Bitcoin weekly forecast: In the middle of nowhere

- Fundamental background remains supportive, but not helpful.

- Bitcoin's trend points downwards as the bullish momentum is losing steam.

Bitcoin has been drifting down since the beginning of the week. as the bulls have no luck with the recovery campaign launched during the previous weekend. At the time of writing, BTC/USD is changing hands at $8,570, down 2.5% on a weekly basis. Lack of upside momentum and bull's inability to take the price above $9,000 bodes ill for bitcoin's short-term forecasts.

The cryptocurrency universe runs its course with no fanfare and little sensations. While bitcoin and all major altcoins have been losing ground during the week, the sell-off was caused mostly by technical and speculative factors.

From the fundamental point of view, the market continues gravitating towards the increased presence of institutional players and convergence with the traditional financial system. Recently, the Swiss banks announced thee plans to launch the cryptocurrency trading platform to close the gap between traditional banking and digital world. Initially, the bank will provide access to five cryptocurrencies, though the list of crypto instruments may be expanded in the future.

Read also: Swiss-based SEBA dives into the cryptocurrency business

CME (Chicago Mercantile Exchange) confirmed its plans to launch options on Bitcoin (BTC) futures in January 2020, thus providing the institutional investors another crypto derivative. The instrument will help the players to enhance their hedging strategies and increase their exposure in the cryptocurrency market.

Read also: CME Group Announces Launch Date of Options on Bitcoin Futures Product

Meanwhile, NEO and TRON reign the alt coin's universe. NEO often referred to as the Chinese Ethereum, gained over 18% in recent seven days and increased by an eye-popping 72% on a month-to-month basis. Tron's momentum was less impressive, though the coin has also gained over 25% in a month. As both coins have Chinese origins, the narrative goes that the hype was driven by the Chinese race for blockchain supremacy. While this theory does not hold water, the speculations did the stuff.

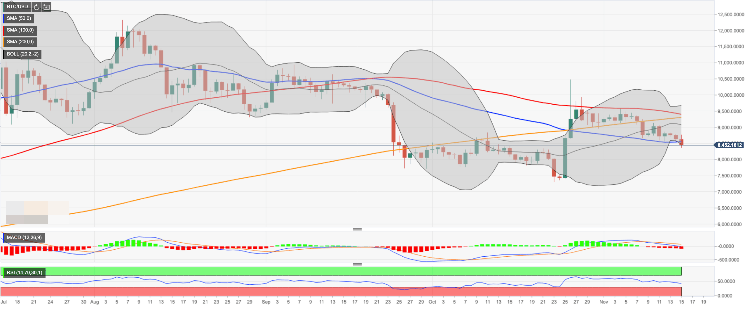

BTC/USD, the daily chart

Bitcoin bears took the market situation under control at the end of the previous week. BTC/USD topped at $9,137 on November 10 only to drop to $8,494 during early Asian hours on Friday. While thee coin has reversed some losses to trade at $8,650 by the time of writing, it is still oscillating within the short-term bearish trend.

On the downside, the price is moving along SMA50 (Simple Moving Average) daily strengthened also by the lower line of the daily Bollinger Band (currently at $8,556). Buying orders located around this barrier stopped the sell-off and helped to initiate a recovery. Once it is sustainably broken, the downside momentum is likely to gain traction with the next focus on psychological $8,000 and $7,800 (the lower boundary of the previous consolidation channel). A confluence of SMA100 and the lower line the Bollinger Band on a weekly chart awaits thee bears on approach to $7,600. This area may serve as a backstop for BTC.

On the upside, we will need to see a sustainable move psychological $9,000 to mitigate the initial bearish pressure. The middle line of the daily Bollinger Band located at $9,080 may serve as an interim barrier on the way to a more important $9,300 (SMA200) and $9,400 (SMA100). Notably, BTC/USD has been trading below SMA100 since September 13, which is regarded by a strong bearish signal in the long run. Eventually, this barrier needs to be taken out to get BTC back on the bullish track.

However, waning momentum and downward-looking RSI implies that the bulls are not strong enough to make it happen.

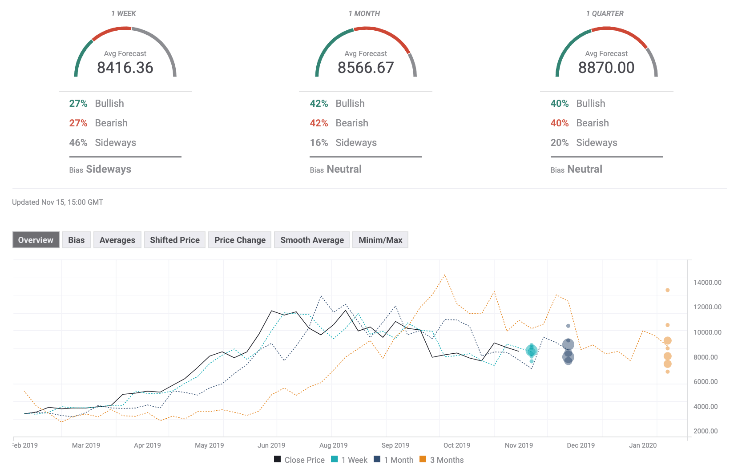

The Forecast Poll of experts worsened since the previous week. Expectations of all timeframes are neutral with bearish bias. The average price forecasts are below 9,000.

Author

Tanya Abrosimova

Independent Analyst