Bitcoin Weekly Forecast: Retesting $50,000 is not a question if but when

- Bitcoin price fills the inefficiency created during its run-up above the yearly open at $46,198.

- The recent retracement is a key in triggering the next leg-up to $50,000.

- On-chain metrics suggest an extremely bullish outlook for BTC in the coming weeks.

Bitcoin price shows affinity to move higher after the recent surge on March 27. The previous downswing helped remove any inefficiencies to the bottom while setting up the stage for another leg-up.

Bitcoin price prepares to swing higher

Bitcoin price set up three equal highs and four higher lows since January 13. Connecting these swing points using trend lines shows an ascending triangle formation, which forecasts a 21% upswing.

The target is obtained by adding the distance between the first swing high and low to the breakout point at $44,418. BTC broke out of its ascending triangle setup on March 27 but stopped moving higher after peaking at $48,238. This lack of momentum mixed with the inefficiency to the bottom, caused BTC to slide lower.

Investors can expect the Bitcoin price to enjoy its gains as long as it stays above the $45,000 support level. A quick recovery above the yearly open at $46,198 will be the key to triggering the next run-up.

In this case, market participants can expect the Bitcoin price to retest the $50,000 psychological level. In a highly bullish case, however, BTC could make a run at $52,000 or the swing highs formed in late December 2021.

Either way, the upside for BTC seems to be capped at around $53,000 and any move beyond this level seems unlikely.

