- Bitcoin price is gathering steam in hopes of retesting the critical psychological level of $40,000.

- BTC adoption progresses as NYDIG partners with NCR to enable digital asset offerings to a broader audience.

- Mining companies still face backlash after China’s cryptocurrency regulations.

Bitcoin price had a bumpy ride this week, but it managed to set up a higher high, signaling a bullish development. However, the second half of the week has not been so kind as BTC continues to decline in search of a foothold.

The flagship cryptocurrency will likely find a support floor soon and kick-start an upswing that tags a key psychological level.

BTC adoption marches forward

Bitcoin adoption does not seem to care about the massive drawdown taking place. From being obscure internet money to making headlines on mainstream media, the BTC story has evolved.

Likewise, the adoption of BTC has also seen a noticeable but positive change from Canada approving multiple Bitcoin ETFs to NYDIG partnering with NCR Corporation to offer the pioneer cryptocurrency to its customers. NCR has roughly $6 billion in assets under management and will offer digital assets with NYDIG acting as custodian to 24 million customers spread across 650 US banks.

On a similar note, the world’s biggest interdealer broker TP ICAP announced plans to launch a crypto trading platform for institutional investors. The platform is under development with the help of Fidelity and Zodia Custody, who will serve as custodians, while Flow Traders will provide the liquidity.

ARK Investments partnered with 21 Shares to market the “ARK 21 Shares Bitcoin ETF,” a new addition to the long line of members waiting for approval from the concerned authorities.

Most institutional investors prefer not to hold cryptocurrencies due to their complicated nature, which is why NYDIG, Fidelity and other companies that provide custody are being sought after. Bitcoin ETFs solve the problems these facilities face and will likely trigger a massive inflow of institutional capital.

The crypto-miner dilemma

While institutional capital continues to flow into the cryptocurrency industry, China’s clampdown has forced miners to move to countries with friendlier regulations. The Bitcoin hash rate has suffered the most from the most recent “Chinese ban on crypto,” declining more than 50% since May 15. Alongside, miner revenue dropped by roughly 42% in June.

Despite this unforeseen development, the Bitcoin Mining Council (BMC) reported promising results.

Based on a recent study, BMC estimated that “the global mining industry’s sustainable electricity mix had grown to approximately 56 percent, during Q2 2021, making it one of the most sustainable industries globally.”

Due to environmental concerns, electric car manufacturer Tesla stopped accepting BTC as payments.

Elon Musk, the CEO of Tesla, noted,

When there’s confirmation of reasonable (~50%) clean energy usage by miners with positive future trend, Tesla will resume allowing Bitcoin transactions.

While critics indicate that BMC is optimistic in approximating results, Musk is yet to confirm if Tesla will roll back its decision and start accepting payments again.

Bitcoin price locks in on $40,000

Bitcoin price has experienced three significant drawdowns since its all-time high in mid-April. The first correction spanned 11 days starting from April 14 and pushed BTC down by 27%. The second was the most brutal sell-off as it pushed the flagship cryptocurrency down by 50% to $30,000.

The third and the most recent crash was between June 20 and June 22, where BTC slipped to $28,805.

Despite the last flash crash, Bitcoin price is still maintaining its range-bound movement and due to the extent of the previous dip, BTC is likely to retest the range high at $42,451.

The 4-hour demand zone ranging from $30,573 to $31,979 appears to be the perfect place for reversal, so investors need to keep a close eye on it. In a bearish case, BTC might extend below this barrier and tag the support level at $30,000.

Assuming a bounce from the $31,979 demand zone’s upper boundary, Bitcoin price might rally by 14% to encounter the first level of resistance at $36,600. Clearing this will allow BTC to test $39,146 and $40,000, which can be considered a significant psychological barrier.

If the bulls manage to produce a decisive daily candlestick close above $40,000, the range high at $42,451 and $43,538 will be back on the table.

