- Bitcoin is on fire, trading at the highest levels in 3 months, decoupling from other cryptos.

- There are five primary reasons for the rise, and seasonality is one of them.

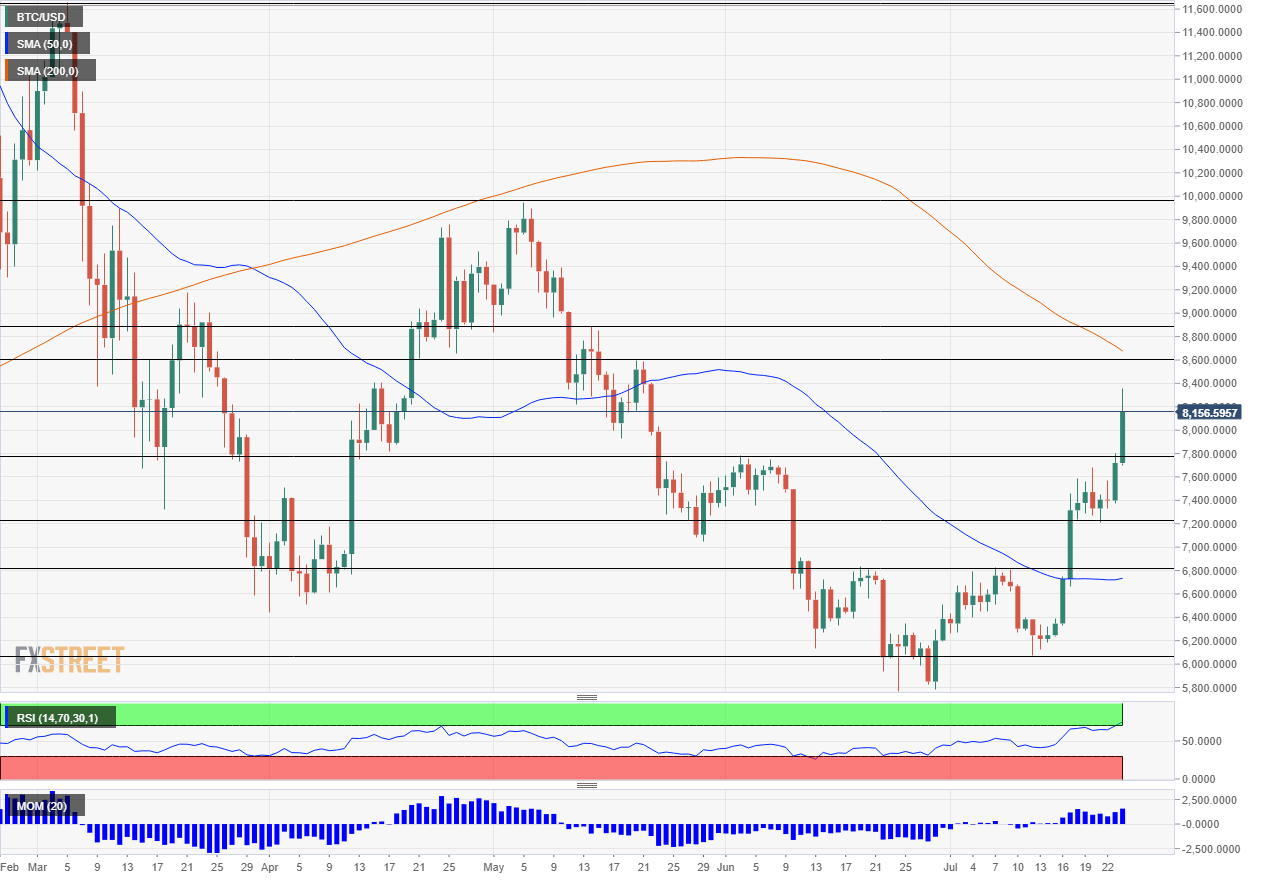

The BTC/USD is has reached a new peak of $8,360 at the time of writing before consolidation it's recent gains. This is the dearest price since mid-May. Why is the granddaddy of cryptocurrencies on the rise?

Here are five reasons for the recent rise, followed by the technical levels to watch.

1) Google and Facebook ease the pressure

The two influential tech giants have previously cracked down on everything crypto-related. Their recent shift has triggered the most recent rally. Facebook, the social media behemoth, now allows Coinbase, one of the largest cryptocurrency exchanges, to advertise on its platform. Google, the search giant, now includes major coins in its exchange rate converter. Web visibility is essential in bringing fresh money into digital coins.

3) Moving towards a Bitcoin ETF

In addition to visibility, investing in Bitcoin needs to be more comfortable for casual investors. The Chicago Board Options Exchange (CBOE) has asked for approval to launch a Bitcoin ETF. The request, from one of the most prominent exchanges, joins applications from other companies. The decision is expected later in the summer. An approval will open the floodgates to further investments, and the price of the Bitcoin is already on the rise.

This is one of the reasons that Bitcoin decouples from the rest of the cryptos.

3) Institutions moving in

Banks such as Goldman Sachs and JP Morgan have already shown interest in cryptocurrencies and the blockchain technology. However, when a heavyweight $6 trillion fund showed interest, it triggered the beginning of the rally. The mere interest from such a significant investment fund makes a difference. They are not alone.

Blackrock has set up a workgroup that is exploring the field.

4) Calls for easier regulation

Strict and unclear regulation has been crippling the prices of cryptos. And now, the US Chamber of Commerce, a body of the US government is calling to clear regulation uncertainty. They say that raising capital to start companies has become difficult. They call on both the SEC and the CFTC to get their act together. A more accommodating regulatory environment also gives Bitcoin a boost.

See: The US Chamber of Commerce requests the SEC and the CFTC to clear regulation uncertainty

5) Seasonality

The price of Bitcoin surges almost every summer. This is a seasonal pattern with a good track record. The leap of 2017 was the largest, but the previous years also saw considerable upswings. And while the BTC/USD makes more substantial moves in July than in August, the gains so far are pale in historical perspective.

See: Summer surge surprise? No, it's a recurring pattern, and it may be only the beginning

Bitcoin levels to watch

Looking up, $8,614is a critical level after capping Bitcoin in late May. It nearly coincides with the 200-day Simple Moving Average. Further above, $8,901 was a cap for the pair earlier in May.

The next line of resistance is already much higher, at $10,000. Not only is it around, psychological level, but also the place where the cryptocurrency turned down in early May. Even higher, $11,650 was a high point back in March.

Looking down, $7,783 held Bitcoin down in early June and now works as support. $7,250 was a low point in early July and retains its role. Lower, $6,824 is a double top after serving as resistance in July and in June.

Indicators: The BTC/USD enjoys upside Momentum, but the Relative Strength Index (RSI) is already touching 70, which is the overbought territory. It is trading above the 50-day Simple Moving Average but still below the all-important 200-day one.

More: 5 most predictable cryptocurrencies

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.