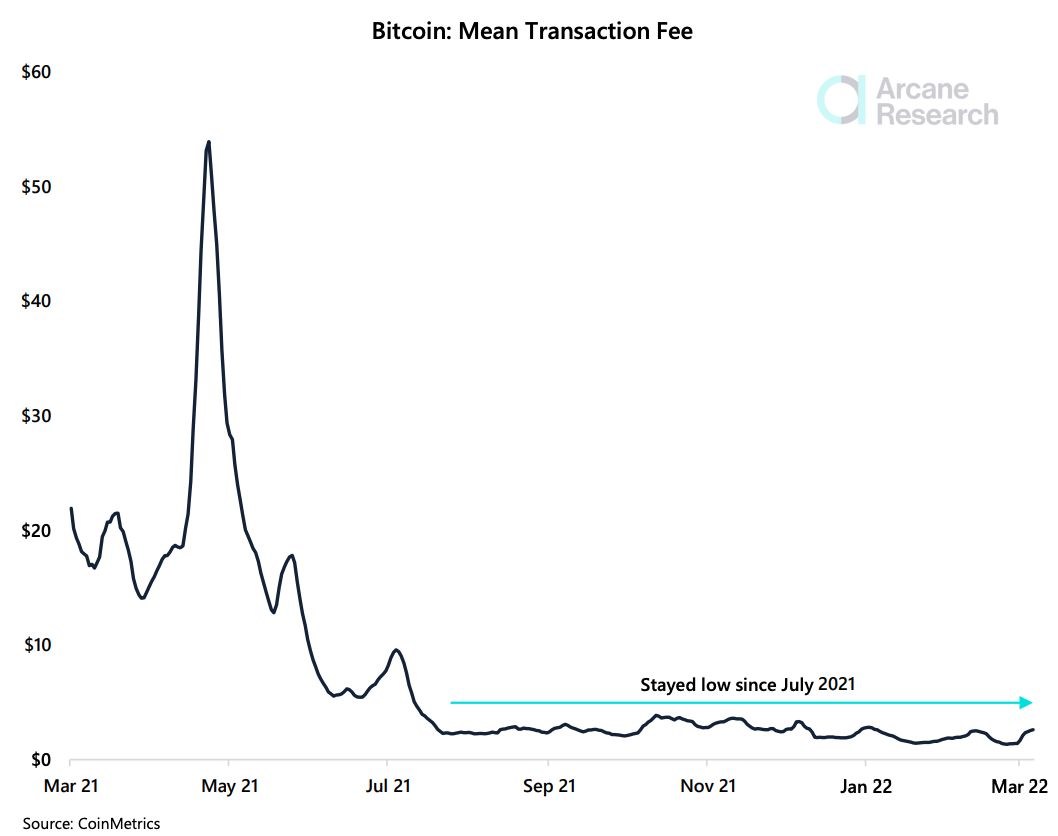

Got some Satoshi to send or Bitcoin (BTC) wallets to reorganize? It’s increasingly cheap to do so. According to an Arcane Research report, Bitcoin “transaction fees have stayed low since July 2021, showing no signs of rising.”

Bitcoin mean tx fees remaining very low despite small hike last week. Source: Arcane Research

There was, however, a small bump in transaction fees last week. Shown as a small jump at the tail end of the graph, clustering of the mempool pushed “up the average transaction fees per day over the past seven days to $691,000, a doubling since last Tuesday.”

Nonetheless, the doubling in transaction fees is insignificant: transaction fees remained in a low range. Miners churned through the mempool transactions over a two-day period, securing the network while keeping transacting affordable.

Eric Yakes, author of the Bitcoin book the 7th Property told Cointelegraph that there were three main reasons why transaction costs are so low: Segwit adoption, hash rate redistribution, and Bitcoin layer 2 infrastructure such as the near-instant payment lightning network kicking in.

“June 2021 saw a large increase in the % of Segwit transactions on-chain increasing from ~50% to ~70% which has steadily risen to above 80%, which fundamentally should be increasing transaction throughput for the network.”

Cointelegraph reported on the growing number of exchanges using Segwit addresses over the course of 2021.

In July 2021, Yakes explains that “network difficulty bottomed and has since risen to ATHs,” following the China ban and redistribution of hash rate. Combined with the rise in the number of Segwit transactions:

“This rebound in hash rate has found blocks more rapidly than the difficulty adjustment can keep up with and that has created a more rapid clearing of transactions than otherwise, thus lowering the price of transactions.”

However, Yakes mentions that transaction fees “should not be expected to remain persistent. Eventually, and this is all contingent upon price, hash rate, and difficulty will find their equilibrium, making the fee market less competitive and increasing transaction costs.”

Tomer Strolight, editor-in-chief at Swan Bitcoin, names another factor for why transaction fees are low:

“We have the biggest exchanges all batching transactions now. This means they are sending out 100 or more withdrawals on a single transaction instead of the terrible practice from several years ago of sending out each withdrawal as a single one.”

Plus thanks to the lightning network’s ability to open “channels when the blockchain is uncongested and then using them over and over again prevents the chain from becoming congested whenever a faster, cheaper lightning transaction is an option.”

Lightning Network nodes and channels map. Source: explorer.acinq.co

The Arcane research report indicates that while these four factors are important, it’s also “likely that a lower number of transactions per day has driven down the average transaction fee.”

For Yakes, “transaction fees could increase in the short term but there are so many trends counter to higher transaction fees that I think they will be persistently lower over the long term.”

Tromer is also positive:

“I genuinely see that we can gradually build the network capacity to handle all the commerce in the world without the blockchain becoming an insurmountable bottleneck.”

It’s another feather to the BTC cap: the protocol continues to successfully scale, making it more affordable to transact on the network.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.