Bitcoin trader predicts end of dip within weeks as BTC price adds 3.5%

Bitcoin (BTC $27,361) held a snap rebound on May 18 as analysts hoped that further upside would come next.

BTC/USD 1-hour candle chart on Bitstamp. Source: TradingView

BTC price sustains knee-jerk move higher

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it circled $27,400 on Bitstamp.

The pair had made swift gains toward the prior day’s Wall Street open, these topping out at 3.5% versus the day’s lows.

Amid changing signals on exchange order books, popular trader Skew was hopeful for continuation.

“Price swept the pre-emptive swing low, which was enough liquidity to push up higher,” he summarized in part of a Twitter analysis.

Skew added that while macro conditions were overall causing friction for BTC price performance, the largest stablecoin Tether pledging regular BTC buys should be a “positive headwind.”

Bitcoin cumulative volume delta (CVD) data annotated chart. Source: Skew/ Twitter

Meanwhile, cumulative volume delta (CVD) showed increasing momentum, further indicating that Bitcoin price might sustain its newfound strength.

“Looking for sustained buying momentum by spot else scalp short,” Skew added.

On-chain monitoring resource Material Indicators tracked the action on the Binance order book, with the price uptick coinciding with an increase in volume from the largest class of Bitcoin whales.

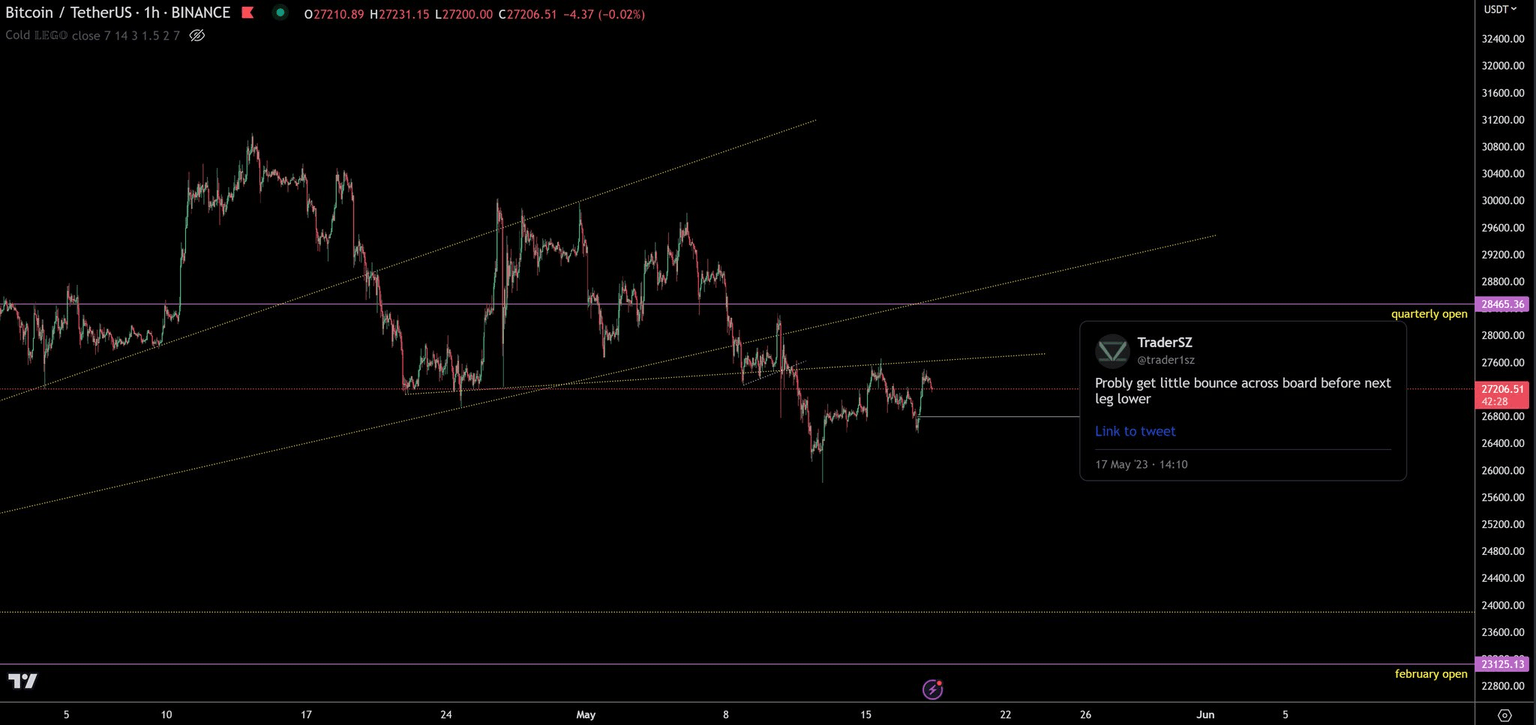

As ever, not everyone was convinced about the uptick’s longevity. Among them was the popular trading account TraderSZ, which began the day closing out a long BTC position.

