So-called “market tourists” are fleeing from Bitcoin (BTC), leaving only long-term investors holding and transacting in the top cryptocurrency, according to blockchain analytics firm Glassnode.

In its July 4 Week Onchain report, Glassnode analysts said June saw Bitcoin have one of its worst-performing months in 11 years, with a loss of 37.9%. It added activity on the Bitcoin network is at levels concurrent with the deepest part of the bear market in 2018 and 2019, writing:

The Bitcoin network is approaching a state where almost all speculative entities, and market tourists have been completely purged from the asset.

However, despite the almost complete purge of “tourists,” Glassnode noted significant accumulation levels, stating that the balances of shrimps — those holding less than 1 BTC, and whales — those with 1,000 to 5,000 BTC, were “increasing meaningfully.”

Shrimps, in particular, see the current Bitcoin prices as attractive and are accumulating it at a rate of almost 60,500 BTC per month, which Glassnode says is “the most aggressive rate in history,” equivalent to 0.32% of the BTC supply per month.

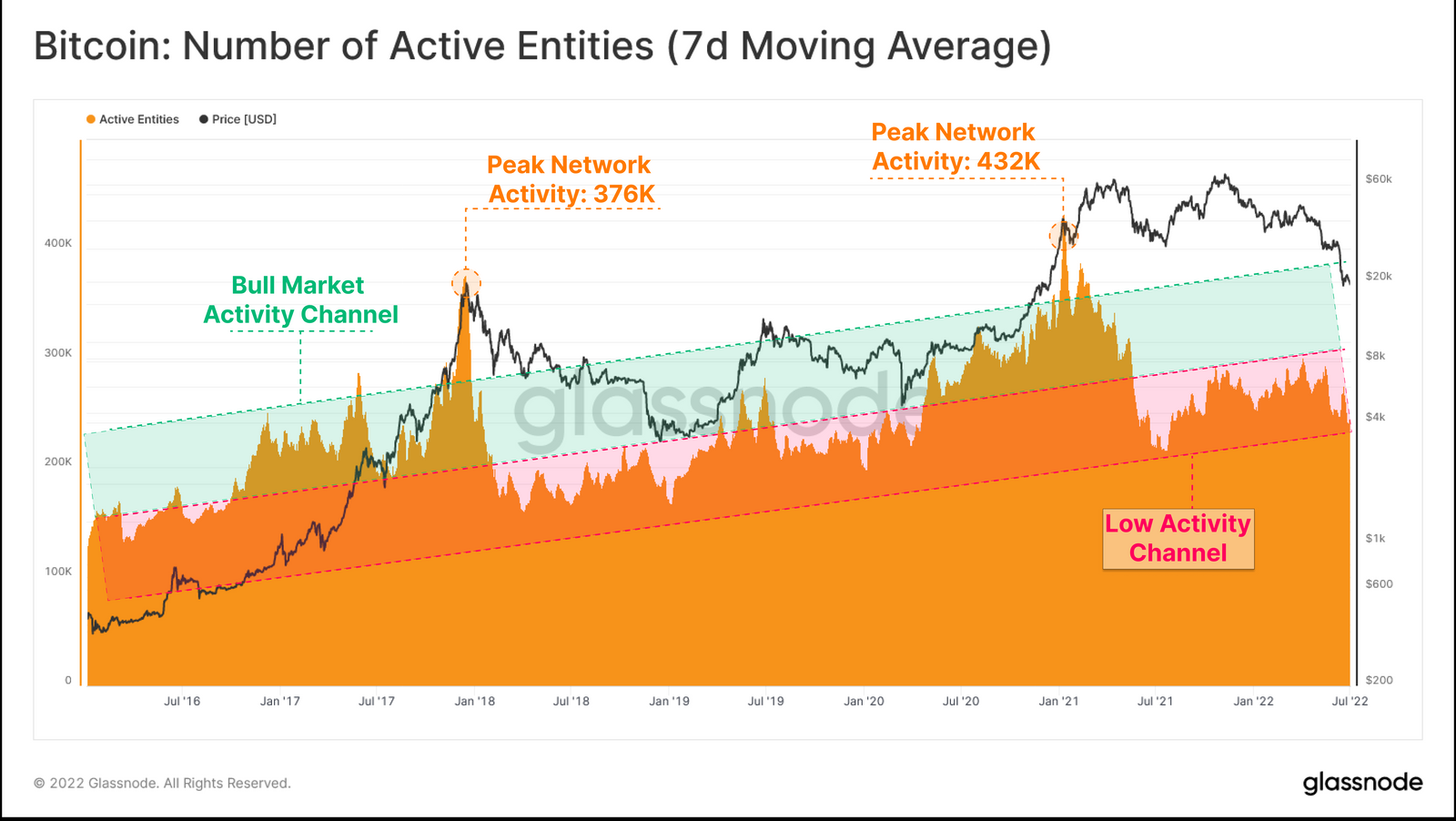

Explaining the purge of these tourist-type investors, Glassnode revealed that both the number of active addresses and entities have seen a downtrend since November 2021, implying new and existing investors alike are not interacting with the network.

