- Bitcoin (BTC) hit by a combination of fundamental negative news.

- The sell-off is contained so far; however, the further market reaction remains to be seen.

- From the technical point of view, BTC is still locked in a range with a bullish bias.

Bitcoin (BTC), the pioneer cryptocurrency, dropped below the local support of $10,600 on Thursday, October 1, and hit a low of $10,363 during early Asian hours on Friday. At the time of writing, BTC/USD is changing hands at $10,450, down over 4% in the last 24 hours. Bitcoin's market capitalization settled at $193 billion, while its market share is registered at 58.2%.

CFTC shoots at BitMEX, ricochets on Bitcoin

The US authorities filed several charges against the cryptocurrency derivatives exchange BitMEX and its top executives, including Arthur Hayes. In a joined statement, the Commodity Futures Trading Commission (CFTC) and the Department of Justice (DOJ) accused the team of running an unregistered trading platform and violating the Bank Secrecy Act.

The experts warn that the charges are severe and may result in jail time for all the people involved, provided that the court sides with the regulators. Read our in-depth article on what does it mean for the cryptocurrency industry.

Bitcoin lost about $400 in a couple of hours after the news broke. The market was spooked by the charges against the large industry player with leveraged positions worth billions of dollars. However, the sell-off was contained, and the digital gold price swiftly recovered back above $10,600.

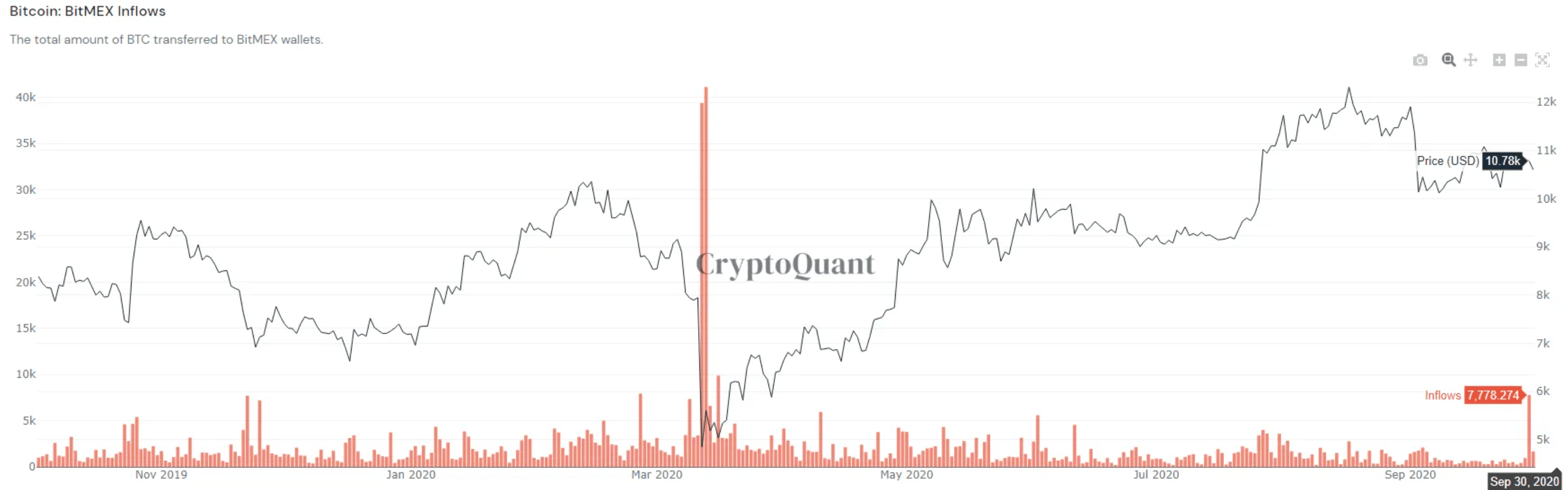

Notably, BTC inflows to BitMEX accounts reached 8,000 BTC (nearly $84 million), which is the highest level since March 2020, right before the major sell-off on the markets.

BTC inflows to BitMEX

Meanwhile, the most recent data revealed by Glassnode implies that people may be running from the troubled cryptocurrency exchange. The on-chain market analysis provider pointed out that users withdrew over 32,000 BTC or 19% of the total amount within the recent hours.

Update: Another batch of ~6k BTC was withdrawn from #BitMEX in the past hour.