BTC/USDT 12-hour chart

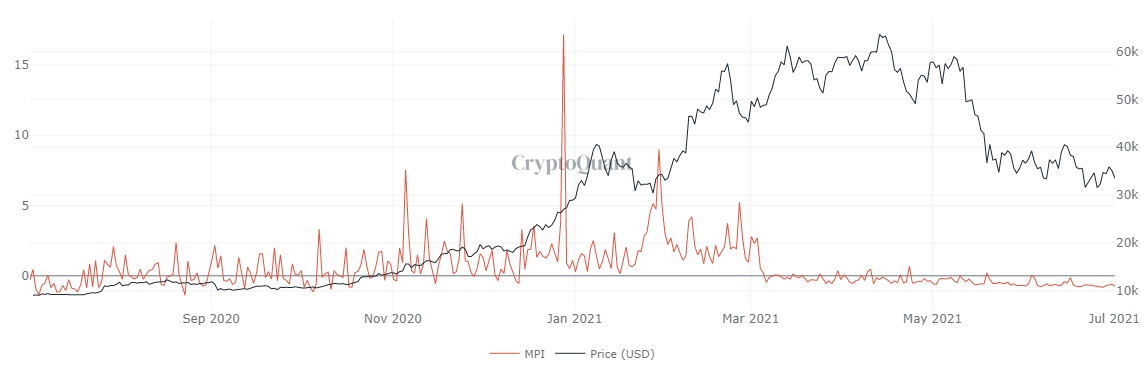

Supporting this massive upswing is the negative value from the Miners Position Index (MPI). This fundamental index is used to track a major shift in miners’ sentiment and is calculated by dividing the number of BTC leaving miners’ wallets by its 1-year moving average.

A negative value indicates that BTC tokens are not leaving miners’ wallets, indicating that the miners are optimistic about Bitcoin price performance in the near future. Additionally, it also suggests that there is no sell-side pressure from the mining community.

BTC MPI chart

Further fortifying the optimism around Bitcoin price is the 365-day Market Value to Realized Value (MVRV) model, hovering in the opportunity zone around -10.78%. The negative number indicates that the short-term investors (weak hands) are selling to long-term holders (strong hands).

The last time this fundamental index dipped below -10% was in mid-December 2019, which was followed up by a 44% increase in Bitcoin price over the next two months.

Therefore, if something similar were to happen, a 33% upswing to $42,451 seems likely.

BTC 365-day MVRV

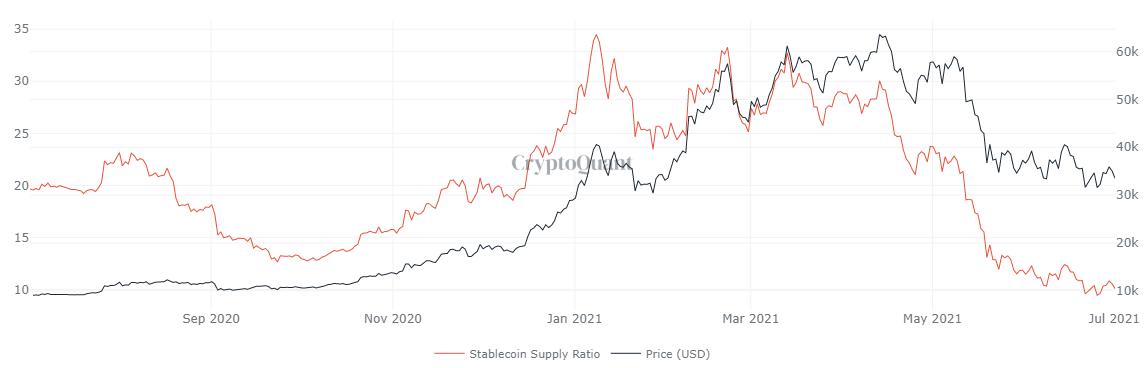

The Stablecoin Supply Ratio (SSR) is a metric that is derived by dividing the BTC market cap by the aggregated market cap of all stablecoins. The lower the SSR is, the higher the potential buying power is.

At the Bitcoin price all-time high of nearly $65,000 in mid-April, SSR was hovering at 30, and since then it has dropped by 66% to 10, where it currently stands. This inverse relationship depicts the market interest in accumulating BTC or other digital assets despite the brutal sell-off.

