- Bitcoin price is likely to correct to $50,000 or $48,000 after failing to hold above the 70.5% Fibonacci retracement level at $54,182.

- This descent will set the stage for a run-up to the next psychological level at $60,000.

- On-chain metrics reveal holders in profit have increased, supporting the short-term correction thesis.

Bitcoin price has positioned itself for a correction after the recent uptick in buying pressure. While the uptick made sense from a technical perspective, the rate of the uptrend did not and could be attributed to the renewed hype around the approval of a futures ETF.

Regulation plays catch-up with adoption

Bitcoin adoption in 2021 has been stellar. From increased usage of BTC in El Salvador to rising BTC ATM installations, the future for Bitcoin looks bright. Although the adoption began with retail, institutions have started taking a second look at BTC. A note shared by JPMorgan to its clients on October 7 revealed that these institutions are looking at BTC as a hedge against inflation instead of gold.

With such an increased interest in Bitcoin, the approval of a Bitcoin ETF makes sense, considering it will allow large investors to gain exposure to BTC without actually holding it. According to Bloomberg analysts, there is a 75% chance that the SEC will approve a futures Bitcoin ETF in October.

If true, this could trigger a bull run in Q4, allowing the ecosystem to recuperate after the May 19 crash. However, some whales do not want to wait or get left behind in the race.

CryptoQuant CEO Ki Young Ju tweeted that an investor(s) purchased “$1.6B worth $BTC via market orders in just 5 minutes.”

Popular analyst Alex Kruger suggested the cryptocurrency markets are trending higher due to the ETF anticipation.

This is what crypto markets are trading now. The dominant narrative is a bitcoin ETF. Dissapoint or not, can worry about that later. https://t.co/aIv3BFZqI4

— Alex Krüger (@krugermacro) October 6, 2021

Where there is heightened interest, there is regulation. Likewise, due to the recent spike in Bitcoin and crypto investments, the US Justice Department recently announced the launch of cryptocurrency cops dubbed the National Cryptocurrency Enforcement Team.

Elaborating on this matter, Deputy Attorney General Lisa Monaco stated,

Cryptocurrency exchanges want to be the banks of the future. We need to make sure that folks can have confidence when they’re using these systems, and we need to make sure we’re poised to root out abuse that can take hold on them.

Bitcoin price to personify the phoenix metaphor

Bitcoin price rose a whopping 37% from September 29 to October 6 as it went from $40,750 to $55,800. Although BTC closed above the 70.5% Fibonacci retracement level at $54,182 on the daily chart, the following daily candlestick closed below it, suggesting investors are booking profits.

The Momentum Reversal Indicator (MRI) also flashed a red ‘one’ sell signal on this candlestick, indicating that the rally is overextended and a one-to-four candlestick correction is likely. Investors can expect this correction to retest the $50,000 psychological support level; a breakdown of this barrier will lead the big crypto down to the demand zone ranging from $43,716 to $48,834.

A bounce off of this area will likely cause the markets to reset, allowing buyers to scoop up BTC at a discount. Market participants can expect the reignited bull rally to shatter through $50,000 and make a run at the 79% Fibonacci retracement level at $57,269 and eventually the $60,000 psychological level.

A decisive close above this barrier will push BTC to retest the all-time high to $64,895 and, perhaps, a new one if the buying pressure persists.

BTC/USD 1-day chart

Supporting the short-term correction is the 365-day Market Value to Realized Value (MVRV) model, which is hovering around 25.21%. This on-chain metric is used to calculate the average profit/loss of investors that purchased BTC over the past year.

Therefore, the BTC network shows that 25% of the buyers that purchased BTC are in profit, increasing the risk of a sell-off if these holders book profits.