“Think the bounce is done,” part of the accompanying commentary stated, anticipating a return to the downside.

BTC/USD annotated chart. Source: TraderSZ/ Twitter

As Cointelegraph reported, shorter-term and longer-term downside targets currently extend to around $25,000 and $24,000, respectively.

Bottom “might be in” for Bitcoin price correction

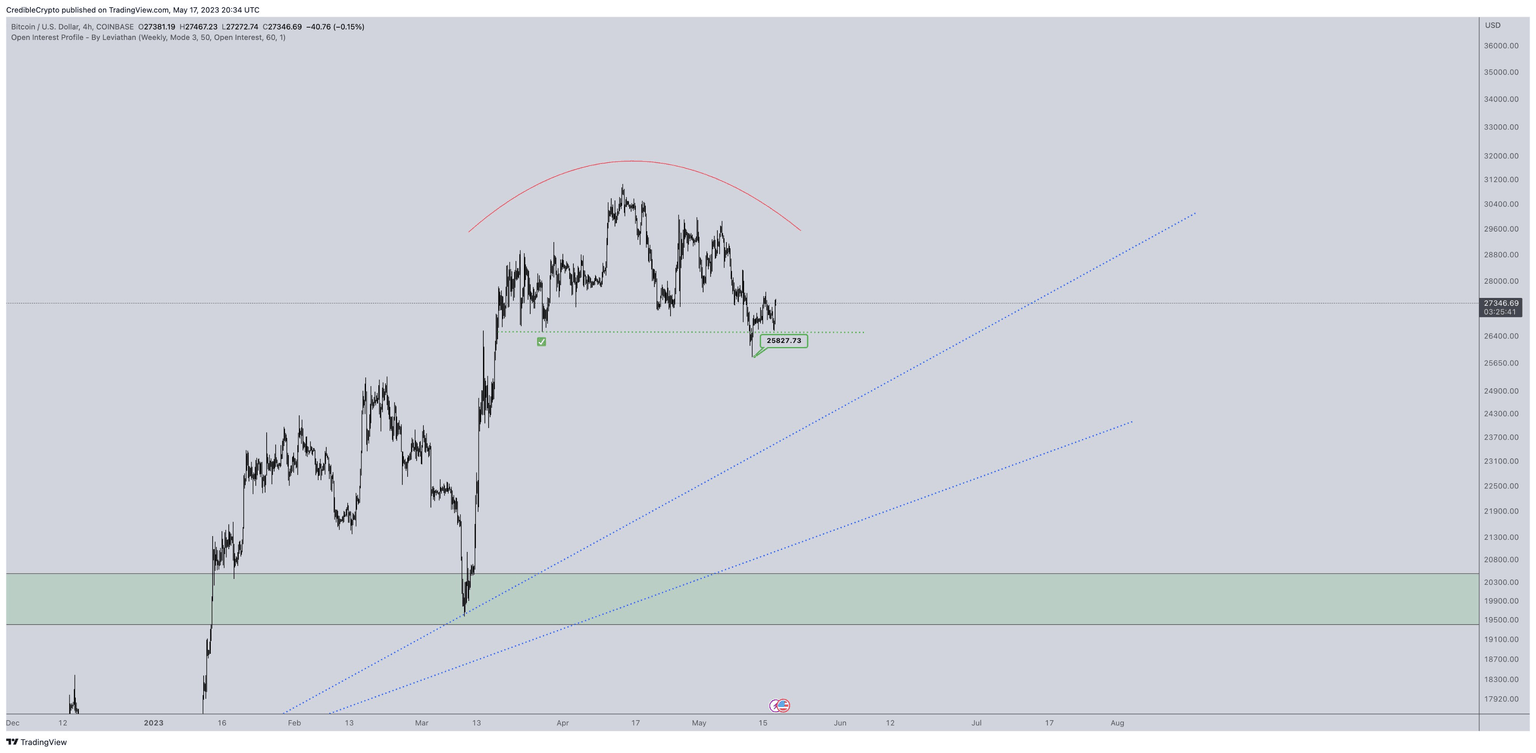

Zooming out, meanwhile, fellow trader Credible Crypto revealed a belief that a more pronounced return to the upside could come within the next month.

“How much longer till expansion and is the bottom in? 25k’s tested, liq below us taken, bottom for this correction MIGHT be in but need to see how PA develops over the coming days. While we can’t rule out a flush lower yet, developing PA will give us some clues to work with,” part of a tweet on the day explained.

Credible Crypto uploaded two charts with trend lines worth noting, adding that the upper one should hold as support, with BTC/USD then going higher.

“I expect that blue dotted trendline on the right to hold which would mean less than 30 days for this sideways phase to complete and the next move up to begin,” he continued, describing the move’s character as “absolutely explosive.”

BTC/USD annotated chart with trend lines. Source: Credible Crypto/ Twitter

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.