- Bitcoin managed to settle above $9,300, new strong barriers on the way.

- Bitcoin's futures and options expiration increase the volatility on the market.

- BTC/USD needs to regain $9,600 to extend the recovery.

After a sharp sell-off at the beginning of the week, BTC/USD climbed back above $9,000 and made its way above another important resistance $9,300. A shall green candle on a weekly chart is a promising signal, though the market is still gripped with uncertainty at this stage. At the time of writing, BTC/USD is changing hands at $9,450 having gained nearly 3% on a week-on-week basis. Bitcoin's market value settled at $173 billion, which is 65.9% of the total capitalization of all digital assets in circulation.

Beware, volatility ahead

The trading volume of Bitcoin options hit a new record high on the Chicago Mercantile Exchange (CME). According to data provided by a research company Skew, $60 million were traded on CME om Thursday, May 28, which is six times bigger from an average daily trading volume. Until now it was below $10 million per day. Open interest, ore the amount of Bitcoin held in the contracts that are set to expire, also climbed above climbing $250mln.

Notably, Bitcoin futures also expire on CME today. According to the statistical data provided by the exchange, the daily volume for Bitcoin futures reached 483 million, while open interest settled at $427 million.

Even though Bitcoin derivatives traded on CME a are cash-settled contracts, which means that no actual Bitcoin transactions are involved, the events often lead to increased market volatility. Moreover, according to the data, compiled by Cointelegraph and Arcane Research, BTC/USD tends to lose 2.3% of its value ahead of the expiration.

Cardano and Theta – stellar altcoins of the week

Cardano (ADA) is the best-performing digital asset out of top-20 both on a day-to-day basis and on a weekly basis. The coin has gained over 10% in the recent 24 hours after IOHK CEO Charles Hoskinson announced the day of Shelley launch. The team plans to roll out the major upgrade for Cardano blockchain during the next month. Speaking on a crowdcast update, he specified 11 dates for the release that will start on June 9.

If everything works without a hitch, June 30 we're shipping Shelley," he added, saying that, if something goes wrong, it might get delayed to July 7. And users must update by July 20, he added.

The community was excited with the news and swiftly pushed ADA/USD above $0.06.

Theta also broke exciting news about Google partnership and received a lot of attention from the community. However, traders got disappointed once they found out that the “partnership” was not real. Theta/USD hit $0.5493 on Wednesday, May 27 and retreated to $0.3188 by the time of writing. Thus, the coin has lost nearly 50% from the recent peak.

BTC/USD: Technical picture

Bitcoin returned to the area above $9,300 after a sharp sell-off to $8,637 and now the first digital asset has a good chance to finish the week in a green zone. However, it is still early to claim the victory over BTC bears as the price is still below the key technical area that separates it from a strong rally.

From the long-term perspective, BTC/USD is trading above strong local support created by weekly SMA50 (currently at $8,850). This technical barrier has been verified on several occasions since the beginning of the month. Moreover, it is reinforced by the lower border of a triangle pattern that has been limiting BTC movements since the beginning of May.

A sustainable move below this area looks unlikely at this stage, though, if it happens, the sell-off may be extended towards $8,450 (the neckline of the double top formation on the daily chart) and down to $8,100-$8,000. This area includes 61.8% Fibo retracement for the downside move from February 2020 high, the lower line of the daily Bollinger Band and a bunch of daily SMA levels. This barrier will serve as the last backstop that separates BTC from correction from an extended decline.

On the upside, BTC/USD needs to push through a strong resistance area $9,500-$9,600 reinforced by an upper border of the above-mentioned triangle. Also, over 2 million BTC addresses have their breakeven point, which makes it a difficult task for the bulls. This is a critical resistance that separates us from a strong bullish rally towards $10,000. Once the bullish momentum gathers pace, the price will reach this barrier pretty quickly with this year’s high at $10,500 next in the line.

BTC/USD daily chart

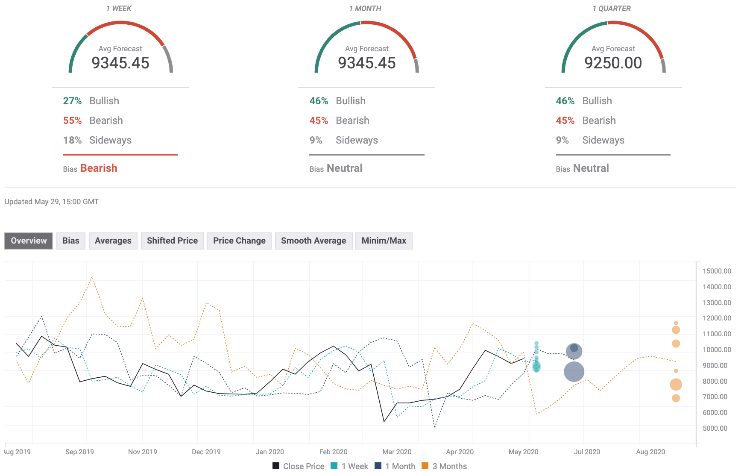

The Forecast Poll showed the market expectations worsened during the previous week. While the forecast on a weekly chart remains bullish, both monthly and quarterly expectations shifted to neutral, which means that the experts do not expect a sustainable price increase both on the long-term and short-term timeframes. Also, the forecasted price is below $10,000 and mostly unchanged along the projecting horizon It means that the market participants take a wait-and-see approach as the global situation and its outcomes for the cryptocurrency market are full of uncertainty.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637263645311998079.png)