Bitcoin Weekly Forecast: Can BTC rally before the next Fed meeting?

- Bitcoin price shows a steady consolidation after a breakout from a declining trend line.

- A spike in bullish momentum could propel BTC to $22,000, but a further move seems unlikely, as portrayed by the transaction data.

- A daily candlestick close below $17,593 will invalidate the bullish thesis for BTC.

Bitcoin price seems to be reacting extremely well to the Fed’s decision to raise interest rates. A part of this connection can be attributed to the high correlation with the stock market. Additionally, high-impact macroeconomic news which affects the traditional markets is also having a noticeable impact on BTC.

The last such announcement was the Consumer Price Index (CPI) print on October 13, which induced a lot of volatility. Since then, BTC’s moves have been lackluster and continue to range. Due to technical advances, investors can expect a bullish move in Bitcoin price between now and the next Fed meeting on November 1, 2.

Bitcoin price at a crucial level

Bitcoin price is currently hovering at the base of a range stretching from $32,427 to $17,593. After a brief rejection at the 30-day Exponential Moving Average (EMA) at $19,474, BTC is trying to find a support level that will absorb the selling pressure, allow it time to recover and kick-start a reversal.

If successful, Bitcoin price will once again face the 30-day EMA and the $20,306 to $20,737 resistance area. Flipping these hurdles into a foothold is crucial for the big crypto to fill the inefficiency at $22,048 or retest the 200-week Simple Moving Average (SMA) at $23,710.

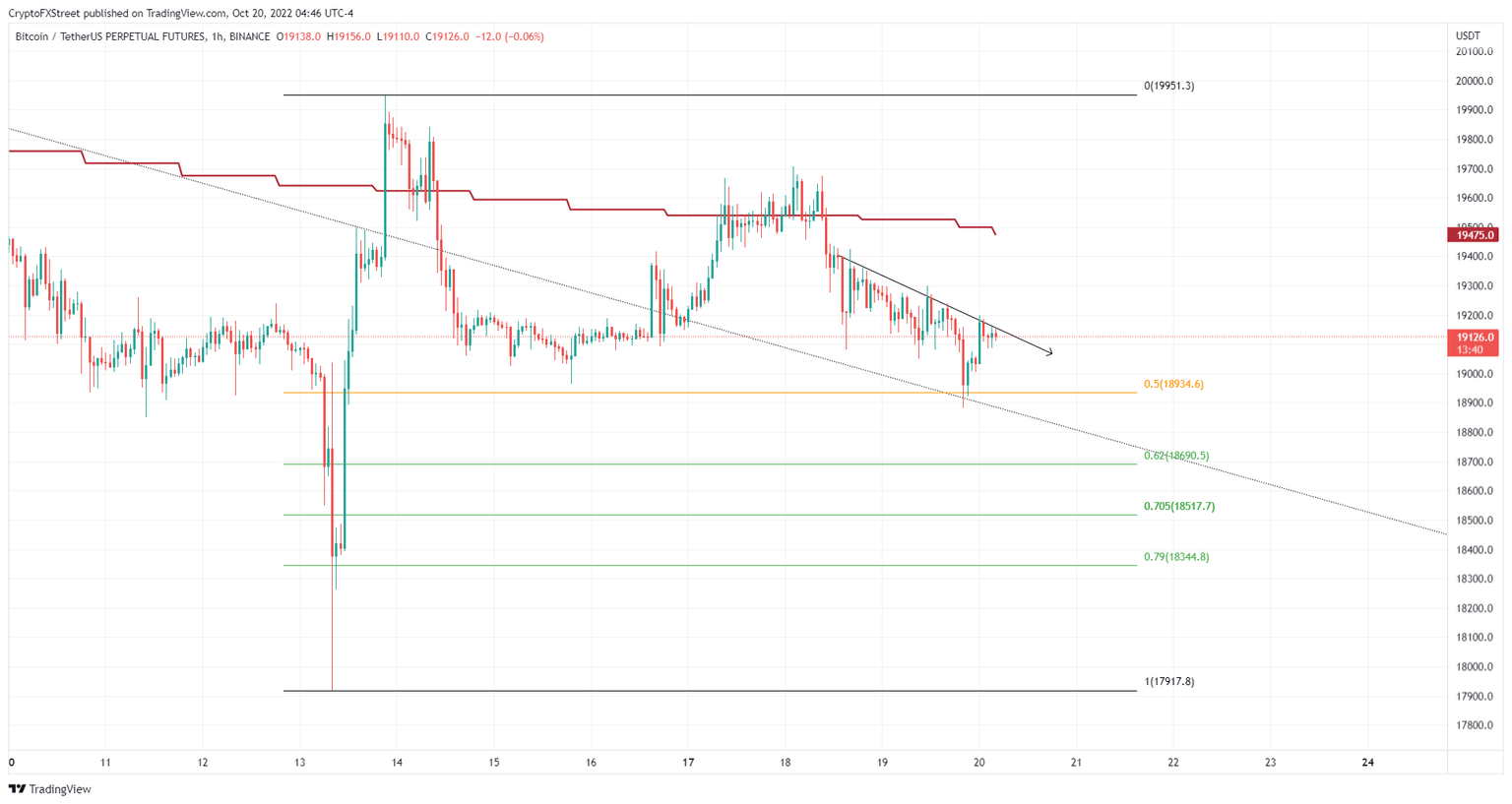

BTC/USDT 1-hour chart

A low-time frame outlook shows that Bitcoin price could have already found stable support to kick-start a reversal. After rallying 11% due to the Consumer Price Index (CPI) print on October 13, BTC triggered a mean reversion to $18,934.

