Bitcoin update: Miner moves tokens held dormant for a decade, Michael Saylor validates BTC reserve plan

- Bitcoin miner who held BTC dormant for over 13 years moved $14 million in the asset on Wednesday.

- Michael Saylor reveals nearly $1 billion in Bitcoin holdings, and backs US strategic Bitcoin reserve plan by Senator Lummis.

- BTC whales bought the recent dip in crypto, per Santiment analysts.

- Bitcoin maintains dominance among cryptos, hovering around $57,000 on Thursday.

Bitcoin (BTC) has noted a series of positive developments that support a bullish thesis for the asset’s recovery this week. The top three market movers are Michael Saylor’s Bitcoin holdings, support from Senator Cynthia Lummis’s Bitcoin reserve idea, and whales buying the recent crash in BTC.

Analysts affirm that Bitcoin is on track to hit a new cycle high as the bull run continues. BTC hovers close to $57,000 after $1.06 billion in crypto liquidations at the beginning of the week.

Bitcoin’s top three market movers, what to expect

Michael Saylor of MicroStrategy disclosed his Bitcoin holdings in a recent interview on Bloomberg Open Interest on Wednesday. Saylor revealed that he holds 17,732 BTC, worth $1.01 billion at the time of writing.

The former MicroStrategy CEO said:

Bitcoin is a great capital investment asset for an individual, a family, an institution, a corporation, or a country. And I can’t see a better place to put my money.

MicroStrategy is one of the largest public holders of Bitcoin. According to their latest report, the firm holds 226,500 BTC, worth nearly $13 billion.

Saylor backed Senator Cynthia Lummis’ plan for a strategic Bitcoin reserve. Senator Lummis announced her historic proposal to officially introduce the Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide (BITCOIN) Act in the US Senate.

Senator Lummis’ BITCOIN Act intends to use Bitcoin as an additional store of value to ensure the treasury management of BTC holdings by the federal government. These developments are bullish for Bitcoin as they could fuel demand for the asset among retail traders, institutions and the government.

Strategic Bitcoin Reserve

Bitcoin whales buy the dip

Bitcoin network’s large wallet investors holding between 100 to 1,000 BTC are accumulating the asset at a fast pace, per Glassnode data.

Whales are panic buying #Bitcoin pic.twitter.com/ZCVBsb60yb

— Crypto Rover (@rovercrc) August 8, 2024

Santiment data shows that whales have been most active in over four months as they scoop up BTC at lower prices through the recent correction. This is evident from large-volume transactions. On Monday and Tuesday, 28,319 transactions worth $100,000 and more were recorded. The count for transactions valued at $1 million and higher stood at $5,738, per Santiment charts.

Large volume transactions are indicative of whale movements, signaling an interest and activity from large wallet investors.

Bitcoin whales are most active in over four months

Additionally, an old miner with a Bitcoin wallet address that was dormant for over 13 years moved their BTC per on-chain data.

NEW: An old miner from 2010 just moved $14 million worth of #Bitcoin

— Bitcoin Magazine (@BitcoinMagazine) August 7, 2024

Hodled all the way from $0.20 to $57,000.

What a legend! pic.twitter.com/ouh01ZxMSs

Analysts’ say Bitcoin bull run is on track, predict cycle highs

Plan B, a crypto analyst behind the X handle @100trillionUSD, says BTC is still in a bull market per his analysis. The analyst’s tweet shows different Bitcoin market cycles.

Bitcoin is still in a bull market!

— PlanB (@100trillionUSD) August 8, 2024

My market analysis https://t.co/GpNT5BjwYZ pic.twitter.com/UBnmbSKlg3

Analyst Ripple Van Winkle, behind the X handle @RipBullWinkle, says Bitcoin is on track for gains in August 2024.

Going live tonight in 30 minutes!

— Ripple Van Winkle | Crypto Researcher (@RipBullWinkle) August 7, 2024

Lets talk about the Crypto Meltdown - AKA the correction!

Where do the markets go next! #XRP

Is #Bitcoin still on pace for a massive month!https://t.co/BrLuqBfR8a pic.twitter.com/24R3hyVH00

Will Bitcoin hit a new all-time high?

Analyst Zero Ika has identified the key levels to monitor to identify whether Bitcoin has maintained its bullish market structure and will proceed to a new all-time high. For BTC, the analyst’s target is $109,000.

