- Bitcoin price has consolidated within the weekly supply zone, extending from $40,423 to $47,209 for the past two weeks.

- The weekly RSI has never reached levels this high without kicking off a raging bull market, analyst notes.

- BTC is likely giving traders a chance to buy the cool off before breaking past the $48,000 psychological level.

- The bullish thesis will be invalidated once the king of crypto breaks and closes below the critical support at $37,800.

Bitcoin (BTC) price has shown resilience in December, resisting selling pressure coming from a weekly supply barrier. It comes as traders exercise patience, resisting the urge to book profits and looking at the bigger picture as 2024 has multiple bullish catalysts lined up for Bitcoin.

Bitcoin price cool-off is a possible entry for investors before 2024

Bitcoin price has cooled off, spending the first two weeks of December within the weekly supply zone, stretching between $40,423 and $47,209. Typically, this would have been a strong rejection and, therefore, a turnaround point for Bitcoin price, but this has not happened. Instead, traders continue to plan their trades.

Weekly Ranges

— TradeR KhaN56 (@TradeRKhaN75) December 15, 2023

Buy at the lower horizental line and sell at the High

This will be our buying and selling Ranges.#bitcoin #binance #BTC . pic.twitter.com/mJWhidib1Y

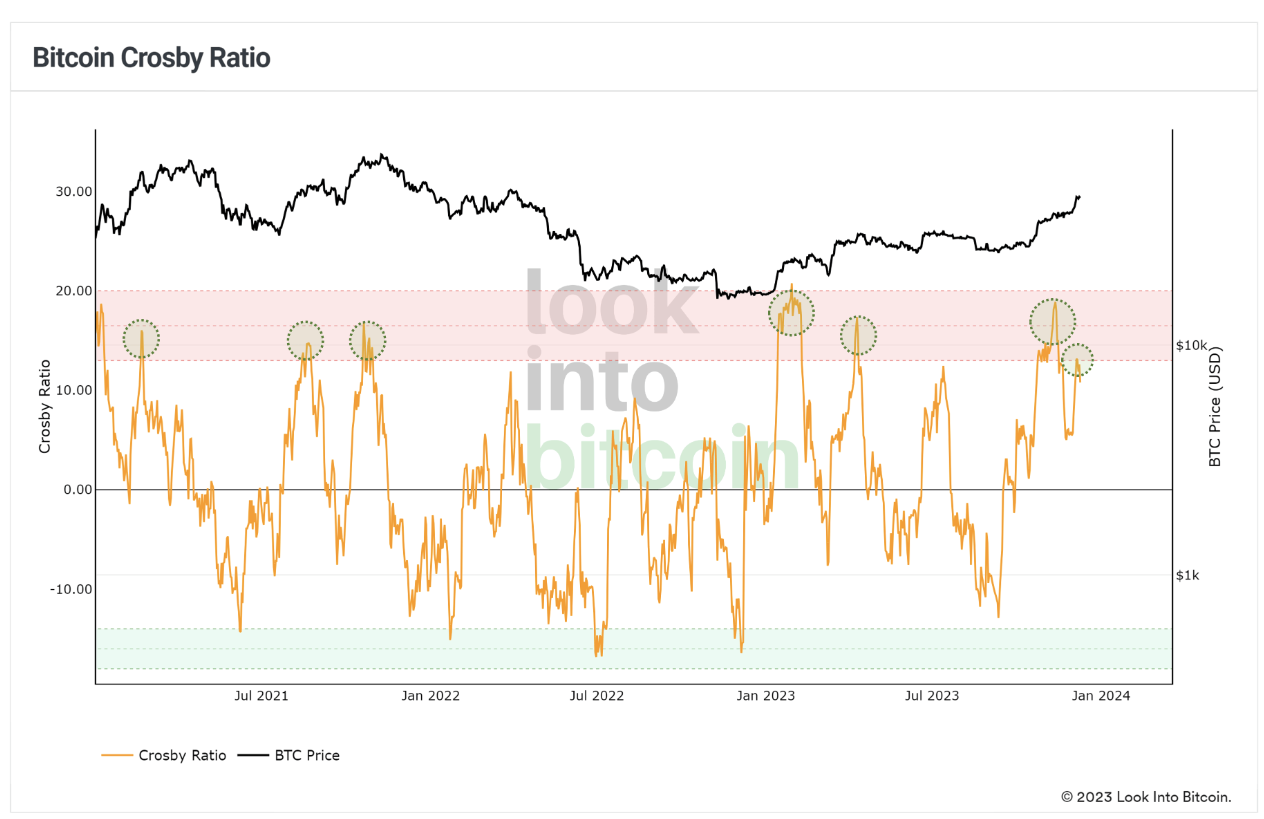

The breather comes as Bitcoin price ascended to its golden ratio multiplier near-term target, as indicated by the Crosby Ratio. This metric reveals Bitcoin’s near-term price at “over-extended levels,” causing the urge for a slow down, or in the dire case, a correction.

Bitcoin Crosby Ratio chart

Meanwhile, anticipation for spot BTC exchange-traded funds (ETFs) continues to brew, with experts marking the calendar for between January 5 and 10. This, together with the BTC halving expected around April 2024, has BTC holders keeping their selling appetite in check, anticipating the next bull run.

Read More: BTC headstrong as Spot ETF talks reach technical stage

BTC Weekly RSI reaches levels where it had created bull markets

Bitcoin price has more upside potential and could rally past the $48,000 psychological level ahead of the expected 2024 bull market. For starters, one trader, @CryptoJelleNL, has evaluated the Relative Strength Index (RSI) momentum indicator, establishing that it is at historical levels. The trader says, “BTC RSI has never reached levels this high without kicking off a raging bull market.”

BTC weekly RSI

If the same repeats, Bitcoin price could nuke, recording another hard pump that could potentially set the tone for the 2024 bull market. As the new year is barely two weeks out, this could happen sooner than expected.

The technicals suggest that the bulls are poised to enjoy the potential rally, with the Awesome Oscillator (AO) indicator showing green histogram bars. Its position in the positive territory, as well as that of the Moving Average Convergence Divergence (MACD), accentuate the bullish outlook.

Read More: Tailwinds abound for BTC as Google suggests ETF readiness

On-chain data: GIOM

IntoTheBlock’s “Global In/Out of the Money” (GIOM) model reveals there is only one supply barrier that could prevent the largest cryptocurrency by market capitalization from achieving its upside potential. Based on this on-chain metric, the major area of interest lies between $43,211 and $67,413, which is filled by a high number of sellers that had previously purchased BTC around this price level. Here, roughly 6.11 million addresses are holding nearly 2.24 million BTC.

The data also shows that Bitcoin price has robust support downward than the overhead pressure it faces. Any efforts to push Bitcoin price lower would be countered by buying pressure from all these addresses.

BTC GIOM

If Bitcoin price manages to record a weekly candlestick close above the mean threshold (midline) of the weekly supply zone at $43,860, it could initiate the continuation of the uptrend, setting the tone for BTC to target the $48,000 psychological level.

The next logical target for Bitcoin price beyond the $48,000 level would be $50,000 or, in highly bullish cases, the $60,000 psychological level.

BTC/USDT 1-week chart

Conversely, if sellers have their say, Bitcoin price could pull south, potentially losing the $40,000 psychological level. In the dire case, the slump could see BTC break and close below the $37,800 support floor, where the bullish thesis would be invalidated.

Also Read: Ethereum leads altcoins north as Bitcoin halts amid bull trap fears

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.