Bitcoin transactions dive 30% in six months amid BTC price ‘disinterest’

Bitcoin network activity has hit three-year lows as a sense of “disinterest” descends over crypto markets.

In one of its Quicktake blog posts on Sept. 4, onchain analytics platform CryptoQuant warned over new BTC price weakness.

Bitcoin transaction numbers fall nearly 400,000 per day

Bitcoin (BTC $56,777) transaction numbers have suffered as a result of months of sideways BTC price action, data shows.

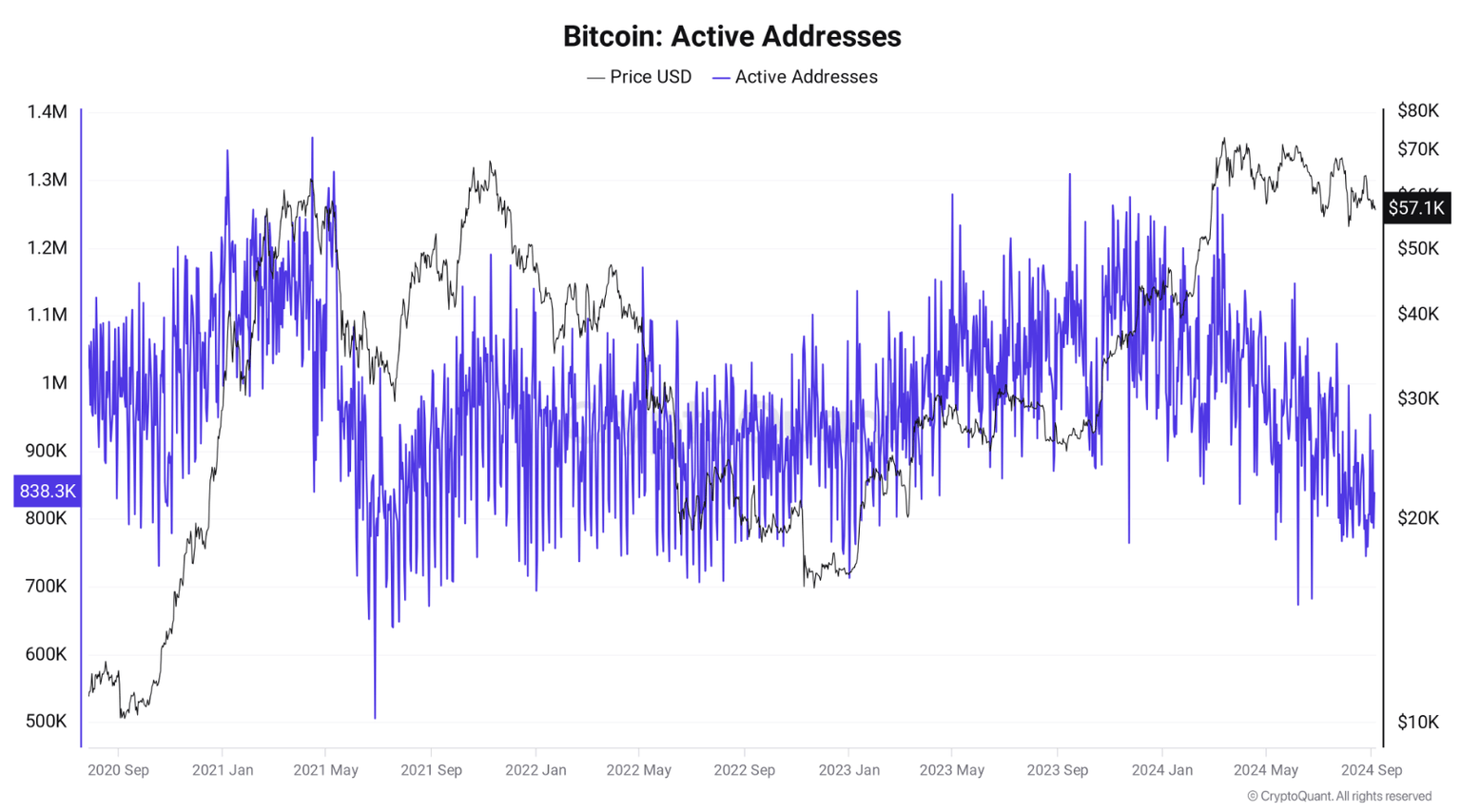

At their peak in mid-March, around the time that BTC/USD set its most recent all-time high in United States dollar terms, daily active addresses numbered nearly 1.2 million.

Now, that number is just 838,000, with a recent low in late August coming in at just 744,000. This, CryptoQuant notes, marks the lowest active daily tally since 2021.

“The total number of active addresses on the Bitcoin network hit new lows in 2024, reaching the same level as 3 years ago, when the price of BTC was quoted at around $45,000,” contributor Gaah wrote.

A decline in active addresses indicates less overall activity on the Bitcoin network, i.e. fewer transactions are taking place, which may reflect less interest in using the network at this point in the market.

Bitcoin active addresses. Source: CryptoQuant

The data feeds into the overall narrative of frustration around the current market landscape, with Bitcoin unable to establish any definitive trend.

As Cointelegraph reported, the Puell Multiple, which compares the value of daily mined Bitcoin to its 365-day moving average, is also treading water.

For CryptoQuant, both metrics suggest that a long-term buying opportunity could soon result for market participants.

“For some investors, a drop in active addresses and price can be seen as an opportunity to buy Bitcoin in anticipation of a future rally,” Gaah concludes.

However, if the decline is interpreted by investors as a sign of weakness or loss of relevance in the current macro scenario new supports should be formed increasing disinterest in the asset providing new entry opportunities.

BTC price “chopsolidation” hints at breakout

The sense of price acting within something of a “no-man’s land” has not been lost on the wider analytics community.

Checkmate, the pseudonymous creator of the onchain analytics platform Checkonchain, describes the current setup as “chopsolidation” — a portmanteau of “consolidation” and erratic or “choppy” BTC price moves within a narrow range.

“The swings are getting larger, and more sustained,” he acknowledged in part of a recent post on X.

Screams to me that this price range is becoming 'unstable', and the market is ready to move somewhere else.

Bitcoin intraday price performance. Source: Checkmate

Another chart shows that despite various long-term lows, BTC/USD has yet to match the kind of correction seen during previous bull markets.

Bitcoin bull market correction drawdowns. Source: Checkmate

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.