- Bitcoin price rose 4% to hit a 10-day peak of $85,900 on Wednesday as the Federal Reserve's rate pause decision aligned with market expectations.

- IntoTheBlock’s on-chain chart shows that BTC large transactions increased by $13 billion since the start of the week.

- Bitcoin ETFs saw over $500 million inflows in the three days leading up to the US Fed meeting.

Bitcoin price surged 4% to a 10-day high of $85,900 amid institutional demand and Bitcoin ETF inflows cross $500 million ahead of the Federal Reserve’s decision. What's the next move for BTC ?

Bitcoin (BTC) price hits 10-day peak after Fed meeting

Bitcoin (BTC) broke above key support levels after the US Fed announced a rate pause, aligning with market expectations. Following cooler-than-expected inflation signals in the CPI and PPI data published earlier in the month, market watchers priced in a high-chance of a rate pause.

Bitcoin price action | BTCUSDT

Bitcoin price action | BTCUSDT

Bitcoin surged 4% on Wednesday, climbing to a 10-day high of $85,900 as the US Fed rate decision macroeconomic conditions and positive sentiment from SEC dropping charges against Ripple both provided dual catalysts for a market-wide rally.

Bitcoin ETFs see $500M inflows as whale demand surges $13B ahead of Fed meeting

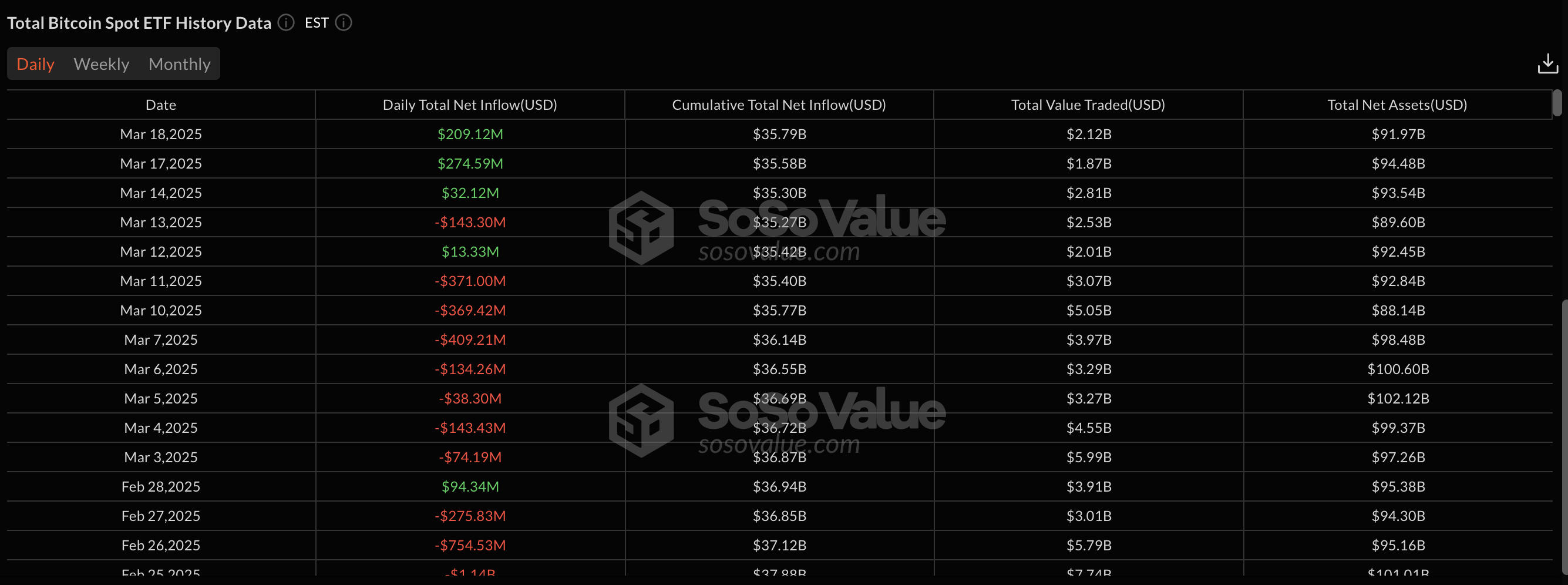

While Bitcoin price only climbed 4% on Wednesday other vital fundamental indicators are pointing towards increased whale accumulation ahead of the Fed rate decision. First, after experiencing a three-week selling streak, Bitcoin ETFs reversed course this week, recording $512 million in cumulative inflows in the last three trading days, according to data from SosoValue.

On Wednesday alone, Bitcoin ETFs attracted $209 million in net inflows, after taking in $32 million and $274 million earlier in the week. Notably, this marks the first time since January 31, that Bitcoin ETFs have entered three consecutive days of positive netflows.

