Bitcoin price has continued to climb, indicating that institutional investors are buying.

Bitcoin price targets $30,000 by the end of 2020

According to statistics extracted from Santiment, the number of addresses that own 1,000 or more BTC own 0.13% more of the BTC supply than smaller addresses did previously since Christmas.

BTC holders chart

Additionally, it seems that whales are sending their coins into exchanges at a lower rate than before, which indicates they are exhausted and can’t sell anymore. The current Exchange Whale Ratio is below 85%. Past price action shows that anything above the 85% range represents a risk of a correction.

$BTC whales seem exhausted to sell. Fewer whales are depositing to exchanges.

— Ki Young Ju 주기영 (@ki_young_ju) December 28, 2020

I think this bull-run will continue as institutional investors keep buying and Exchange Whale Ratio keeps below 85%.

Chart https://t.co/TLWRvP7pyZ pic.twitter.com/goUmowVv2e

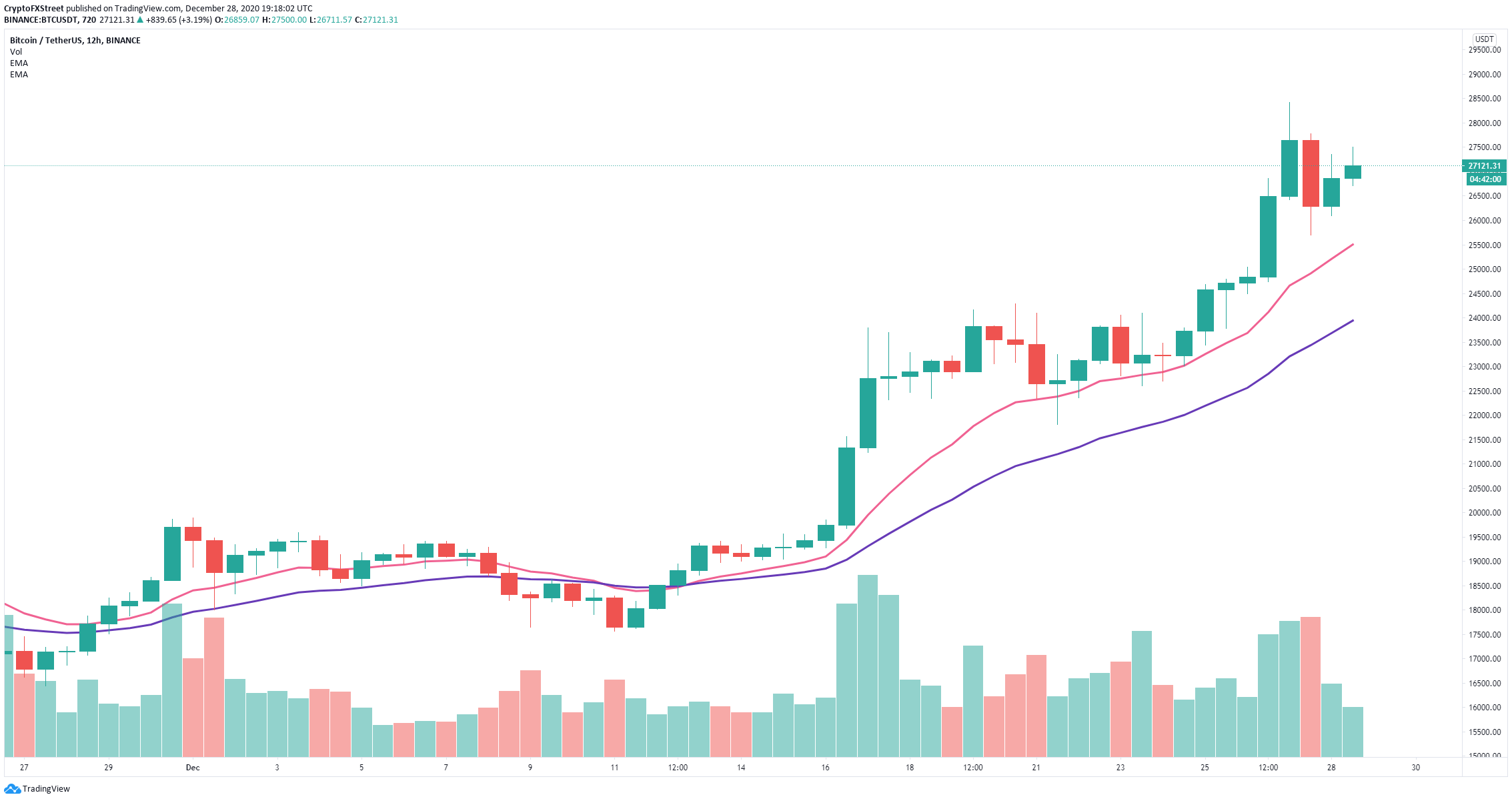

Less than 48 hours ago, Bitcoin price hit a new all-time high at $28,422 and remains trading above $27,000. There are no red flags so far and bulls have been able to keep BTC above the 12-EMA on the 12-hour chart for now.

BTC/USD 12-hour chart

As long as the bulls can hold the 12-EMA and the 26-EMA, the uptrend will remain intact. A breakdown below the 12-EMA at $25,531 can quickly push Bitcoin price towards the 26-EMA at $24,000.

