Bitcoin traders remain fearful of 'tail risk' amid renewed price lull: Observers

-

Relative richness of out-of-the-money call and put options tied to bitcoin suggests traders are pricing in "tail risk" in the bitcoin market.

-

Tail risk suggests a higher possibility that an investment will move more than three standard deviations from the mean.

They call it tail risk in the crypto market: the risk of an asset moving three standard deviations from its current price on the back of a rare event.

Traders fear such an event in bitcoin (BTC) even though the cryptocurrency has been listless around $26,000 since falling over 10% in the week ended Aug. 20. BTC's annualized seven-day historical or realized volatility has cooled to 26% from nearly 60% seen early last week, according to Amberdata.

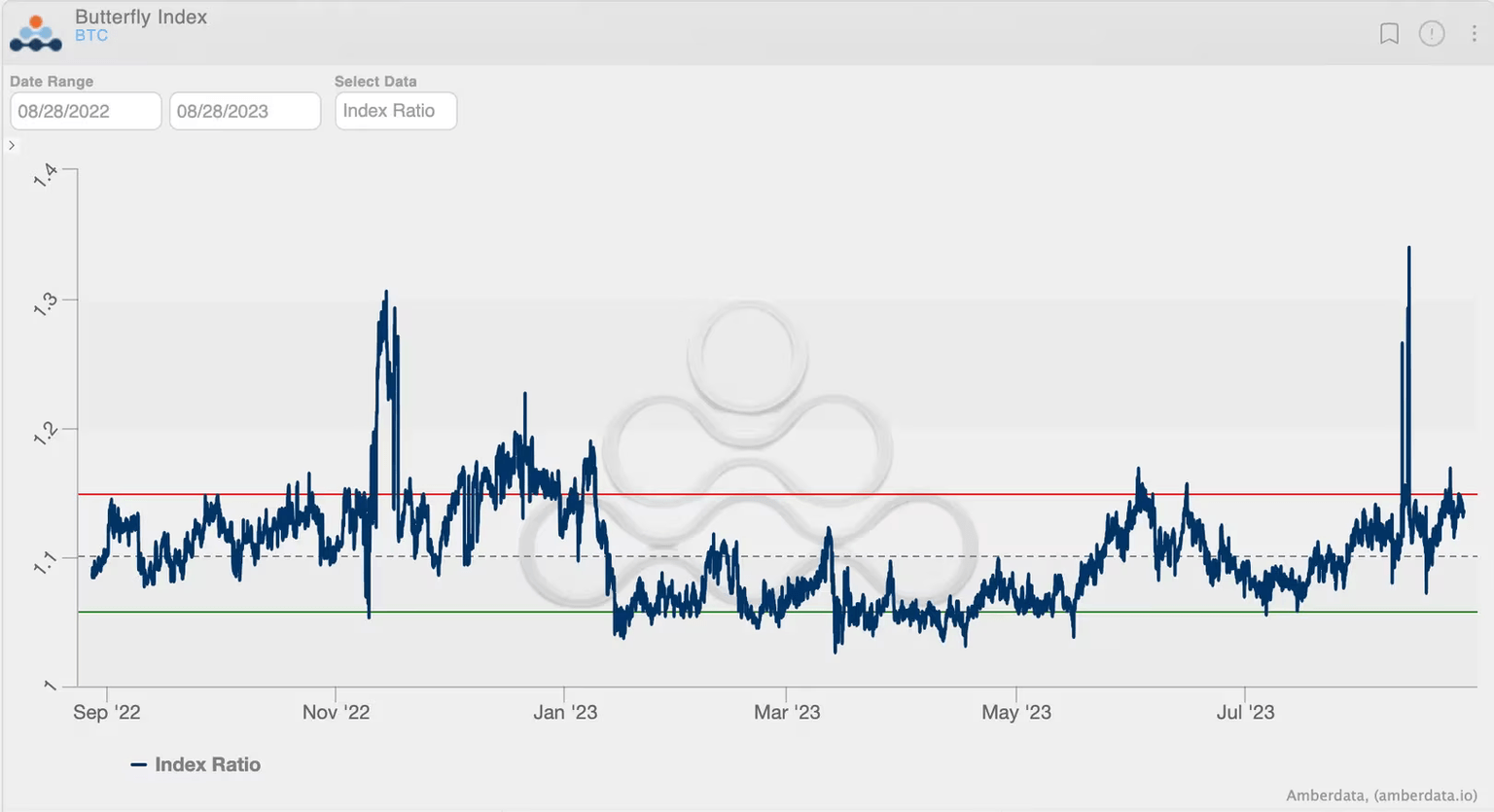

"Bitcoin's butterfly index has risen to yearly highs. It shows investors and market makers are pricing in tail risk," Griffin Ardern, volatility trader from crypto asset management firm Blofin, said.

The butterfly index gauges the relative richness of the out-of-the-money (OTM) higher strike call options and lower strike put options by comparing crypto exchange Deribit's bitcoin volatility index (DVOL) with the at-the-money (ATM) volatility.

An elevated index indicates relatively stronger demand for OTM options (wings) or call options at strikes higher than BTC's current price and puts at strikes lower than BTC's going market rate. In other words, it signifies traders' fear of the tail risk or sensitivity to uncertainty.

Calls are derivative contracts that give the purchaser the right to buy the underlying asset at a preset price at a later date. A put option gives the right to sell. A call buyer is implicitly bullish on the market, while the put buyer is bearish. Demand for OTM calls and puts rises when traders anticipate an above-average price move.

"Looking at the BTC butterfly index, we can see that wings are near the upper 90% percentile (red horizontal line). So, [while] outright volatility [metrics] seems confident in spot price consolidation, traders are still paying up for tails," Greg Magadini, director of derivatives at Amberdata, said in the weekly newsletter.

The butterfly index remains elevated, indicating lingering fears of an outsized move in bitcoin's price. (Amberdata) (Amberdata)

The index is expressed as a ratio or spread between crypto exchange Deribit's bitcoin volatility index (DVOL) and the at-the-money (ATM) volatility. Deribit's DVOL considers the pricing for all options, while the ATM tool is based on pricing for at-the-money options.

The pricing for tail risk is consistent with the lingering macroeconomic uncertainty.

On Friday, Federal Reserve Chairman Jerome Powell reaffirmed that the central bank remains committed to hitting the 2% inflation target and keeping it there while signaling that the monetary policy will remain tight for longer than expected.

The Fed's continued bias for tightening has lifted bond yields to the highest since 2007. Rising yields tend to weigh over risk assets, including cryptocurrencies.

"A key insight from Jerome Powell is that 'getting inflation back to 2% likely requires below-trend growth', meaning he isn't afraid of some pain to the economy and jobs market," Magadini noted.

Ardern said the tail risk will likely remain higher in the lead-up to Friday's U.S. nonfarm payrolls report. Per Wall Street Journal, the data is likely to show the U.S. economy added 200,000 jobs last month following June's 209,000 additions, resulting in the jobless rate holding steady at 3.6%.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.