Bitcoin ETF Flows | SosoValue

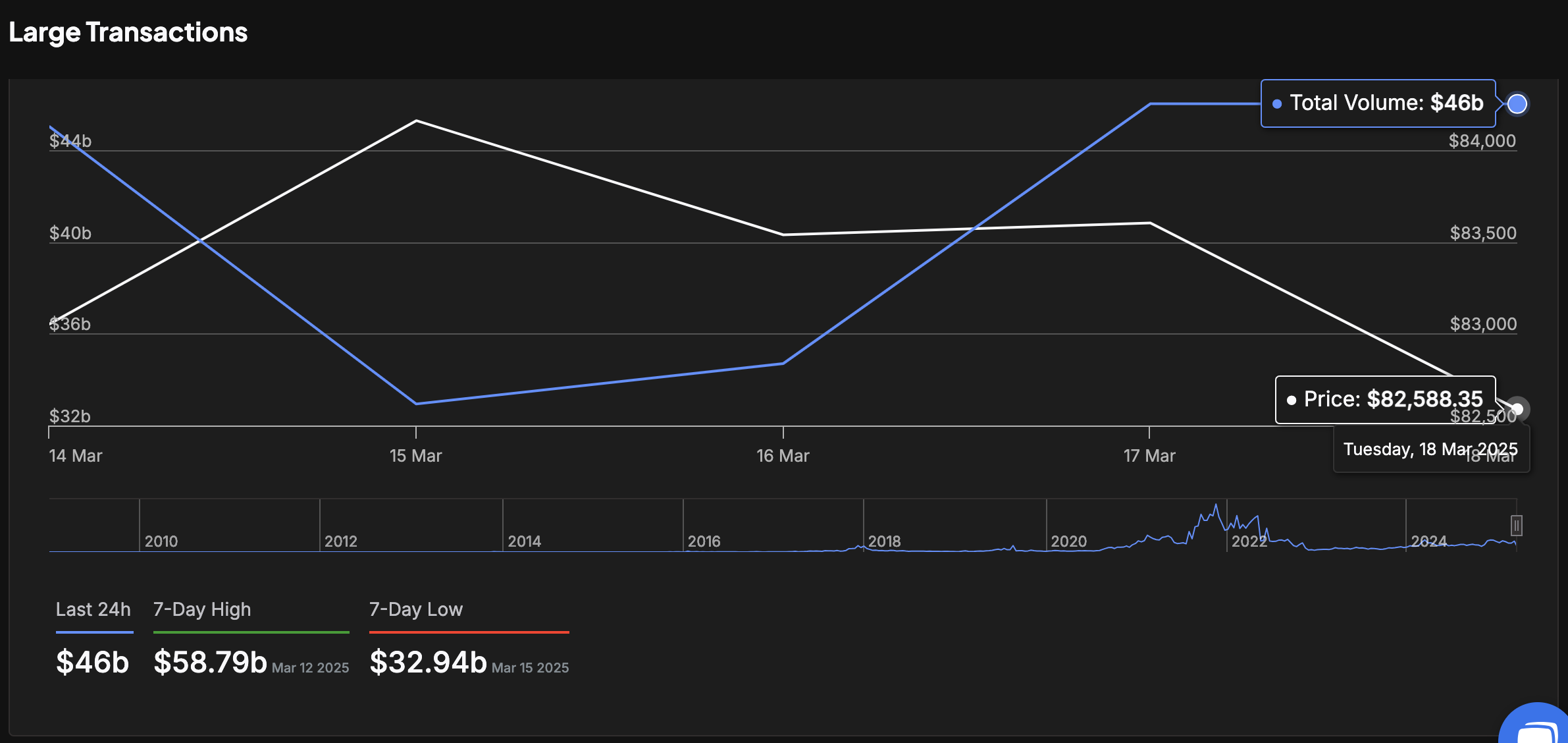

Furthermore on-chain data from IntoTheBlock also confirms that Bitcoin whales increased that buy pressure significantly in the days preceding the Fed rate cut.

The BTC Large Transactions chart below tracks the total value of Bitcoin transactions that exceed $100,000 in a single day. This provides real-time data on the amount of capital deployed by whale traders and large corporate investors around key market events.

Bitcoin Whale Transaction volumes rise $13 billion ahead of US Fed Meeting | Source: IntoTheBlock

As seen above Bitcoin only recorded a $32.9 billion large transactions at the start of the week on March 15.

But since then BTC large transactions have risen 40% to hit $46 billion as of Wednesday.

This shows that BTC whales’ demand increased by $13 billion ahead of the US Fed rate decision.

Bitcoin price forecast: Sell-the-news triggers could trigger pull-back to $80K

Bitcoin’s 4% rally on Wednesday was accompanied by strong whale demand.

However, when whales make large purchases ahead of a key market event, as observed in Bitcoin markets this week, it often raises the risk of a sell-the-news strategy in play.

If the large investors opt to execute strategic exits, Bitcoin price could enter a sharp correction phase in the coming trading sessions.

Bitcoin price forecast | BTC

However, Bitcoin’s short-term momentum remains dominantly positive, as evidenced by the Moving Average Convergence Divergence (MACD) indicator in the chart above.

The MACD histogram has flipped green, confirming a shift in momentum toward the upside, while the MACD line is approaching a bullish crossover above the signal line.

This pattern typically signals the potential for extended gains if buying pressure remains consistent.

