Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in

- Bitcoin price shows no signs of directional bias while it holds above $60,000.

- The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

- But history shows that BTC generally appreciates a year into halving and hits an ATH.

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Also read: Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains uncertain

Bitcoin price is the centre of all uncertainty regardless of the events, such as the halving, macroeconomic events, or other developments. Since the fourth Bitcoin halving is set to take place between 16 and 18 hours, investors are wondering about two things: Is the halving priced in? What will happen to Bitcoin price post-halving?

Also read: Bitcoin likely to drop after the halving, JPMorgan says

Let’s take it step-by-step and answer the above questions.

Is the halving priced in?

According to Deutsche Bank Research, the halving is already priced in, at least partially as they “do not expect prices to increase significantly following the halving event.” But that doesn’t mean the German bank is expecting a correction. Instead, they mention that prices could remain higher for longer due to the following reasons:

- Ethereum spot ETF approval anticipation

- Future central bank interest-rate cuts

- Regulatory changes

As for not expecting a massive rally in Bitcoin price, Deutsche Bank Research notes a spike in the launch of Layer 2 (L2) scaling solutions. Since L2 solutions augment the network’s practical utility, its share of the market has been slowly increasing.

What will happen to Bitcoin price post-halving?

Bitcoin halving, as Deutsche Bank mentions in its research, is a retail-driven event. Retail investors consider the negative supply shock to have a positive effect on Bitcoin price. As a result, the number of addresses holding BTC sees a huge uptick after halving.

Roughly 150 days after halving, the retail addresses holding up to 1,000 BTC grew by 52%, 37% and 3% in 2012, 2016 and 2020, respectively, making the halving event a retail-driven upgrade.

Currently, there are 53.3 million addresses of retail investors holding between up to 1,000 BTC as opposed to 2121 addresses for whale/institutional investors holding more than 1,000 BTC. These numbers will go up significantly after the halving if history repeats itself, which is likely to have a positive impact on Bitcoin price.

BTC Supply Distribution by Balance of Addresses

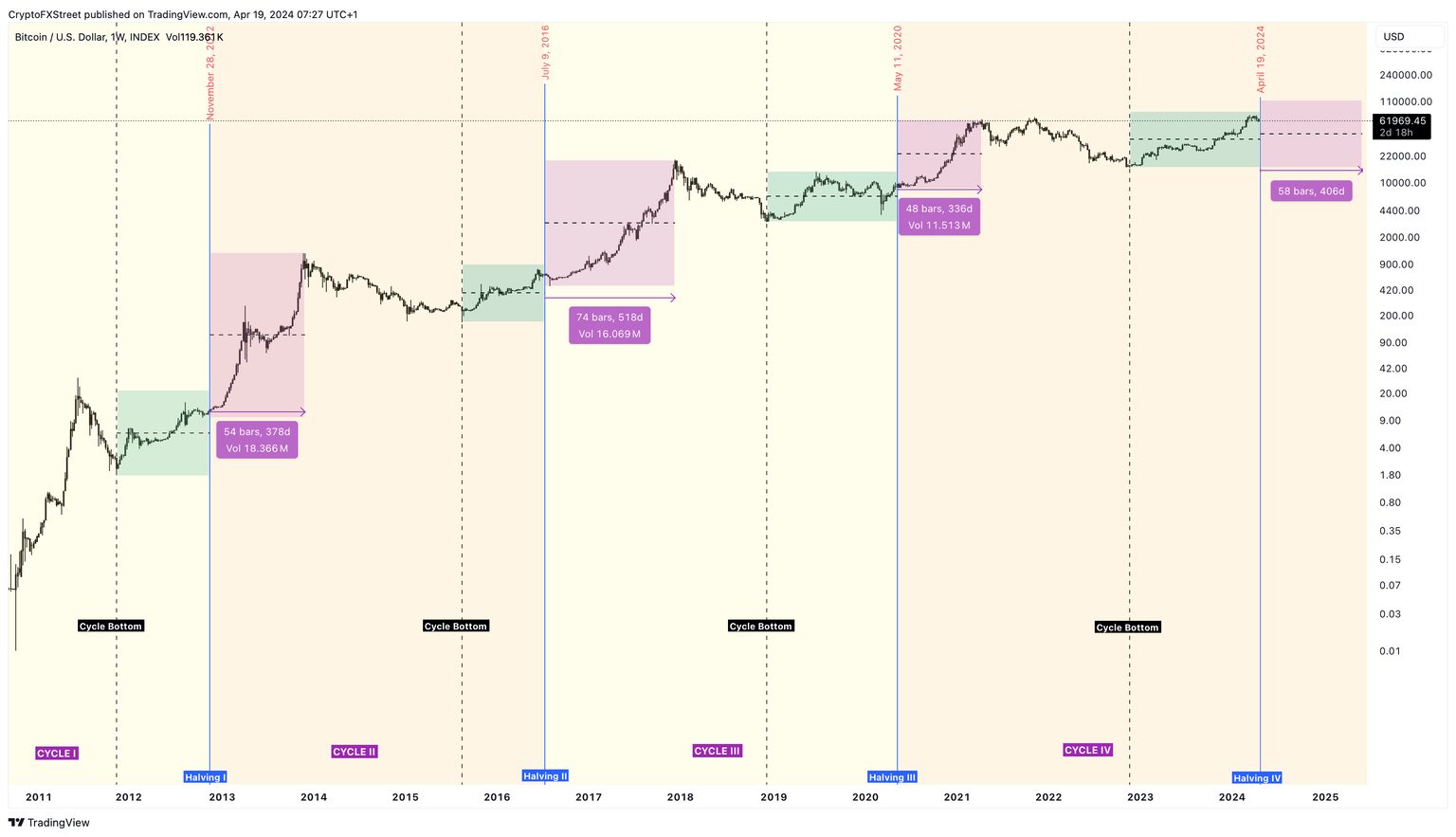

From a historical perspective, Bitcoin price has set up an ATH on an average of 410 days after halving. Roughly 378 days, 518 days and 336 days after the first, second and third halving events, Bitcoin price set up an ATH.

As explained in a previous publication, if history repeats or even rhymes, the chances of Bitcoin continuing its ascent are high.

Also read: How to approach the fourth Bitcoin halving as an investor - all you need to know

BTC/USDT 1-week chart

On the other hand, if Bitcoin price triggers a steep correction that shatters the $50,000 psychological level into a resistance level, it would invalidate the bullish thesis. Such a development could see BTC drop down to the next key weekly support level at $45,000.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B11.33.03%2C%252019%2520Apr%2C%25202024%5D-638491117484614589.png&w=1536&q=95)