BTC/USDT 1-day chart

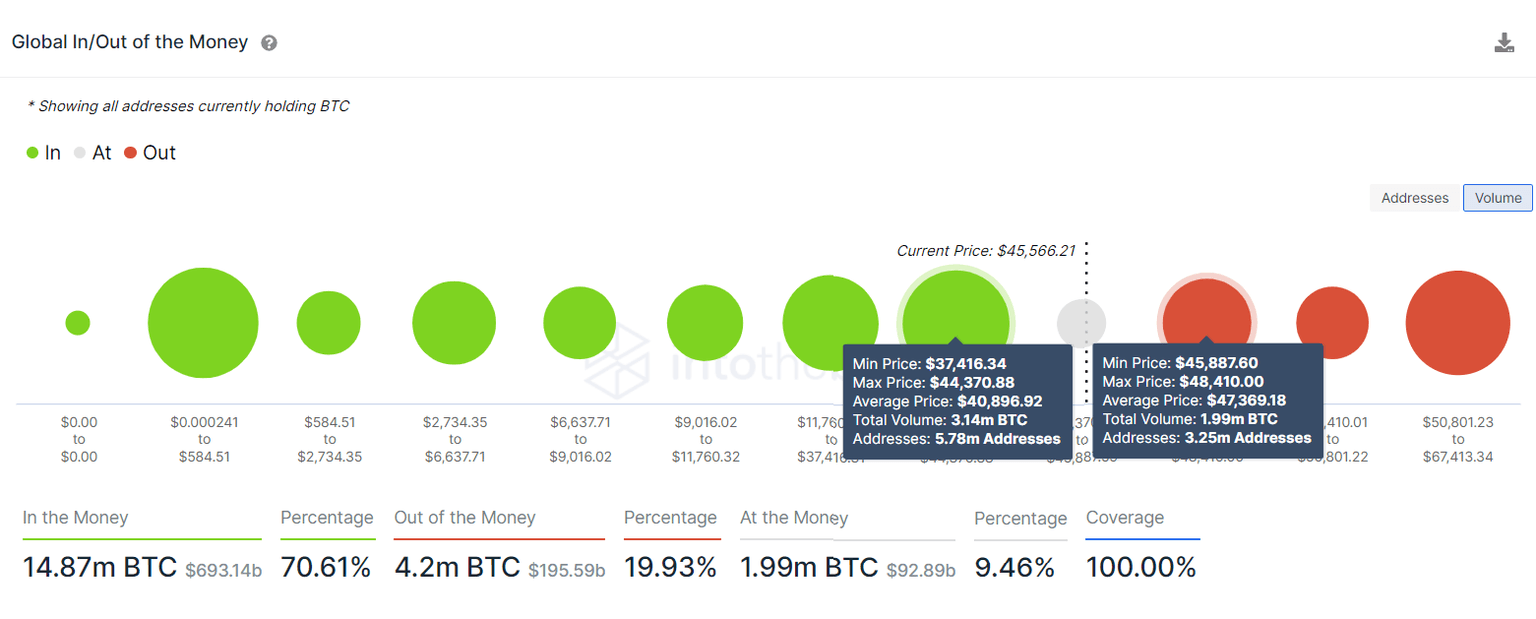

While the technicals are displaying an optimistic outlook for Bitcoin price, IntoTheBlock’s Global In/Out of the Money (GIOM) model supports that. This index shows that the immediate resistance barrier, stretching from $45,887 to $48,410 is relatively weak.

Here roughly 3.25 million addresses that purchased nearly 2 million BTC are “Out of the Money.” Therefore, a substantial increase in buying pressure is necessary to overcome this hurdle. Doing so will pave the way to $50,000 or higher.

BTC GIOM

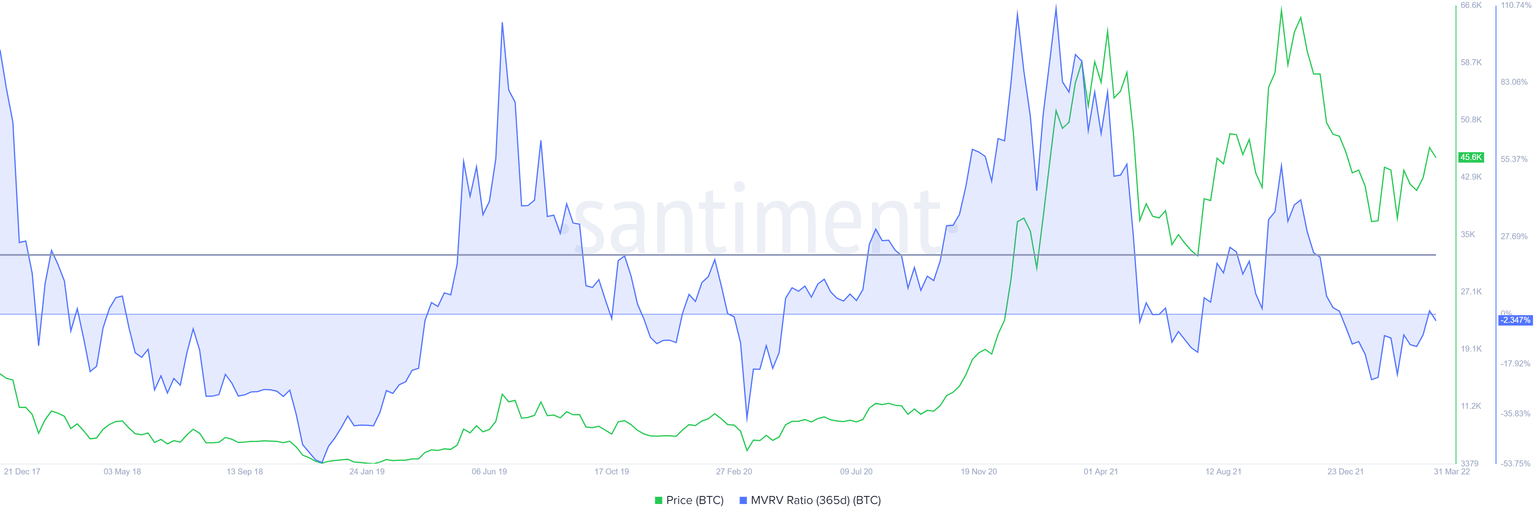

With Bitcoin price moving to $48,000, the Market Value to Realized Value (MVRV) model briefly flipped positive. This on-chain metric is used to determine the average profit/loss of investors that purchased BTC over the past year.

Even with this index heading over the zero-line, the historical data suggests that the 365-day MVRV peaks at roughly 22%, indicating that there is more upside yet to be seen for the Bitcoin price.

