- Bitcoin whales have increased buying activity to the highest level in two months.

- Investors show no signs of FOMO despite BTC’s recent tussle with the $70,000 mark.

- US spot Bitcoin ETFs experienced a notable uptick in activity, reflecting growing market interest.

Bitcoin (BTC) price is showing a positive outlook despite recent stabilization at around $71,000. According to on-chain data, whales are returning with strong buying power, US spot Bitcoin ETFs are increasing, and the absence of FOMO among investors suggests that Bitcoin is poised to set new all-time highs.

Bitcoin whales accumulating

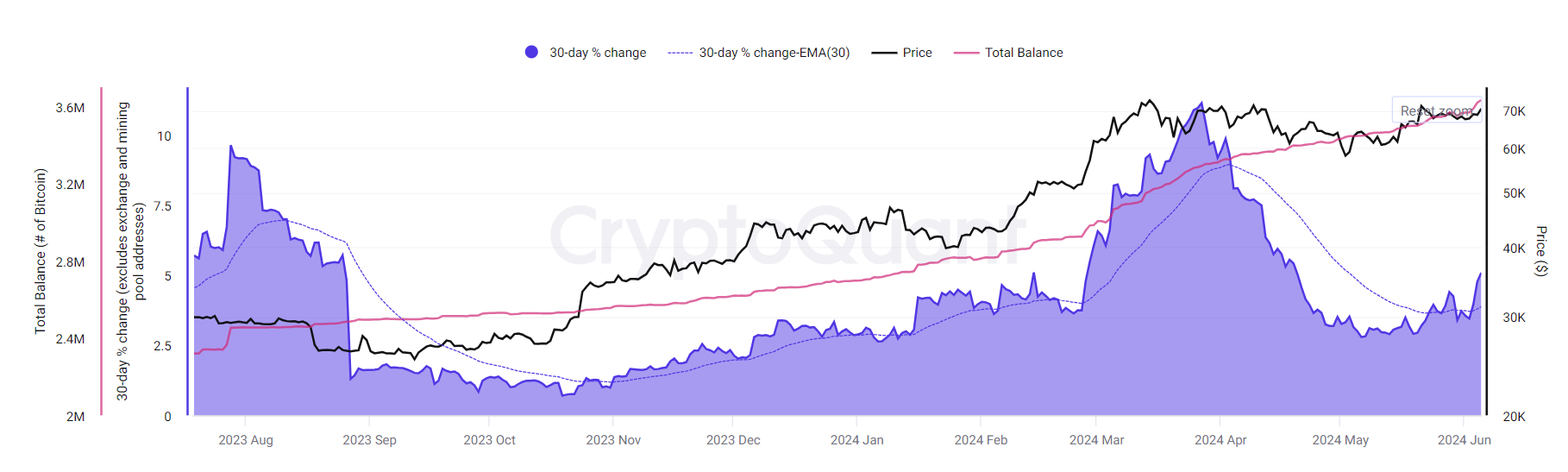

Data from CryptoQuant Total Whale Holdings and Monthly Percentage Change refers to the combined amount of Bitcoin held by large investors or institutions, often known as whales, due to their substantial influence on the cryptocurrency market.

The Monthly percentage Change reflects the percentage shift in these holdings over a one-month period. This metric is closely observed to assess market sentiment and potential future market movements, as the actions of these major holders can significantly impact Bitcoin's price through their buying or selling activities.

In Bitcoin’s case, the 30-day percentage change increased from 2.79% to 5.08% from May 6 to June 6, the highest in two months. This 2.29 percentage point increase indicates that the whales are returning with strong buying power once again.

BTC Total Whale Holdings and Monthly Percentage Change chart

According to CryptoQuant data for Bitcoin ETFs, Historical Bitcoin Holdings Trend (Aggregated) shows a historical overview of the total amount of Bitcoin held by all ETF issuers combined. Increases or decreases in the aggregated Bitcoin holdings of ETFs may indicate shifts in institutional demand for Bitcoin exposure or changes in investment strategies.

US spot Bitcoin ETFs have also seen a significant uptick, with holdings increasing from 819.02K on May 2 to 875.5K on June 6, signaling growing confidence in Bitcoin's long-term prospects among investors.

-638533418836088584.png)

BTC Etfs Historical Bitcoin Holdings Trend (Aggregated) chart

Santiment's BTC Social Volume data offers valuable insights into the level of discussion and mentions of Bitcoin across diverse social media platforms, forums, and online communities. It tracks the volume of posts, comments, tweets, and other interactions related to Bitcoin over a specific period.

According to BTC’s Social Volume indicator, recent observations suggest that the significance of Bitcoin price reaching $70,000 is not nearly as substantial for investors as it was three months ago, on March 11, when it crossed $70,000 for the first time. This lack of FOMO (Fear of Missing Out) is generally perceived as a positive sign because it indicates more sustainable and rational market behavior and reduces the risk of speculative bubbles and price crashes. Thus Bitcoin may have the potential to break through with less crowd euphoria than what previously marked market tops.

%20[09.44.04,%2007%20Jun,%202024]-638533419376923056.png)

BTC Social Volume chart

The combination of increasing whale buying power, the uptick in US spot Bitcoin ETFs, and the decreasing Social Volume collectively indicate the robustness of Bitcoin bulls, suggesting their ability to support the pricer in the current bull market towards the all-time high registered in March.

Read more: Bitcoin Weekly Forecast: BTC likely to provide another buying opportunity

BTC not out of woods yet

Despite the recent rally in Bitcoin price, the bearish market structure remains intact. A breakout above the May 21 swing high of $71,958 will produce a higher high, signaling that the bulls are attempting a comeback. Such a development could see the pioneer crypto aim to revisit the current all-time high of $73,794. But if bulls are successful in flipping the Momentum Reversal Indicator's breakout level of $74,780, it would open the path for a 7% rally to the next key psychological level and a new ATH of $80,0000.

Coupled with positive sentiment from on-chain metrics and whales accumulating BTC, a new ATH is highly likely.

BTC/USD 1-day chart

If there is a market-wide crash that knocks Bitcoin price to produce a lower low below $67,151, it would invalidate the short-term bullish trend. This development could trigger a move toward the $60,000 psychological level. If buyers fail to defend this critical level, leading to the production of a lower low on a daily or higher timeframe, it would invalidate the bullish outlook. Such a pessimistic move could catalyze a selling spree that could potentially knock BTC down to $56,196, which is the midpoint of the $53,015 to $59,313 imbalance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Slow but positive start

Bitcoin edges slightly lower, trading around $96,500 on Friday after an over 2.5% recovery this week, with historical data showing modest average January returns of 3.35%. On-chain metrics suggest the bull market remains intact, indicating a cooling-off phase rather than a cycle peak.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

BTC, ETH and XRP eyes for a rally

Bitcoin’s price finds support around its key level, while Ethereum’s price is approaching its key resistance level; a firm close above it would signal a bullish trend. Ripple price trades within a symmetrical triangle on Friday, a breakout from which could signal a rally ahead.

Could XRP surge to new highs in January 2025? First two days of trading suggest an upside bias

Ripple's XRP is up 7% on Thursday, extending its rally that began during the New Year's Day celebration. If long-term holders (LTH) continue their recent accumulation, XRP could overcome the $2.9 resistance level and aim for a new all-time high.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.