— glassnode (@glassnode) October 2, 2020

In total, over 32,200 $BTC were pulled from the exchange (~19% of funds) in three larges baches since the announcement.#Bitcoin

Live chart: https://t.co/jlunNHscY3 pic.twitter.com/9oTL0qAaeP

Trump falls ill; markets fall in solidarity

The cryptocurrency market reaction to the BitMEX debacle seemed to be contained; however, another blow hit the market during early Asian hours on Friday. The US President Donald Trump announced on Twitter that he and his wife got confirmed COVID-19

Tonight, @FLOTUS and I tested positive for COVID-19. We will begin our quarantine and recovery process immediately. We will get through this TOGETHER!

— Donald J. Trump (@realDonaldTrump) October 2, 2020

While both the president and the first lady feel well and do not have severe symptoms so far, the markets hit the panic button and start selling all risk-related assets. Stock markets entered the red zone; oil collapsed, gold, and the US dollar gained ground.

Basically, the market produced a natural knee-jerk reaction to an unexpected event with unclear consequences. Bitcoin went down as the cryptocurrency has been tightly correlated with the US stock markets recently. BTC/USD tested the above-mentioned intraday low of $10,360 before the recovery started.

BTC/USD: The technical picture

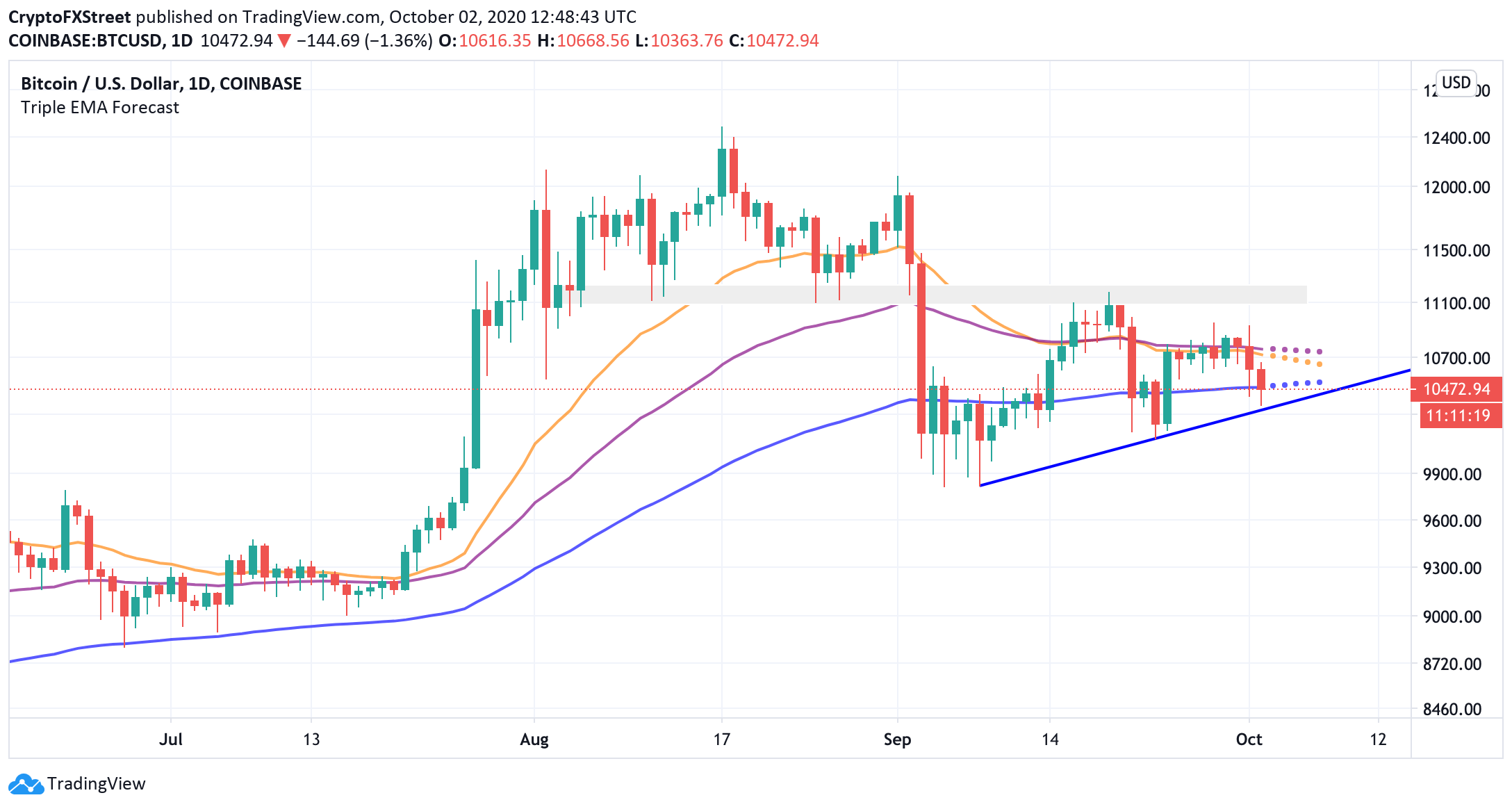

From the technical point of view, BTC/USD is moving within an upside trendline ($10,350) from September 8 low. This barrier stopped the sell-off today and confirmed its status of a formidable backstop. While the price is still hovering below the daily EMA50 at $10,500, the overall trend remains positive.