BTC 365-day MVRV

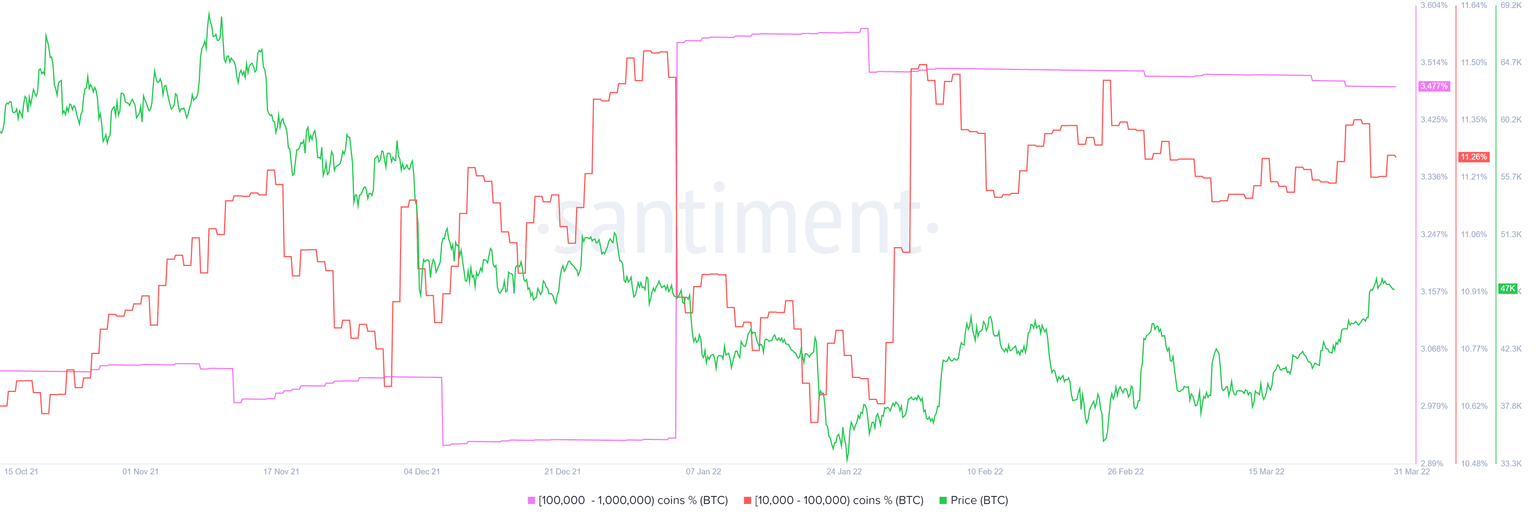

Perhaps the most important index is the uptick in the number of whales accumulating BTC. Since November 12, the Bitcoin price has dropped from $66,000 to a low point of $34,000 and whales holding between 10,000 to 1,00,000 BTC have been busy accumulating.

The category of investors with 10,000 to 100,000 BTC has increased its holdings from 10.26% to 11.26%, while those holding 100,000 to 1,000,000 BTC have moved up from 3.03% to 3.48%.

This development only points to one thing, the institutions’ outlook on how bullish they are on the Bitcoin price.

BTC supply distribution

Since March 6, the Bitcoin price has rallied from $38,400 to $48,000. Despite this uptick, investors seem to be moving their holdings off exchanges. This can be seen in the increasing outflows via the net exchange position change since March 7.

In conclusion, not only are the institutions and whales accumulating but they are also moving their holdings to cold wallets, which paints a bullish picture for the future of Bitcoin.

BTC exchange net position change

While things are looking up for the Bitcoin price, the ascending triangle outlook could fail if the $44,418 support level is breached. This move would hint at a retest of the immediate support level at $42,076.

If Bitcoin price produces a daily candlestick close below $42,076, it will invalidate the bullish thesis and send the big crypto crashing to the lower limit of the ascending triangle at roughly $37,000.

In a highly bearish case, a breakdown of the $35,000 support floor could cause the Bitcoin price to trigger a crash to $30,000.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

-637843860652932856.png&w=1536&q=95)