Bitcoin price decays less than three months away from BTC halving, retail traders exit steadily

- Bitcoin wallet addresses have been on a decline since October 2023.

- BTC price drop below the $40,000 mark triggered liquidations in over 487,000 wallets holding upto 1 Bitcoin.

- Bitcoin price is range bound less than three months away from the upcoming BTC halving event in April.

Bitcoin price is range bound close to the psychologically important $40,000 level, nearly two weeks post Spot ETF approval by the Securities and Exchange Commission. Retail traders holding less than 1 BTC have shed their holdings, evident by the decline in Bitcoin wallets since October 2023.

Bitcoin price could plummet to the support zone between $38,304 and $38,957, in the event of further correction in the asset.

Also read: Bitcoin price eyes comeback above $40,000, traders unsure of where BTC is headed next

Daily Digest Market Mover: Bitcoin wallet addresses holding upto 1 BTC on a decline

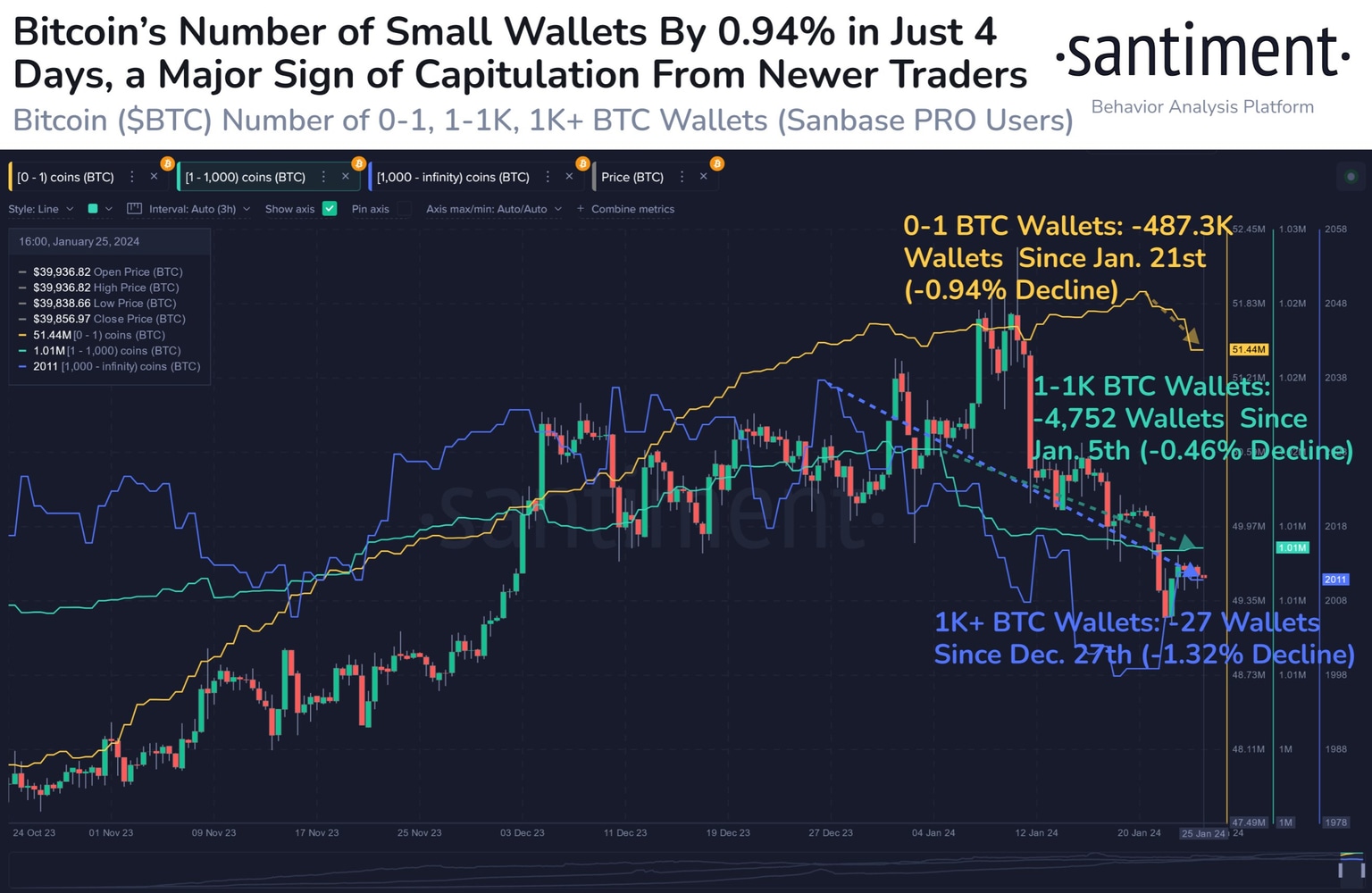

- According to Santiment data, the count of Bitcoin wallets holding up to 1 BTC has declined at a swift pace since early October 2023. In the past four days with Bitcoin price decline to a low of $38,555, 487,000 BTC wallets holding up to 1 BTC were liquidated.

- Bitcoin’s retail traders are therefore on a decline amidst BTC price correction.

Bitcoin small wallets holding up to 1 BTC on a decline. Source: Santiment

- Santiment analysts note that the sentiment among BTC traders since the ETF approval is the likely driver of the capitulation among retail traders.

- Bitcoin halving event that is set to slash the mining reward in half is less than three months away. Typically Bitcoin price declines in the days leading up to the halving and the event acts as a catalyst, pushing BTC to a new high in a stipulated time period.

- The halving event is 2 months and 28 days away, as of January 26.

- Experts consider BTC halving as the next key driver of Bitcoin price, after ETF approvals.

- While ETF approval turned out to be the “sell the news” event, halving could act as a bullish driver for Bitcoin, sending BTC price higher.

Technical analysis: Bitcoin price range bound close to $40,000

Bitcoin price is in a tight range close to the psychologically important level of $40,000. BTC price is $40,132, at the time of writing. The asset yielded nearly 3% weekly losses for holders. The ETF approval likely catalyzed a correction in Bitcoin, ushering a decline in BTC from its 2024 peak of $48,989.

Bitcoin price is at risk of dipping to its support zone between $38,304 and $38,957 where 512,030 wallet addresses acquired 258,320 BTC.

BTC/USDT 1-day chart

If Bitcoin price sees a daily candlestick close above resistance at $41,466, it is likely to invalidate the bearish thesis and send BTC towards its next key resistance at $43,074.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rate affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.