Bitcoin Weekly Forecast: Can BTC hit $100,000 without a correction?

- Bitcoin price shows signs of exhaustion as it trades below the 2021 all-time high of $69,000.

- Investors need to exercise caution as the recent volatile dynamic could make a comeback.

- A short-term correction to $59,000 could be an opportunity for sidelined buyers before BTC heads to $100,000.

Bitcoin (BTC) price shows a slowdown in momentum as it set up a new all-time high of $73,949 on March 13. Considering the massive uptrend that BTC has been experiencing, a short-term correction is nothing to be concerned about.

Read more: Bitcoin Weekly Forecast: BTC contemplates an increase to $100,000, but when?

Bitcoin price at crucial levels

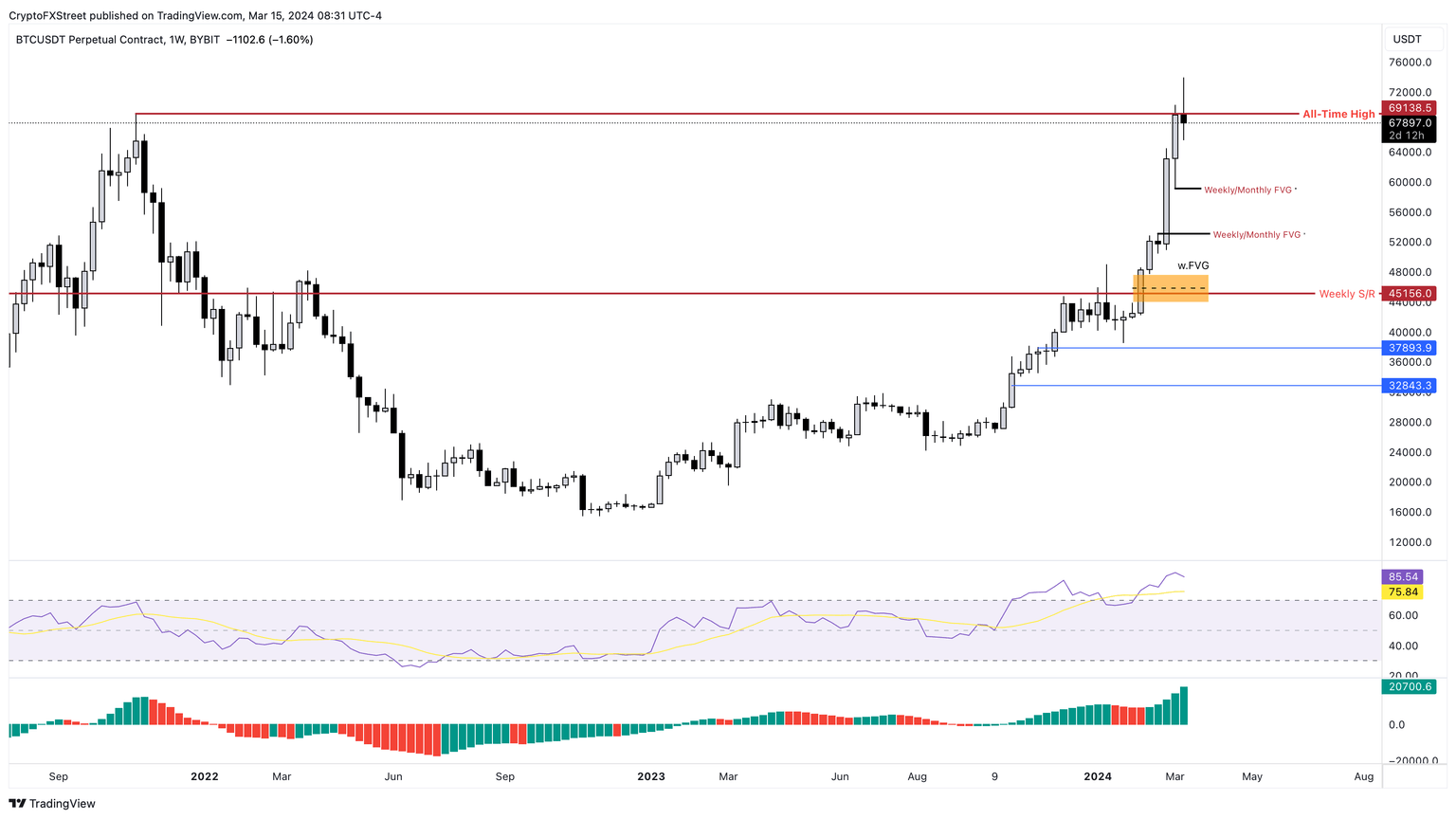

Bitcoin trades at $67,557, below the previous all-time high (ATH) of $69,138 and at an extremely pivotal point. If the current weekly candlestick fails to recover above this critical barrier, it could provide low timeframe signs of a shift in market structure, favoring bears. In such a case, BTC could trigger a steeper correction.

But if Bitcoin price establishes itself above $70,000 after a strong spike in bullish momentum, it will improve the chances of continuing the uptrend. This development could result in BTC heading straight to the $100,000 psychological level.

While this forecast may seem out of the realm of possibility, readers should note that in March 2020, when BTC overcame the previous ATH of $20,000, it kicked off a nearly 100% rally in just four weeks. If history were to repeat or even rhyme, Bitcoin's price could easily move to $100,000.

Another alternative or a maximum pain scenario could see BTC slide lower and dip into the weekly imbalance, in the $53,120 to $59,111 range, before it shoots higher. This move would accomplish two things: liquidate late bulls and encourage the addition of short positions, which could eventually get squeezed as the price moves higher.

Hence, investors need to exercise caution going forward.

Also read: Bitcoin extends its correction to Asian session, liquidations more than double to $660 million

BTC/USDT 1-week chart

While the market outlook is bullish, no doubt, investors need to note that if Bitcoin price fails to produce a weekly candlestick close above the previous ATH of $69,000, it would result in a swing failure pattern. This setup indicates an exhaustion of the uptrend and hints at a potential trend reversal.

It is unlikely that the Bitcoin price will reverse just after setting up a new all-time high. But if it does, the key swing low at $42,000 must be breached on the weekly timeframe to set up a lower low. Considering the bullish ETF flows and the general outlook of the market, it is highly unlikely for this scenario to unfold.

Perhaps a scenario triggered by the US Federal Reserve (Fed) starting to cut interest rates could trigger a volatile, short-term correction. Again, this outlook also feels unnatural, considering the present market conditions.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.