BTC/USD daily chart

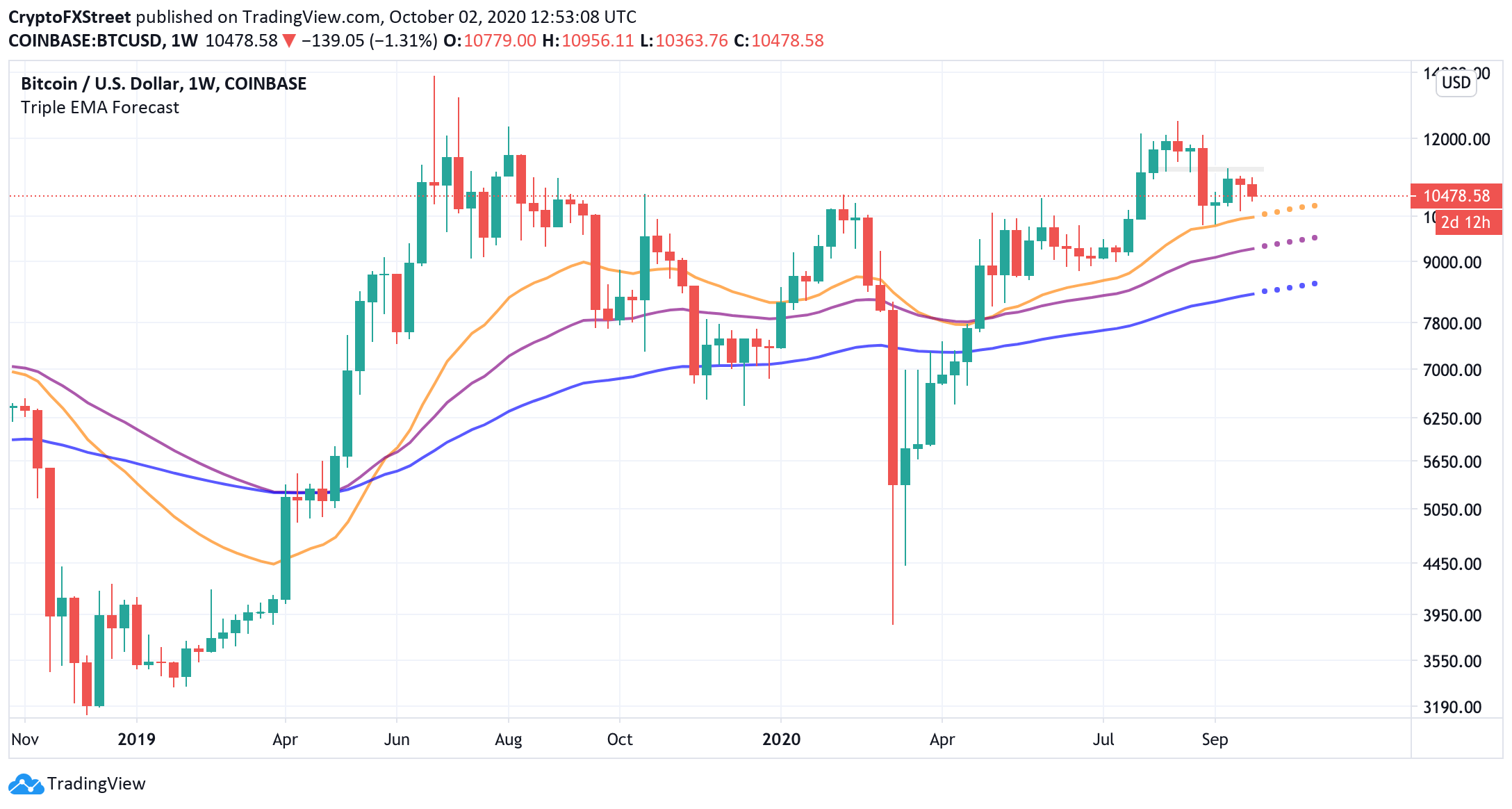

A sustainable move below $10,300 will worsen the immediate technical picture and bring psychological $10,000 into focus. It is reinforced by weekly EMA25 that has served as a strong barrier since the beginning of May. This support is closely followed by the September 8 low of $9,800 and weekly EMA50 at $9,350.

BTC/USD weekly chart

On the upside, the technical setup has barely changed. The local resistance is created by a combination of the mid-term and long-term EMAs on the daily chart at $10.700. The psychological barrier of $11,000 remains the key for further recovery. As we have previously reported, bulls are intimidated by the cluster of strong technical levels around $11,000-$11,200. Once it is out of the way, the upside is likely to gain traction with the next focus on $12,000 and $12,500, the highest level of 2020.

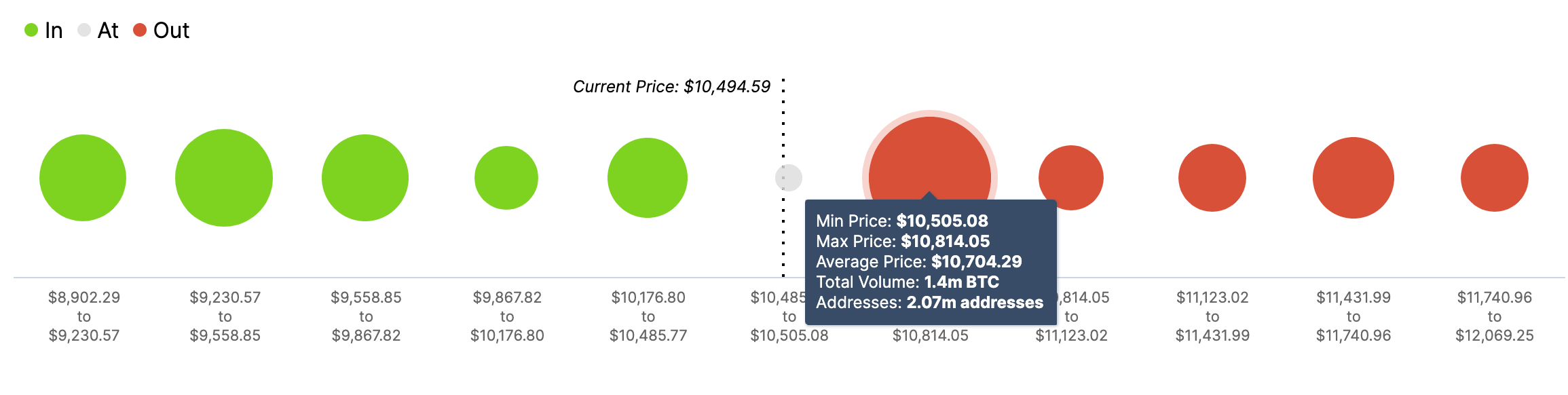

Meanwhile, on-chain data confirms that there is a substantial supply area all the way from the current price and to $10,800. Over 2 million addresses holding 1.4 million BTC have their breakeven point within this range.

Bitcoin's In and Out of the money data

Source: Intotheblock

On the downside, strong support comes only at $9,400, where a cluster of 1.3 million addresses with over 800,000 coins has the potential to absorb the selling pressure.

To conclude: Despite the recent sell-off caused by BitMEX regulatory troubles and risk-aversion sentiments on the global markets, Bitcoin managed to stay above the critical support area created by the upside trendline on approach to $10,300. If this barrier holds, BTC/USD will continue moving in the current range. Sustainable recovery is hardly possible as long as the price stays below $10,700-$10,800, which is confirmed by technical indicators and on-chain data. Once it is cleared, the upside momentum may gain traction.

On the downside, a daily close above $10,300 will worsen the technical picture, while a sustainable move below $10,000 will invalidate the favorable scenario and bring $9,400-$9,350 into focus.

