Bitcoin Weekly Forecast: BTC likely to correct to $50,000 soon

- Bitcoin price has formed a potential top signal that forecasts a sell-off.

- The weekly chart also points to a bearish divergence, which adds credence to the bearish outlook.

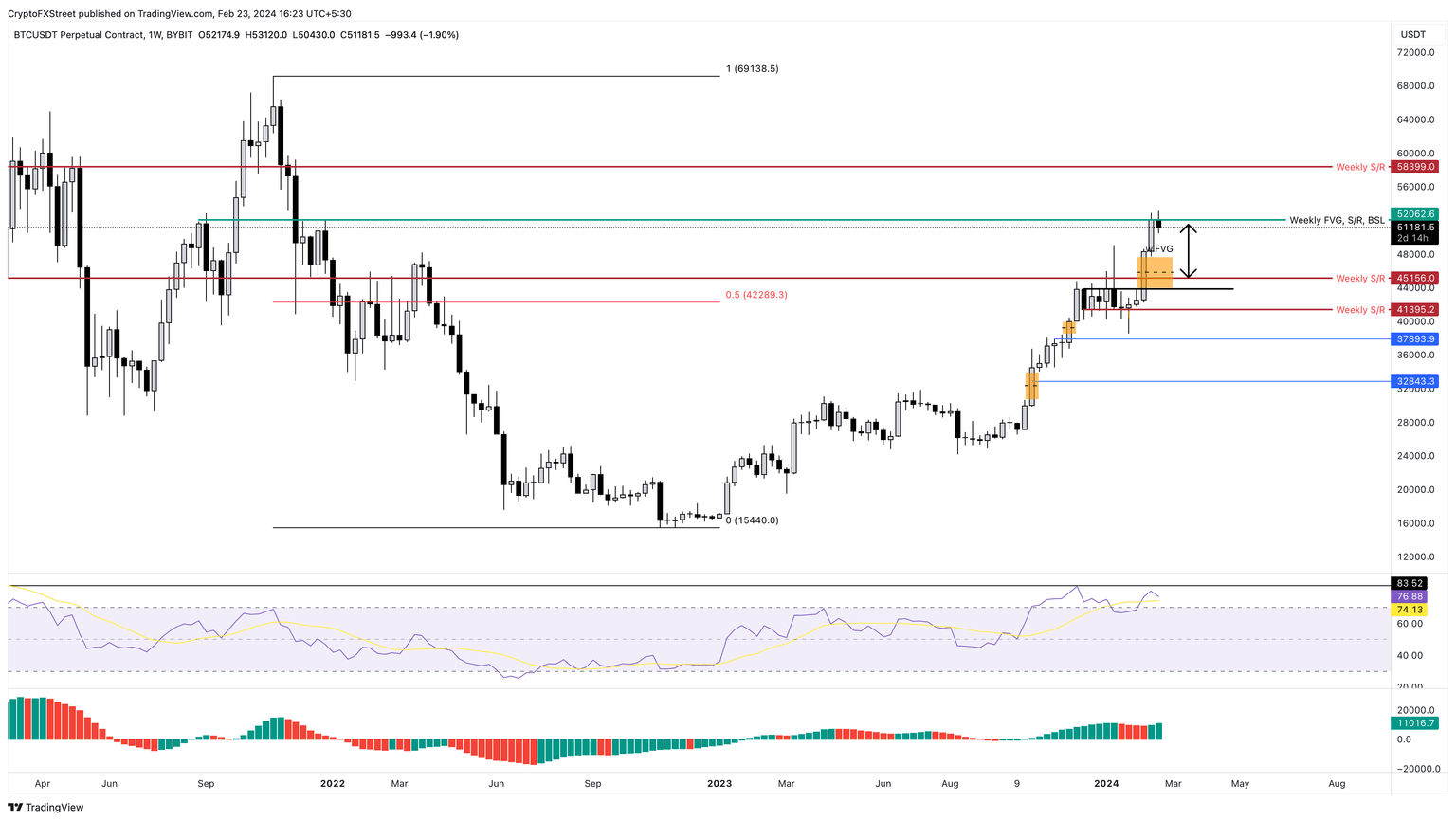

- Investors can expect BTC to consolidate between the $52,062 to $45,160 levels.

- Invalidation of the correction thesis will occur on the flip of the $52,062 resistance into a support floor.

Bitcoin (BTC) price action over the past eight days signals a lack of volatility and reduced liquidity. This coiling up could lead to a steep correction in the near future for BTC.

Also read: Bitcoin price eyes $48,000 as European Central Bank tears down at BTC after spot ETF approval

Bitcoin price flashes a sell signal

Bitcoin price action has produced the same local top formation over the last three months. This setup has a few key identifying factors:

- BTC rallies violently to the upside.

- This impressive rally is followed by a sideways movement that leads to an equal high formation.

- The consolidation here is also characterized by blow-off tops or swing failure patterns.

- Following the blow-off tops, the range tightens and is followed by a volatile move to the downside.

Between January 23 and February 23, Bitcoin price has rallied violently to the upside, forming relatively equal highs with bearish swing failure patterns. If history rhymes, then all that’s left to happen is for a steep correction to trigger.

Also read: Ethereum price risks decline as increasing exchange supply raises chances of profit taking

BTC/USD 4-hour chart

The weekly chart for Bitcoin price also adds credence to this outlook which shows a higher high formation that does not conform with Relative Strength Index’s (RSI) lower highs. This divergence is a bearish sign, which aligns well with the four-hour chart’s forecast.

The key levels for a correction include:

- Support located at the $50,000 psychological level, in an optimistic scenario.

- From a weekly perspective, however, BTC could retest the upper limit of the imbalance, extending from $47,712 to $43,890.

- A rather bearish outlook would see BTC sweep $41,395.

BTC/USDT 1-week chart

Both the short-term and higher-time frame charts are hinting at bearish outlooks, which makes sense after a 37% rally in Bitcoin price in just 28 days. Therefore, investors should note that this retracement will be healthy in keeping the uptrend alive.

However, should Bitcoin price breach the $41,395 weekly support level and flip it into a resistance level, it would invalidate the high-time frame bullish thesis that has kept BTC on an uptrend since January 2023.

In such a case, BTC could revisit the $37,893 and $32,843 support levels, depending on the selling pressure at the time.

Also read: XRP price plunges as Kraken cites SEC v. Ripple lawsuit in its legal battle against the regulator

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.