More so, BTC’s price has broken above the middle band of the Donchian Channel at $85,803, suggesting bullish dominance as it targets the upper band resistance near $96,000.

Conversely, if Bitcoin fails to breach the $90,000 psychological resistance, profit-taking by whales and short sellers could spark a retracement.

The MACD’s negative values indicate residual bearish pressure, while the lower Donchian Channel boundary at $76,606 remains a crucial downside target.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dozens of crypto-related ETFs await SEC approval, among them those related to XRP, Litecoin, and Solana

Eric Balchunas, Senior ETF Analyst for Bloomberg, highlights 72 crypto-related ETFs awaiting SEC approval. The diversity of these ETFs encompasses major cryptocurrencies, such as XRP, Litecoin, and Solana, as well as meme-based memecoins.

Aptos price extends gains on broader crypto market recovery, presence in Osaka expo

APT token rises for the second consecutive day amid a widespread crypto recovery and expectations of growing adoption. Aptos powers the official digital wallet of Expo 2025 in Osaka, processing over 588,000 transactions with 133,000 new accounts.

Bitcoin bullish momentum builds as premium exceeds 9% for first time in three months

Bitcoin price is extending its gains, trading above $94,000 at the time of writing on Wednesday, following a two-day rally of 9.75% so far this week. BTC rally gathers momentum as trade war fears ease, following US President Donald Trump’s downplaying of tensions with China.

Solana and Sui surge, igniting interest in DeFi as TVL rebounds

Altcoins like Solana (SOL) and Sui gain strength on Wednesday, buoyed by several factors, including a significant recovery in the networks' Total Value Locked (TVL) in Decentralized Finance (DeFi).

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.