BTC SSR chart

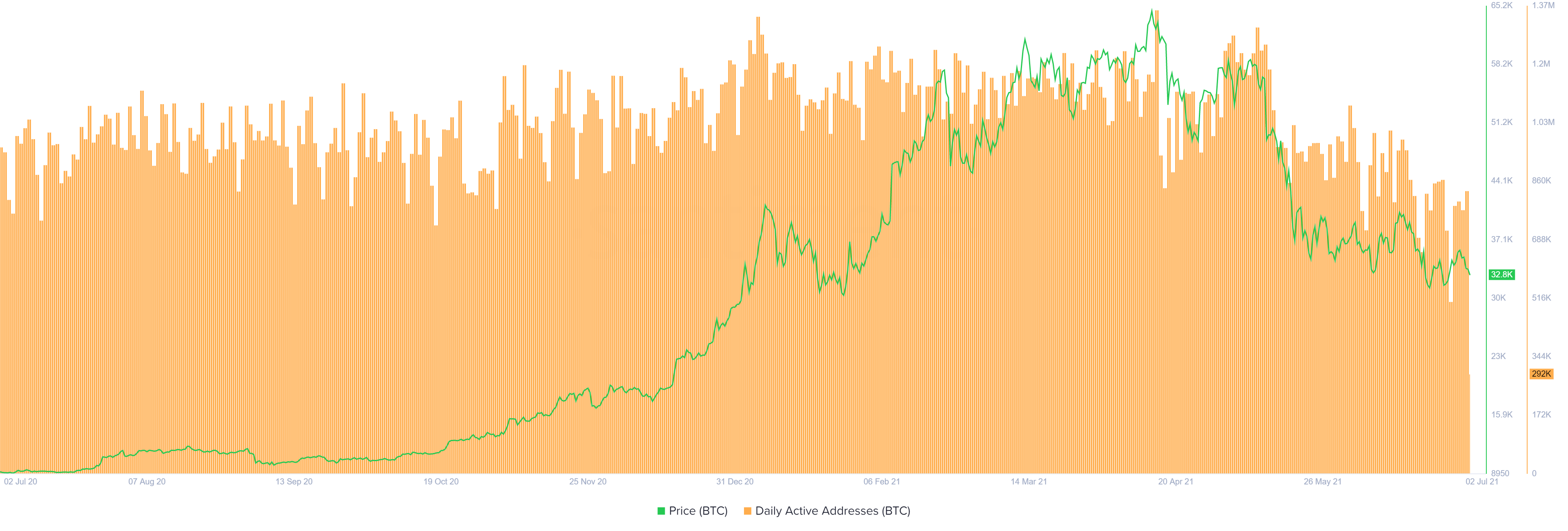

While some fundamentals and on-chain metrics hint at a bullish outlook, investors need to pay heed to not-so-bullish metrics. For instance, the Daily Active Addresses (DAA), as the name suggests, is an indicator that shows the number of investors interacting with the BTC blockchain.

After the 50% crash in mid-May, the number of DAA has stayed below 1 million. This is a major shift in trend as the DAA stayed above this threshold for more than ten months. The sudden decline is apparent considering the massive sell-off that liquidated billions of dollars worth of long and short positions across the board.

If Bitcoin price were to turn bullish and tag the $42,451 target mentioned above, the DAA has to see a corresponding increase. If not, then the probability of a rally might be fleeting.

