Bitcoin Weekly Forecast: BTC/USD in coma, we need a miracle to bring it back to life

- BTC/USD stays lethargic as the cryptocurrency market is in the summer lull.

- BTC ignores the fundamentals, both positive and negative.

- The technical levels have barely changed from the previous week.

Bitcoin has barely changed during the week. The intraweek range of the first digital coin has been limited by $9,350 on the upper side and $9,000 on the downside. At the time of writing, BTC/USD is changing hands at $9,150, unchanged on a week-on-week basis and mostly unchanged since this time on Thursday.

Meanwhile, several altcoins from top-20 continued moving within a strong bullish trend and even registered double-digit gains. Thus, Chainlink (LINK), the growth leader of the week, jumped by over 40%, while Tezos and Stellar increased by over 20%. As a result, Bitcoin's market dominance dropped to 62.3%. Dogecoin (DOGE), the star of the previous week, dropped from the all-time high of $0.005113 to $0.0300. The coin has lost over 40% of its value as the TikTok induced pump is over.

On-chain stats

Bitcoin's on-chain data confirms the uncertain conditions and implies that the range-bound trading may stay in place. However, once the price breaks free outside the claustrophobic channel, the market may become really violent due to the high level of stored energy.

As we have already reported earlier, only 69% are making money at the current BTC price, which is the lowest level in the recent seven days. Even though the number of large transactions has been rising, the trading activity remains depressed.

Volatility vanishes into thin air. In the previous weekly report, we noted that Bitcoin's 30-day volatility decreased to 25.5%, which is the lowest level since March 2019. However, the metric continued to decline during the week and hit 20.07%.

Bitcoin's fundamental factors

The first digital currency is insensitive to whatever happens in the world. Stocks go up, stocks go down, Bitcoin stays unaffected. The US is swept by the second wave of COIVD-19 pandemic, the UK virologists move a step closer to creating a vaccine against the deadly decease, Bitcoin has nothing to do with it. Trump and Xi go mad at each other, Bitcoin looks the other way. Someone hacks Twitter and tries to scam users of their Bitcoins, cryptocurrency market yawns.

The situation looks pathological as it is hard to understand what might serve as a spark that will set the market on fire and create a strong directional move. As the trading theory goes, every range is resolved in either direction with the proper trigger; however, the cryptocurrency market gives us no hints at what those triggers might be.

BTC/USD: Technical picture

On a weekly chart, Bitcoin (BTC) has printed another Doji candle and partially negated the feeble growth attempts of the previous weeks. The hopes that the reversal is just around the corner are dashed and the long-term picture implies more oscillations in the range. The RSI on a weekly chart is completely flat and neutral as the market stays lethargic and waits for strong triggers that will help the price to find the direction.

The critical support is still created by weekly SMA50 currently at $8,620; however, the bears will have to clear daily SMA100 at $8,850 before they get to their final destination. This technical level has served as a backstop for Bitcoin bears since the beginning of May and now it creates the lower line fo the consolidation channel. The MA has started to reverse to the downside which means the market may be vulnerable to the downside movements; however, as long as the price stays above this level, the BTC bulls have a chance to push BTC above the channel resistance.

Once the above-said support level is broken, the sell-off may be extended towards $8,500 (daily SMA200) and $8,350 (the middle line of the weekly Bollinger Band). It is followed by the psychological $8,000 and weekly SMA100 above $7,300.

BTC/USD weekly chart

The daily chart confirms the range-bound forecast with the strong resistance created by the combination of daily SMA50 and the upper line of the daily Bollinger Band at $9,400. BTC/USD has been trading below this area since the end of June. The local support is created by the psychological $9,000 with the lower line of the daily BB located marginally above this area. Once it is out of the way, the sell-off is likely to gain traction with the next focus daily SMA100 at $8,850 and the above-mentioned weekly SMA50 at $8,620.

BTC/USD daily chart

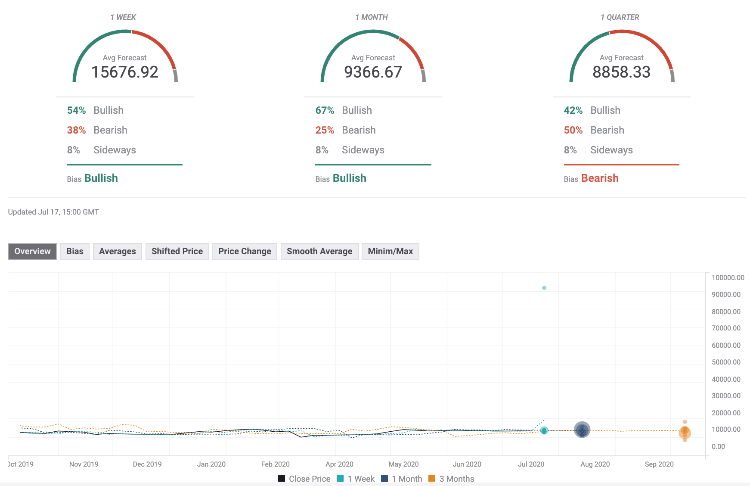

The Forecast Poll has improved since the previous week, especially in the short-term timeframe. The market sentiments are bullish on a weekly and monthly basis; however, the quarterly forecast remains bearish. Notably, the weekly price expectations jumped dramatically above $15,000, while both monthly and quarterly forecasts are below $10,000. It means that the experts bet on the short-term price increase within the long-term consolidation trend.

Author

Tanya Abrosimova

Independent Analyst

-637305938914512043.png&w=1536&q=95)

-637305939094357147.png&w=1536&q=95)