Address activity has fallen from over 1 million daily active addresses in November 2021 to around 870,000 per day over the past week. Similarly, active entities, a collation of multiple addresses owned by the same person or institution, are now approximately 244,000 per day, which Glassnode says is around the “lower end of the ‘Low Activity’ channel typical of bear markets.”

“A retention of HODLers is more evident in this metric, as Active Entities is generally trending sideways, indicative of a stable base-load of users,” the analysts added.

Source: Glassnode

The growth of new entities has also dived to lows from the 2018 to 2019 bear market, with the user-base of Bitcoin hitting 7,000 daily net new entities.

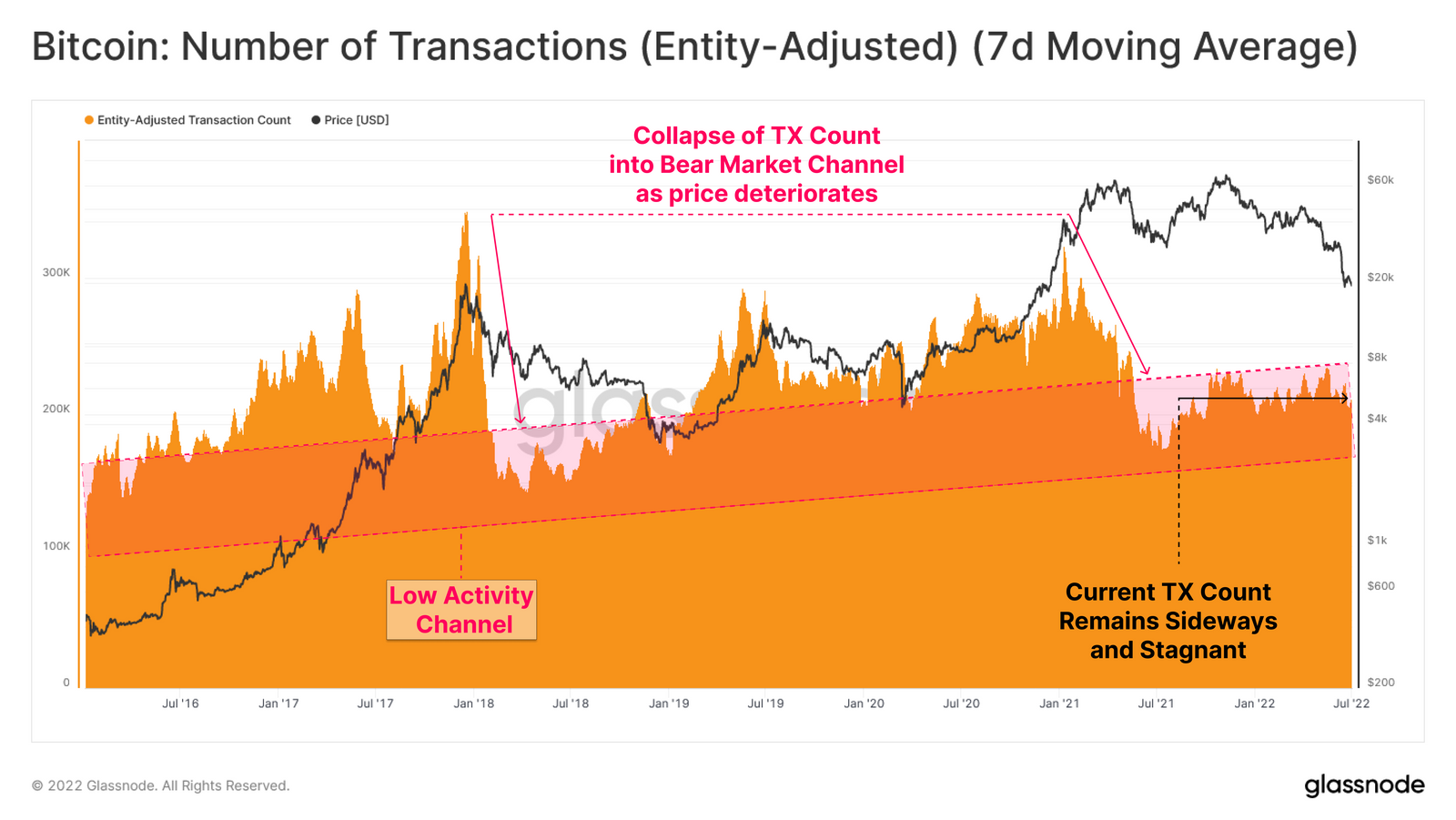

The transaction count remains “stagnant and sideways,” which indicates a lack of new demand but also means that holders are being retained through the market conditions.

“Transactional demand can be seen to move sideways throughout the main body of the bear,” - Glassnode

Driving home its point, Glassnode concluded that the number of addresses with a non-zero balance, those that hold at least some Bitcoin, continues to hit all-time-highs and is currently sitting at over 42.3 million addresses.

Past bear markets saw a purge of wallets when the price of Bitcoin collapsed. Still, with this metric indicating otherwise, Glassnode says it shows an “increasing level of resolve amongst the average Bitcoin participant.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.