From the fundamental point of view, a sustained reaction to negative news flow may be regarded as a positive long-term signal for BTC.

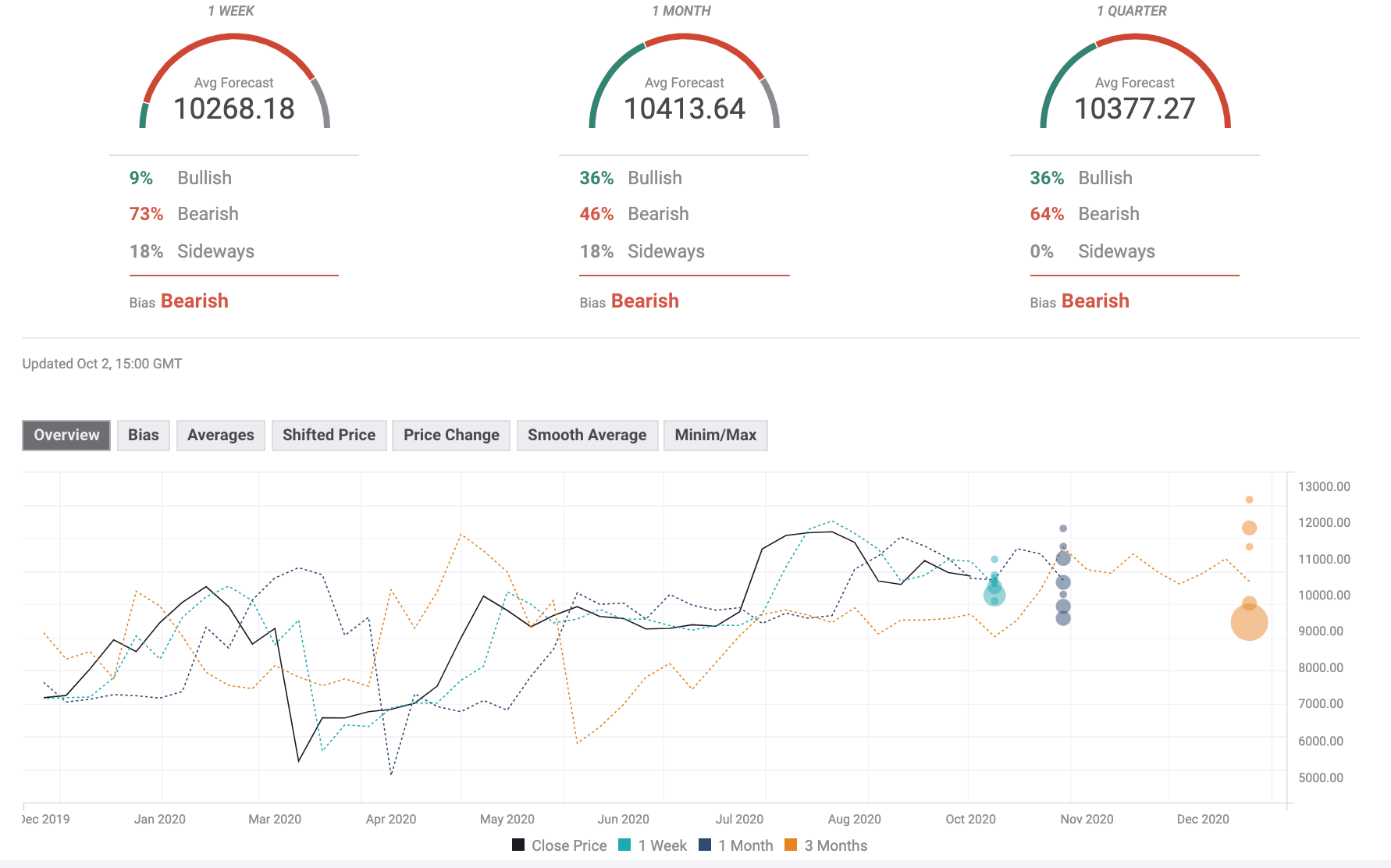

BTC/USD sentiment poll

The BTC/USD Forecast Poll has somewhat worsened since the previous week as expectations on all time frames turned bearish. Now the experts believe that the risks are tilted to the downside both in the short-run and in the long-run. The price expectations on all time frames moved below $11,000. It means that experts bet on a slow price decrease within the current ranges. According to the median price forecast, the first digital coin will stay range-bound around the current levels.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.