Bitcoin Weekly Forecast: BTC ready to escape from the range; bulls have $12,000 in mind

- Bitcoin's fundamentals imply that BTC is ready for a new rally.

- The next significant resistance is created by $12,000.

- On-chain metrics confirm the short-term positive outlook.

Bitcoin has been gaining ground amid positive fundamental developments. The flagship cryptocurrency is ready to break free from its current range and proceed with the recovery towards $12,000. Let's have a closer look at what's going on.

Fundamentals are supportive

Square joined the ranks of large companies stacking Bitcoins. When the company bought $50 million worth of BTC as a part of its long-term vision, Bitcoin got a strong upside impulse.

While some investors believe that the cryptocurrency industry overestimates the effect of corporates buying Bitcoin, there is no denying that the trend is positive.

According to the popular economist and trader Alex Krueger, if the trend gains traction, banks will have to adapt their services to satisfy corporate customers' cryptocurrency needs.

That said, if this were to become a trend, something interesting would happen: major banks would be forced to have a crypto team on payroll to service corporate clients' hedging needs.

— Krüger (@krugermacro) October 8, 2020

The US stimulus package saga is another potentially bullish catalyst for the cryptocurrency market. US President Donald Trump confirmed that he continued negotiating the package with the Democrats adding credence to the theory that the initial refusal to discuss it until the elections were just a tactical trick.

As FXStreet previously explained, the stimulus package is inevitable, and the Fed will continue trying to print its way out of the crisis and debasing the traditional money. Bitcoin will eventually benefit from this strategy due to the limited supply and decentralized nature.

Bitcoin's accumulation is getting trendy

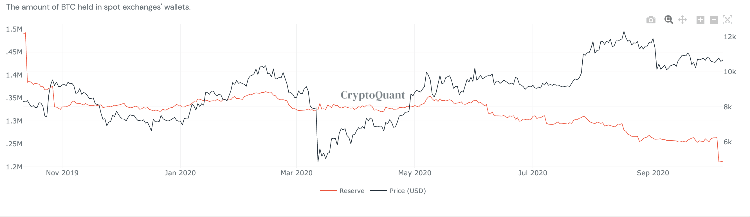

Despite the slow October start, the number of BTC held on the hot wallets of the cryptocurrency exchanges has been trending down, according to the on-chain data provider CryptoQuant. When traders start taking their coins from the exchange wallets for long-term storage, it is a signal that the market sentiments are turning bullish. The crypto analyst, Willy Woo share this view:

When coins on spot exchanges drop, it's a sign that new buyers are coming in to scoop coins off the markets and moving them into cold storage HODL, we are seeing new HODLers right now. Very macro bullish.

Bitcoin's Spot Exchanges Reserve

Source: CryptoQuant

BTC/USD: The technical picture

Bitcoin (BTC) is hovering around $11,000 after a strong recovery on Thursday. The flagship cryptocurrency rebounded from the local support and retested the channel resistance amid improved market sentiments. Bitcoin's market capitalization moved above $200 billion, which is 58.4% of the total value of all digital assets in the circulation.

Bitcoin is escaping the channel

BTC/USD used the daily SMA50 as a spring-board to jump above the local channel resistance level of $10.950. If the breakthrough is confirmed, the upside momentum may gain traction and take the pioneer digital currency's price towards the next bullish target located on the approach to $12,000. This range has been limiting BTC recovery for most of 2020; now, it is considered a critical barrier that separates the coin from the new bullish cycle.

BTC/USD daily chart

If the bulls fail to keep up the pace and let BTC return below $11,000, new highs will have to wait at least until the price retests $10,600. This local support is created by the daily SMA100 that backstopped the downside corrections since the end of April 2020. It is followed by the recent channel support on approach to $10,400 and the psychological $10,000.

The latter limited the price recovery in May and June and flipped into support at the end of July. This area is likely to slow down the bears, however, if they manage to take it out, daily SMA200 at $9,500 will come into focus.

The upside is the path of least resistance

The on-chain metrics confirm Bitcoin's short-term bullish bias. Thus, Intotheblock's data on In and Out Market Positioning shows that there is a strong cluster of nearly 2 million addresses with over 1,4 million coins bought on approach to $10,400. Considering that they will be protecting their breakeven, BTC may find it hard to push through.

Bitcoin's IOMP data

Source: Intotheblock

Meanwhile, there is little in terms of resistance above the current price. About 600,000 coins held on 940,00 addresses may slow down the recovery; however, this supply is likely to be absorbed by the potential demand.

To conclude: The technical indicators and on-chain data imply that Bitcoin is positioned to continue the recovery towards $12,000, provided that the daily candle closes above $11,000. Otherwise, the price may retreat towards the lower line of the current range. A sustainable move below $10,000 negates the immediate bullish forecast.

Bitcoin's poll of experts

The FXStreet Forecast Poll view on BTC/USD has somewhat improved since the previous week as expectations on weekly and monthly time frames turned bullish, while the quarterly forecast is still bearish. Now the experts believe that the risks are tilted to the downside in the long-run, though on shorter time frames an upside correction is possible. The price expectations on all time frames stay below $12,000. It means that experts bet on a price consolidation within the current ranges.

Author

Tanya Abrosimova

Independent Analyst