Bitcoin Weekly Forecast: Christmas rally on the balance for BTC as it confronts $43,860 threshold

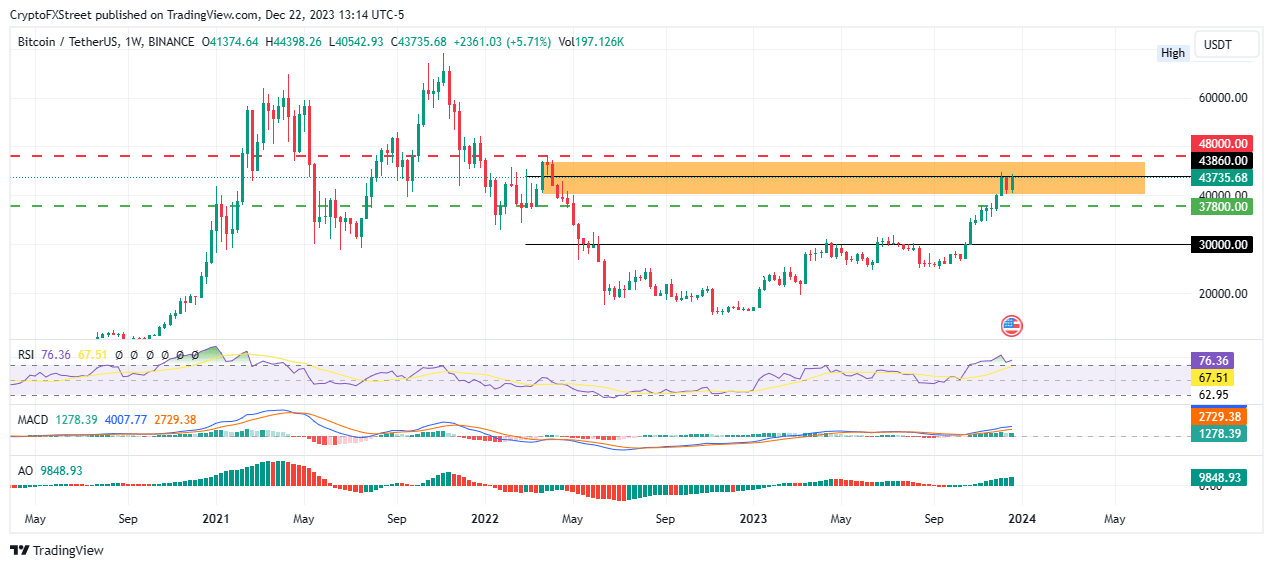

- Bitcoin price is trading within a weekly supply barrier between $40,065 and $47,017.

- The midline of this order block at $43,860 is critical for BTC’s next directional bias, putting the Christmas rally in the balance.

- The $48,000 psychological level and the $37,800 buyer congestion zone will be critical over the next coming days.

Bitcoin (BTC) price is trading with a bullish bias ahead of the weekend that will usher in the Christmas festivities. Expectations of low trading volume abound even as traders embrace the holidays, which when coupled with typical weekend dynamics, leaves the market in a very volatile place. The king of crypto could record big moves this weekend, around December 25, and towards the year’s close.

Bitcoin yearly with ¬9 days left to go pic.twitter.com/3XRmMgdKHU

— Eric Crown (@KrownCryptoCave) December 22, 2023

Also Read: Bitcoin Price Annual Forecast: BTC readies for home run in 2024 with two bullish fundamentals on tap

Bitcoin price readies for Christmas volatility

Bitcoin (BTC) price is upside momentum in 2023 is under threat as it remains stuck within a weekly supply barrier since the onset of December. The supply barrier extending between $40,065 and $47,017 continues to hold as resistance, with its midline, $43,860, being the level to beat.

Flipping the $43,860 level into a support floor could open the expanse for a continuation of the trend, with Bitcoin price likely to test the $48,000 psychological level. In a highly bullish case, the gains could extend for BTC to tag $50,000 or in highly ambitious cases, extend a neck higher to $60,000.

The Relative Strength Index (RSI) shows that BTC is overbought, but its inclination to the north only goes to say that momentum is still rising. Also, the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD) are in the positive territory, showing the bulls are leading the market. These accentuate the bullish thesis.

BTC/USDT 1-week chart

On the other hand, if the weekly supply barrier holds as resistance, Bitcoin price could pull south, falling out of the supply zone to test the $37,800 support. A break and close below this level would invalidate the prevailing bullish outlook.

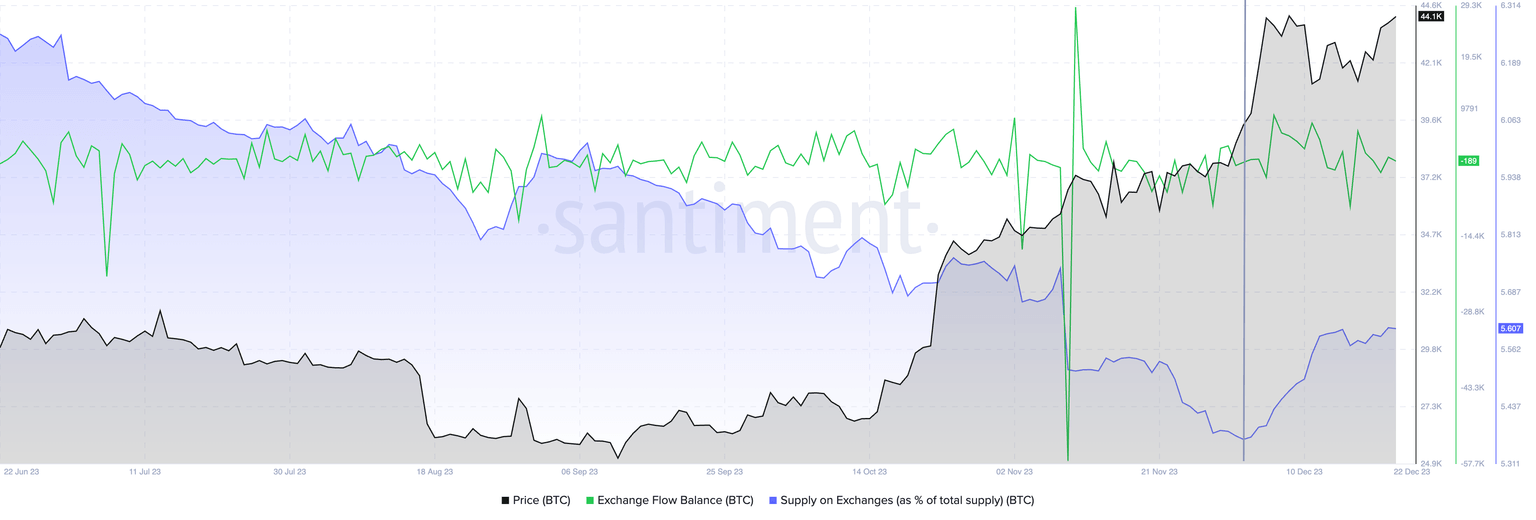

Behavior analysis tool, Santiment, shows that there is a neutral to bearish outlook on BTC, with the supply on exchanges rising since early in the month. Furthermore, the supply on exchanges is also up almost 5%, moving from 5.36% to 5.61%.

BTC Santiment supply on exchanges

This is besides the increase in profit-taking evidenced in the Network Realized Profit/Loss metric,

BTC Santiment: Network Realized Profit/Loss. Source: Santiment

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B11.46.53%2C%252022%2520Dec%2C%25202023%5D-638388231028316898-638388712118865221.png&w=1536&q=95)