This midpoint, however, coincides with the declining support trend line connecting the swing highs since May 31. Due to this support confluence, there is a good probability that the Bitcoin price will trigger a rally from here.

BTC buyers need to overcome the hurdles mentioned above for this move to be successful.

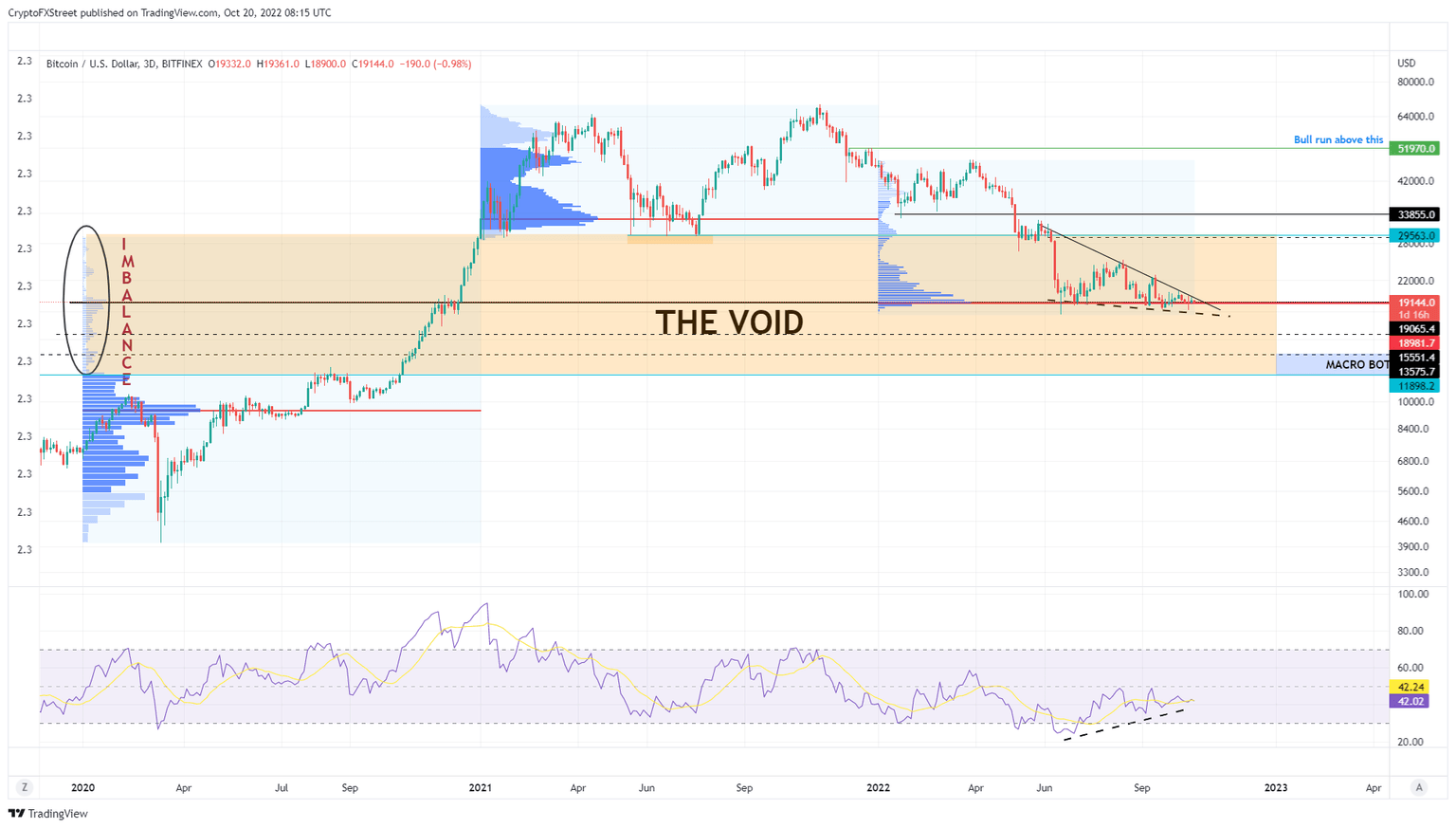

BTC/USDT 1-day chart

Additionally, the three-day chart for BTC shows an increasing chasm – or convergence – between the Relative Strength Index (RSI) and the Bitcoin price. This is a bullish sign as it shows momentum as measured by RSI revealing underlying strength not represented in the price. These convergences often foreshadow recoveries..

Such a recovery is likely to propel Bitcoin price to retest and overcome the declining resistance trend line connecting the swing highs since May 28. A three-day candlestick close above this hurdle could potentially kick-start a bullish move to $25,000 and $28,000, provided the big crypto can overcome the 200-week SMA mentioned above.

BTC/USDT 3-day chart

IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that roughly 4.43 million addresses that purchased 2.72 million BTC at an average price of $21,793 are “Out of the Money.”

Therefore, the potential for a move up to $22,000 is high and possible, since the investors that are “Out of the Money” highlighted by the GIOM will be urging prices higher so they can offload their positions without incurring a loss.

A retest of $28,000, however, seems highly unlikely – for the same reason – since the increased selling from traders trying to reach breakeven will slow BTC price’s advance, and the rally could run out of steam without a proper spike in bullish momentum.

BTC GIOM

While things are looking up for Bitcoin price from multiple time frames, liquidity and volatility seem to be missing. If this lackluster performance continues and sellers take over, BTC could still slide lower and sweep the June 18 lows at $17,593.

Recovery after a sweep could indicate a bullish regime, but a failure to do so will invalidate the bullish thesis for Bitcoin price. In such a case, BTC might continue to crash until it finds a stable support level, which could be at either $17,000 or $15,551.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.