BTC DAA chart

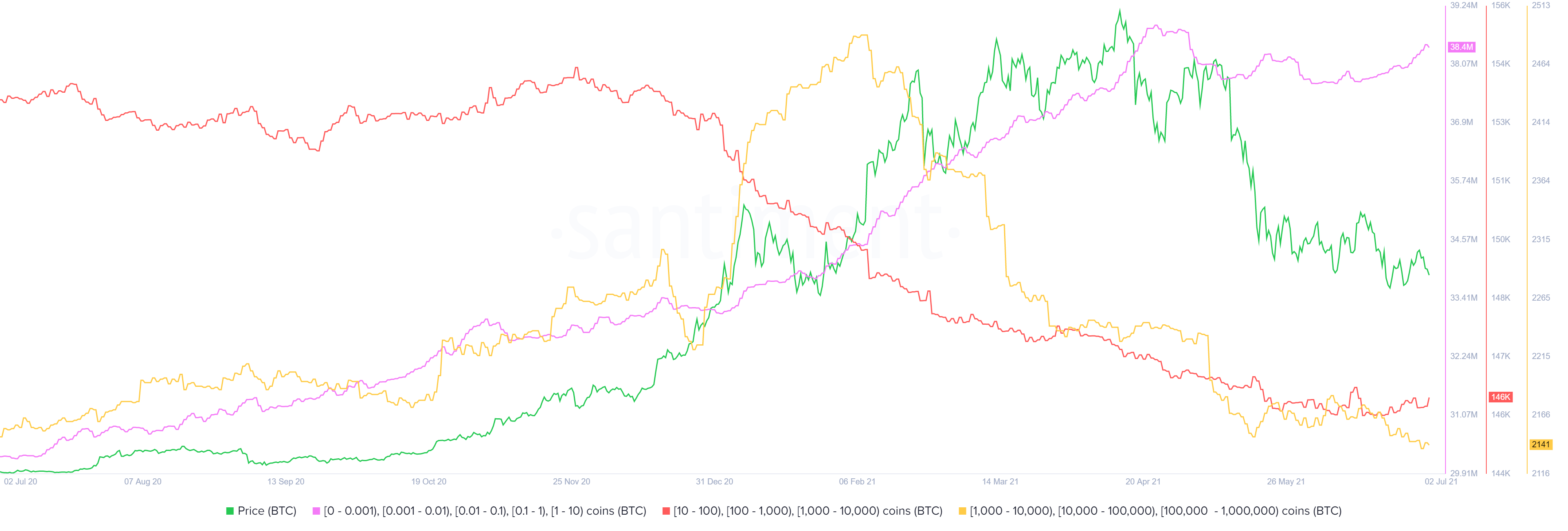

Retail investors play a pivotal role in Bitcoin bull runs. Therefore, a massive decline in retail interest could represent a bearish outlook.

Interestingly enough, retail investors holding between 0 to 10 BTC seem to be accumulating heavily since June 1. The number of such addresses increased from 37.77 million to 38.38 million, indicating a bullish development over the past month.

Market participants holding between 10 to 1,000 BTC are typically referred to as “sharks.” This category of addresses has plateaued at 146,000 addresses, which paints indecisiveness considering the range-bound moves.

Meanwhile, addresses holding between 1,000 to 1,000,000 BTC, known as whales, seem to be hesitant at the moment, which is why their numbers have dwindled from 2,156 to 2,141. Whales’ buying behavior is the most correlated with Bitcoin price, so the recent decline does not necessarily add to bullishness described from a technical perspective.

BTC supply distribution chart

Given the lack of interest from whales, investors must note that a breakdown of the support level at $30,000 will confirm the inability of the buyers. A decisive daily candlestick close below the range low at $28,785 will invalidate the bullish thesis and lead to a Bitcoin price drop of roughly 10% toward $25,700.

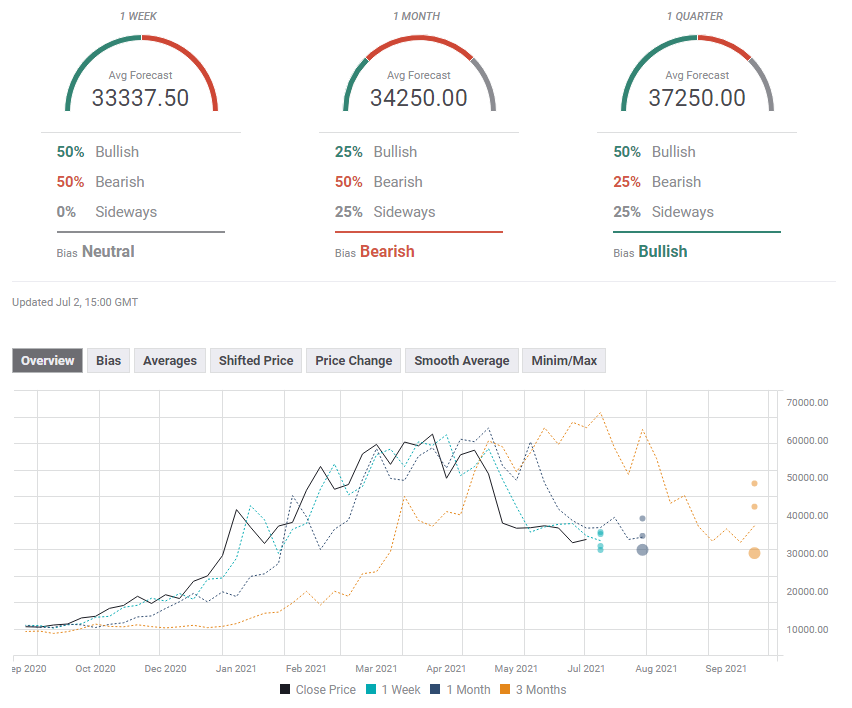

Bitcoin Forecast

The FX Poll is pointing to another week of consolidation at the current low levels before the granddaddy of cryptocurrencies embarks on a sustained rally. For the longer term, experts expect a move to above $37,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.