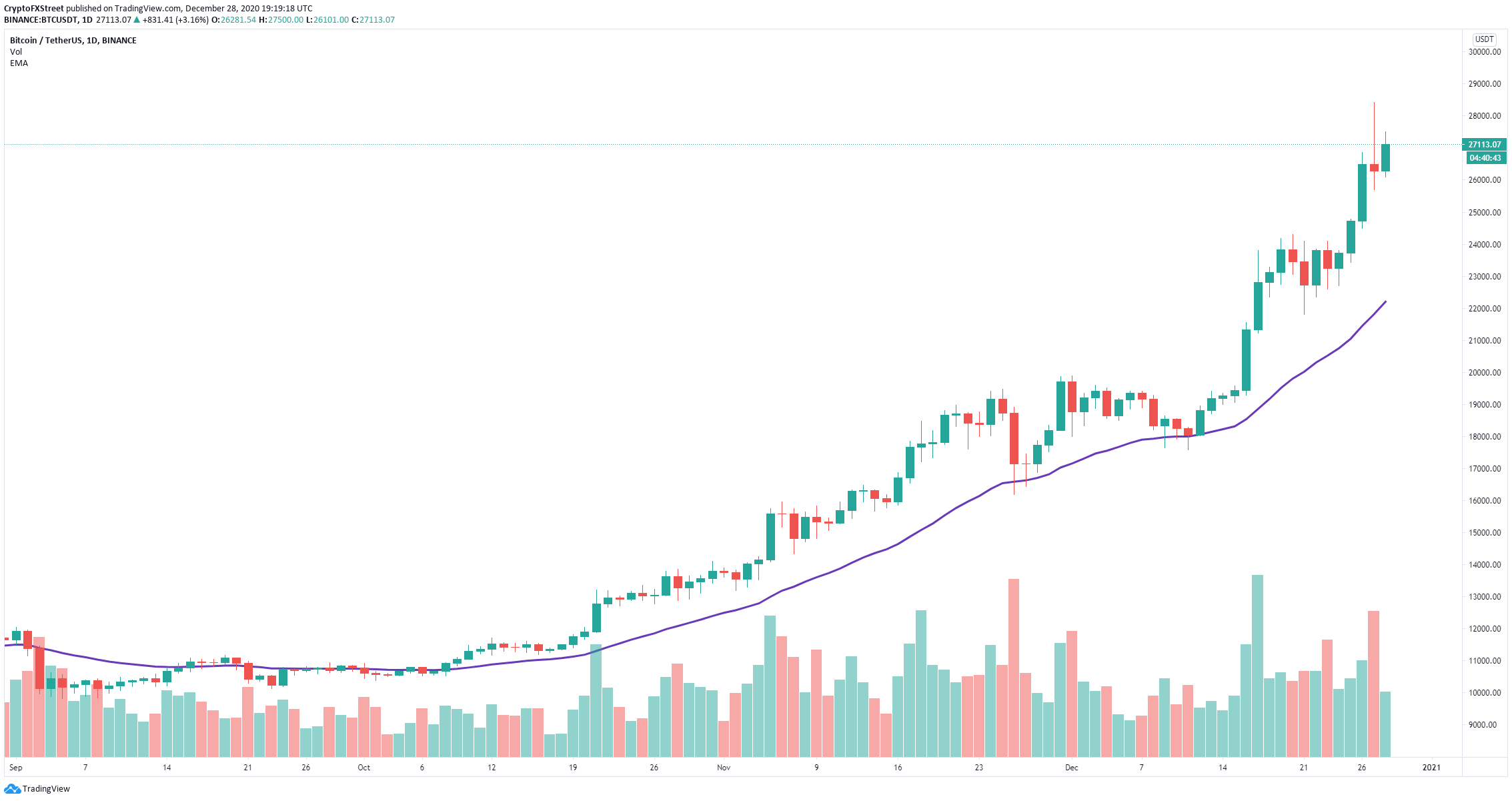

BTC/USD daily chart

However, on the daily chart, the 26-EMA which was defended several times during this rally and served as an accurate dip-buying indicator is established at $22,220 currently. This means that if Bitcoin price drops towards $22,220 but doesn’t crack it, the uptrend will continue.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Hedera price surges more than 25% following a spike in trading volume

Hedera price surges more than 25% on Monday after rallying 64% last week. The rally was fueled by Canary Capital, which submitted an S-1 registration to the US SEC for an HBAR ETF, offering investors exposure to the crypto asset’s price.

Robinhood CEO calls UK approach to crypto “backwards”

Robinhood CEO Vlad Tenev criticized the UK’s restrictive crypto policies, comparing them to regulated gambling. Concerns grow over crypto trading addiction, with a significant amount of traders relating it to gambling.

Bonk holds near record-high as traders cheer hefty token burn

Bonk (BONK) price extends its gains on Monday after surging more than 100% last week and reaching a new all-time high on Sunday. This rally was fueled by the announcement on Friday that BONK would burn 1 trillion tokens by Christmas.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC consolidates after a new all-time high

Bitcoin price consolidates between the $87,000 to $93,000 zone. Ethereum's price is nearing its support level of $3,000; a close below would cause a further correction.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.