- Bitcoin price takes the first step to recovery but needs solid confirmation that will arrive after a flip of the $19,539 level into a support floor.

- After a successful flip, investors could expect a move up to an intermediate hurdle at $20,737.

- A daily candlestick close below $17,593 will invalidate the bullish thesis for BTC.

Bitcoin price has produced three consecutive lower lows since September 7, but at the same time, the Relative Strength Indicator (RSI) has shown a positive rise demonstrating a lack of underlying bearish power. This lack of confirmation indicates a possible reversal is in sight, and BTC has started to climb higher, but it still faces one of the biggest hurdles and only by overcoming it will it confirm a short-term shift in regime favoring bulls.

Stablecoins under fire from US watchdogs

While technicals are struggling to develop a firm bias, regulators in the US have taken a serious approach in culling algorithmic stablecoins after the recent collapse of Terra/LUNA that sent shockwaves in the crypto ecosystem.

The House of Representatives Financial Services Committee (FSC) has targeted stablecoins such as DAI, FRAX and USDD and proposed a bill that could put a two-year ban on these assets. The reason for this bill can be traced back to the collapse of the Terra-LUNA ecosystem in the second quarter of 2022.

In this regard, Rep. Warren Davidson stated,

There's an outside chance we find a way to get to consensus on a stablecoin bill this year.

While there is a war on stablecoins, Tether, one of the largest issuers of stablecoins, came under fire this week as Katharine Polk Failla, a U.S. Judge in New York, ordered the company to produce documents confirming that all the issued USDT is backed with US dollars.

Regardless of the regulatory mayhem, BTC is slowly trying to regain momentum and needs to overcome one crucial hurdle to jumpstart its uptrend.

Bitcoin price and its technical woes

BTC price is in a tight corner, technically speaking. After forming another swing low at $18,804, BTC price has rallied 7% and is currently grappling with the $19,405 to $19,599 resistance box. August’s lows at $19,539 are key to the outlook, as we shall see.

There are two things investors should pay attention to:

- A flip of the $19,539 barrier into a support level.

- RSI sustaining above the 43 to 46 support box as BTC flips the aforementioned level.

If both these conditions are met, then Bitcoin price would be primed for a move higher. In such a case, BTC will face a significant resistance confluence consisting of the $20,737 resistance level combined with the declining trend line connecting the swing highs since May 31.

Clearing these hurdles will not be easy, but it will be necessary to open the path to retest and sweep the previous weekly high at $22,850.

Beyond this level, market participants should shift their focus to August’s high at $25,200. This level is significant since it contains the midpoint of the $32,427 to $17,593 range at $25,010. A retest of this level could create a local top for Bitcoin price.

