Average daily transaction fees on Bitcoin (BTC $37,407) have flipped with Ethereum following a frenzy of Ordinals-related activity on the Bitcoin network.

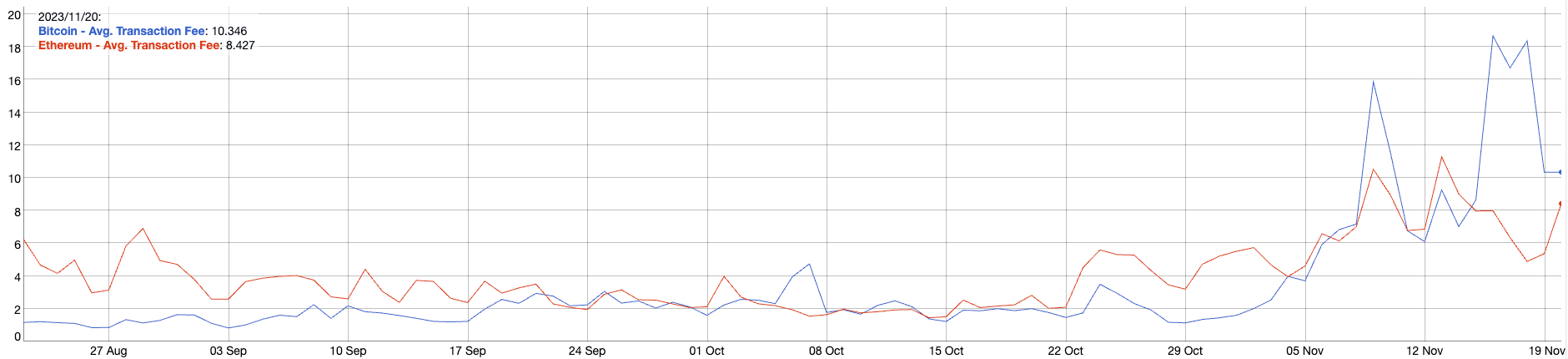

On Nov. 20, the average daily transaction fee for Bitcoin stood at $10.34, while Ethereum’s transaction fees came to an average of $8.43, according to BitInfoChart data.

Bitcoin’s average daily trading fee notched a new six-month high on Nov.16, reaching a peak of $18.67, while Ethereum fees reached $7.90.

Bitcoin’s average daily fees have surged above Ethereum’s in the last five days. Source: BitInfoCharts

The sudden uptick in Bitcoin transaction fees stems from a renewed market appetite for assets inscribed with the Ordinals Protocol — a tool for creating nonfungible token (NFT)-like assets and BRC-20 tokens on Bitcoin.

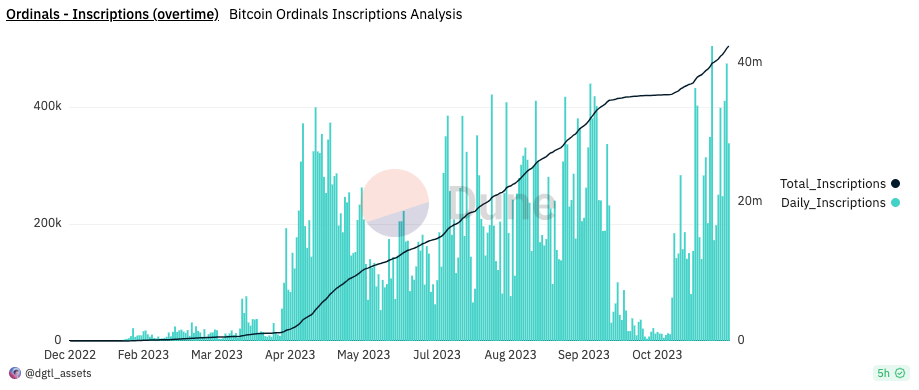

Following a significant lull in activity between Sept. 25 and Oct. 23, Ordinals-based assets saw a drastic uptick beginning in late October, per Dune Analytics data.

The number of Ordinals inscriptions grew by over 6 million since late October. Source: Dune Analytics

Since Oct. 24, over 6 million Ordinal assets have been created, resulting in more than 800 BTC in fees — worth $30 million — being redistributed to the network.

The uptick in Ordinals inscription activity compounded as ORDI, the second largest BRC-20 token by market cap, was listed on Binance on Nov. 7. The listing spurred a wider wave of BRC-20 buying activity from traders with the price of the ORDI token jumping by just over 50% on the day.

Additionally, on Nov. 17, the Ordinals-based project Taproot Wizards announced a $7.5 million seed round.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

PEPE Price Forecast: PEPE could rally to double digits if it breaks above its key resistance level

Pepe (PEPE) memecoin approaches its descending trendline, trading around $0.000007 on Tuesday; a breakout indicates a bullish move ahead.

Tron Price Prediction: Tether’s $1B move triggers TRX ahead of US Congress stablecoin bill review on Wednesday

Tron price defied the broader crypto market downtrend, surging 3% to $0.25 on Monday. This bullish momentum comes as stablecoin issuer Tether minted another $1 billion worth of USDT on the Tron network, according to on-chain data from Arkham.

Ethereum Price Forecast: Short-term holders spark $400 million in realized losses, staking flows surge

Ethereum (ETH) bounced off the $1,800 support on Monday following increased selling pressure from short-term holders (STHs) and tensions surrounding President Donald Trump's reciprocal tariff kick-off on April 2.

BlackRock CEO warns Bitcoin could replace US Dollar as global reserve currency, crypto ETFs witness inflows

BlackRock CEO Larry Fink stated in an annual letter to investors on Monday that the US national debt could cause the Dollar's global reserve status to be replaced with Bitcoin if investors begin to see the digital currency as a safer asset.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.