BTC 365-day MVRV chart

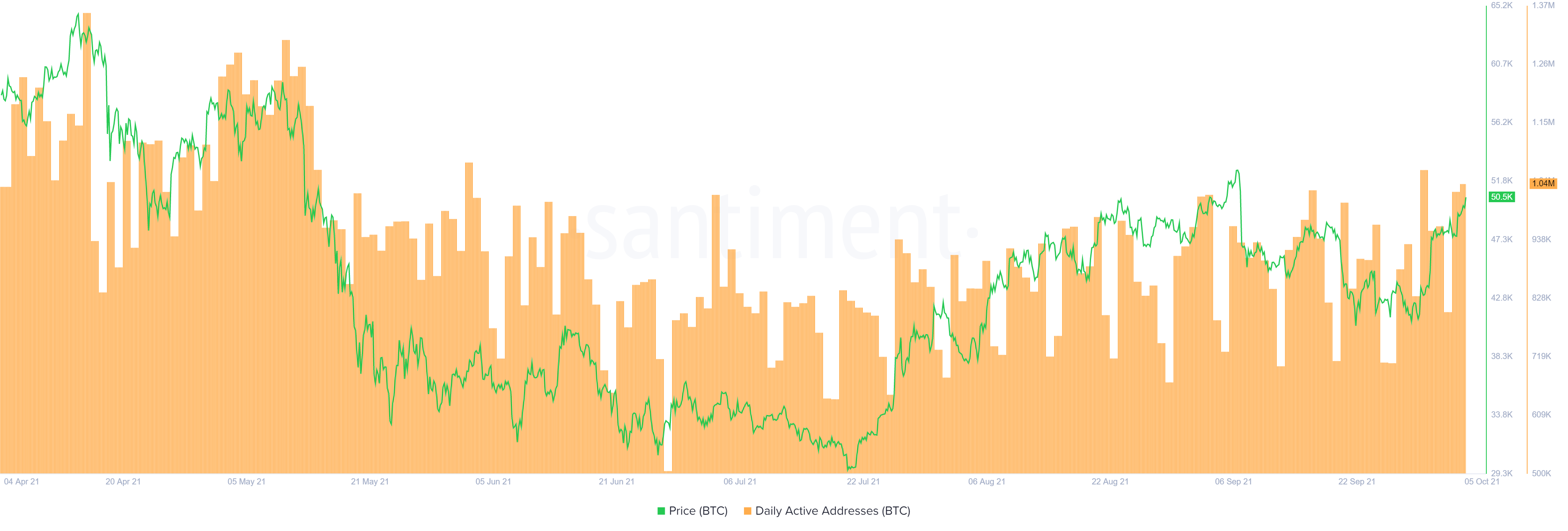

Revealing the long-term bullish outlook for Bitcoin are the daily active addresses, which are increasing. Interestingly, BTC’s price has set up lower highs since September 7, but the active addresses have created higher highs. This forking is referred to as the bullish divergence and indicates that the interest among investors interacting with the Bitcoin blockchain is increasing.

BTC DAA chart

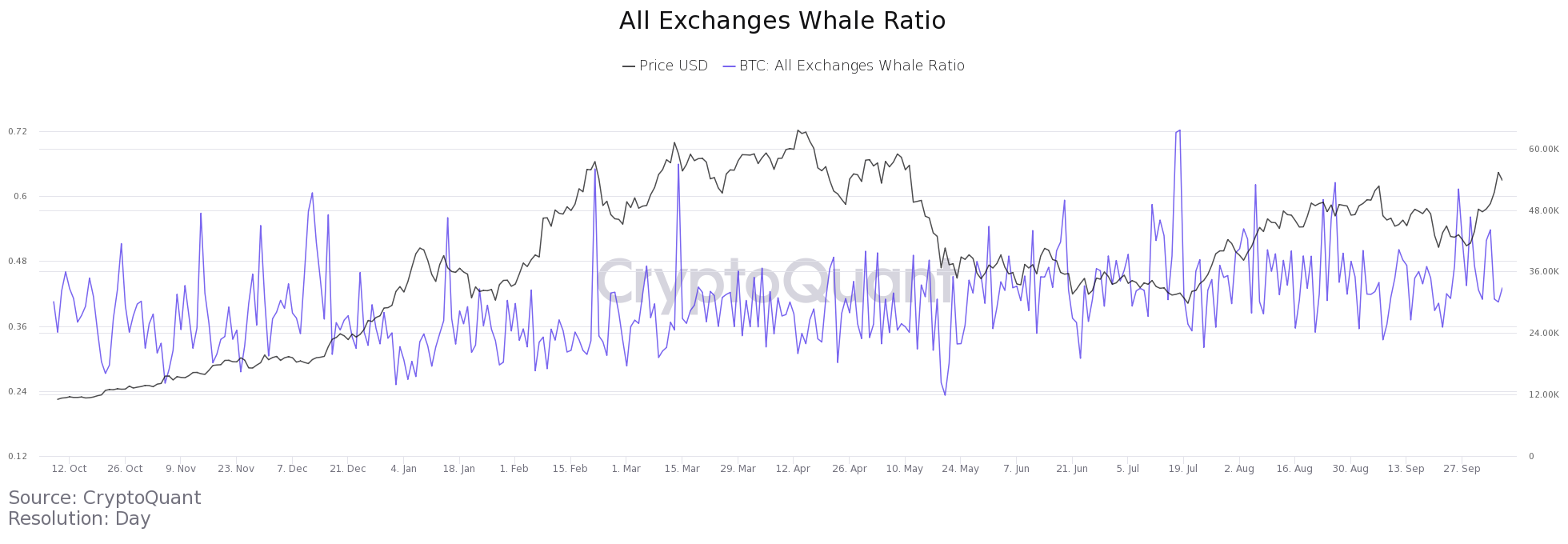

Additionally, the Whale Ratio metric has dropped to 0.43, indicating that the long-term outlook is bullish without any risk of a significant sell-off. CryptoQuant defines this on-chain model as the relative size of the top 10 inflows to total inflows for all exchanges.

An increasing Whale Ratio indicates that whales are depositing their holdings to exchanges looking to book profits. Therefore, the recent decline hints at a bullish outlook.

BTC Whale Ratio chart

While things are looking good for Bitcoin price a breakdown of the demand zone ranging from $43,716 to $48,834 will be a bad development. However, a decisive close below the 50% Fibonacci retracement level at $46,738 will create a lower low and invalidate/delay the upswing.

In this case, BTC will likely revisit the $44,893 foothold before taking another jab at a bull rally.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

[14.44.16, 08 Oct, 2021]-637692812617002159.png)