Levels to monitor if Bitcoin maintains its HTF bullish structure and proceeds forward to a new ATH:

— ZERO IKA ️ (@IamZeroIka) August 8, 2024

- BTC : 87/109K

- TOTAL 2 : 2/2.5 T

- OTHERS : 600/685 B

- BTC D : 43.87%

- USDT D : 3.80%

If I'll find confluences between those charts I'll cut 80/90% of the positions,…

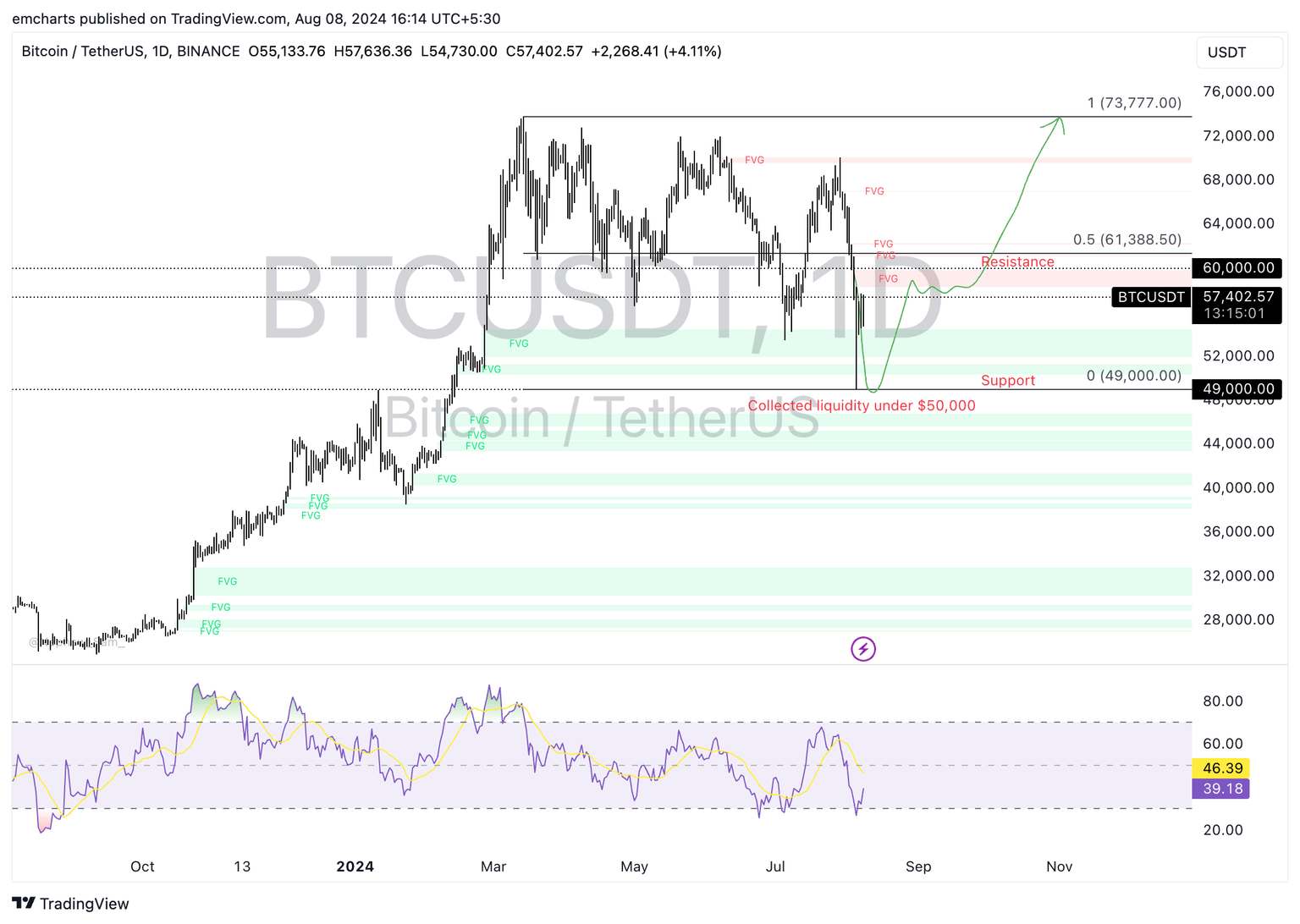

Bitcoin dipped under $50,000 and collected liquidity on Monday. BTC could rally now towards its $60,000 target next and continue towards a new all-time high. Bitcoin hovers around $57,000 early on Thursday and could rally towards its 73,777 all-time high after collecting liquidity in the imbalance zones seen on the daily chart below.

BTC faces resistance at $60,000, $61,388 and $70,000. The Relative Strength Index (RSI) indicator in the daily chart showed that Bitcoin was oversold when the price dipped under $50,000. Bitcoin has recovered and RSI reads 39, making steady progress toward the neutral zone.

BTC/USDT daily chart

A daily candlestick close below $55,000 could invalidate the bullish thesis for BTC. In that case, Bitcoin could find support at Monday’s low of $49,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.