BTC/USDT 1-day chart

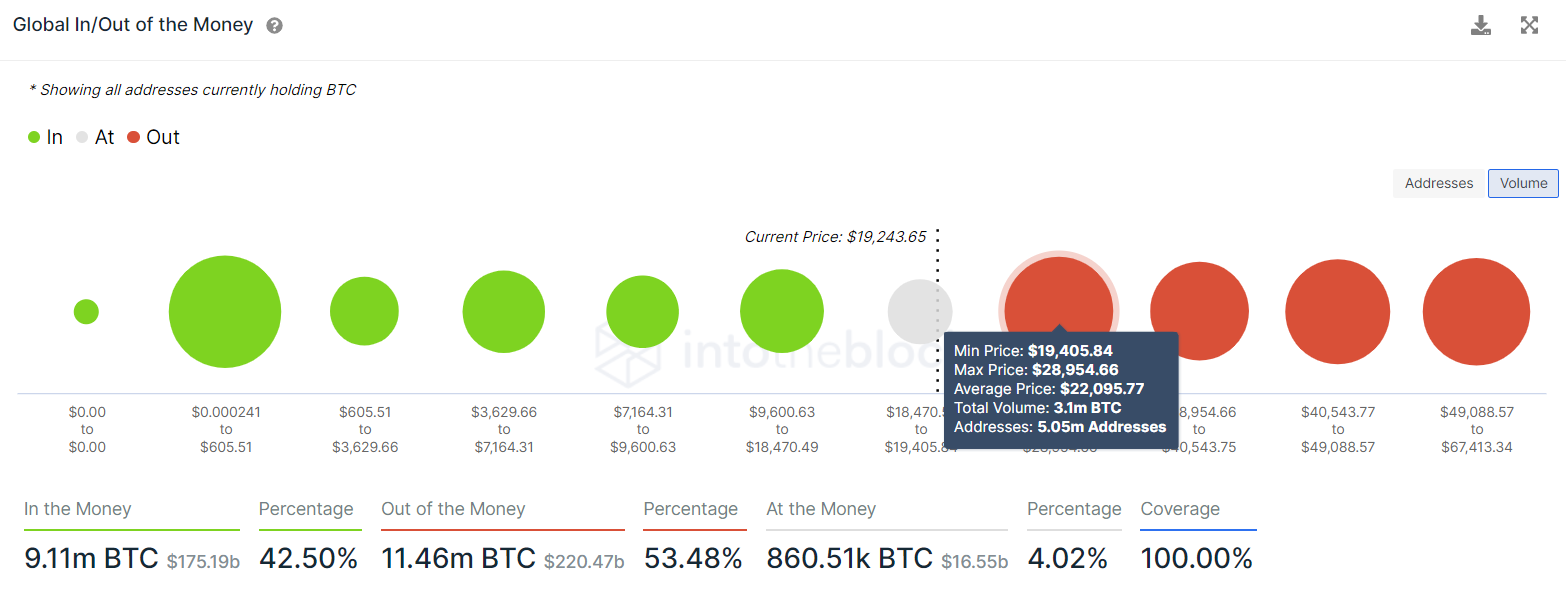

IntoTheBlock’s Global In/Out of the Money (GIOM) model supports this rally in Bitcoin price. This indicator shows that the immediate support level, extending from $9,600 to $18,470, is not as strong as the resistance level but is capable of producing a bounce.

The immediate hurdle, however, extends from $19,405 to $28,954, where roughly 5.05 million addresses that purchased 3.1 million BTC at an average price of $22,095 are “Out of the Money.”

This resistance cluster coincides with the targets mentioned from a technical perspective, adding more credence to the possibility of a bounce.

However, investors should note that a move into the said cluster could result in a sell pressure from these underwater holders who would want to break even.

BTC GIOM

Another interesting metric that promotes this bullish narrative is the on-chain volume, which has been on a steady uptrend. After dipping to 16.39 billion BTC in the first week of July, it has steadily surged to where it currently stands, 41 BTC. This uptick indicates that more investors are interacting with the BTC blockchain, and hence there is an increase in capital inflow, which is a bullish sign depending on the market structure.

BTC on-chain volume

While things are looking up for Bitcoin price, investors should be prepared for a whipsaw scenario which would include a sweep of the June 18 swing low at $17,593. This move would be a good opportunity to buy if BTC recovers and sustains above this level quickly.

However, a daily candlestick close below the said level that flips it into a resistance level will invalidate the bullish thesis. In such a case, Bitcoin price could crash to $15,500, which is the next stable support level.

If the selling pressure continues to spike, the big crypto could trigger a sell-off to $13,500 and $11,989, where a macro bottom for the bear market could form.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Who is Satoshi? Crypto lawyer sues DHS to reveal Satoshi Nakamoto's identity

Crypto attorney James Murphy, popularly known as "MetalLawMan", files a lawsuit against DHS to reveal Satoshi Nakamoto's identity. The lawsuit is based on Special Agent Rana Saoud's 2019 claim that the DHS had uncovered the creator of Bitcoin.

Binance to delist BADGER, BAL, 12 more tokens on April 16

Binance will delist 14 tokens on April 16 following a successful vote and standard delisting processes. TROY, SNT, and UFT top Binance’s first batch of the vote to delist results. Binance token delisting will impact futures, margin, loan and simple earn services.

Bitcoin Price Forecast: MicroStrategy’s SEC form 8-K filing hints at possible Bitcoin sales to meet financial obligations

Bitcoin price stabilizes around $80,000 on Tuesday after reaching a new year-to-date low of $74,508 the previous day. MicroStrategy’s SEC Form 8-K filing reports a loss of $5.91 billion, hinting at possible BTC sales to meet financial obligations.

Top 3 gainers Fartcoin, Hyperliquid and Telcoin: Asian session sparks tariff relief rally in meme coins and DeFi

The cryptocurrency market is experiencing a tariff relief rally, with altcoins like Fartcoin, Hyperliquid (HYPE) and Telcoin (TEL) bouncing back with double-digit gains. Fartcoin has jumped 28% in the past 24 hours, reaching $0.5801.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

[13.17.54, 23 Sep, 2022]-637995197159551063.png)