- The markets are controlled by bears ahead of the US presidential elections.

- Bitcoin act as a risky asset amid global turmoil.

- The markets will calm down once the elections are over.

Traditional markets have already hit the panic button amid the lingering economic uncertainty on top of the upcoming second wave of COVID-19 and the Presidential elections in the US. Investors are bracing for the worst and prefer to sell everything for cash, distorting common correlations, and market reactions to the risk-on/risk-off environment.

Spiraling down on the pre-election drama

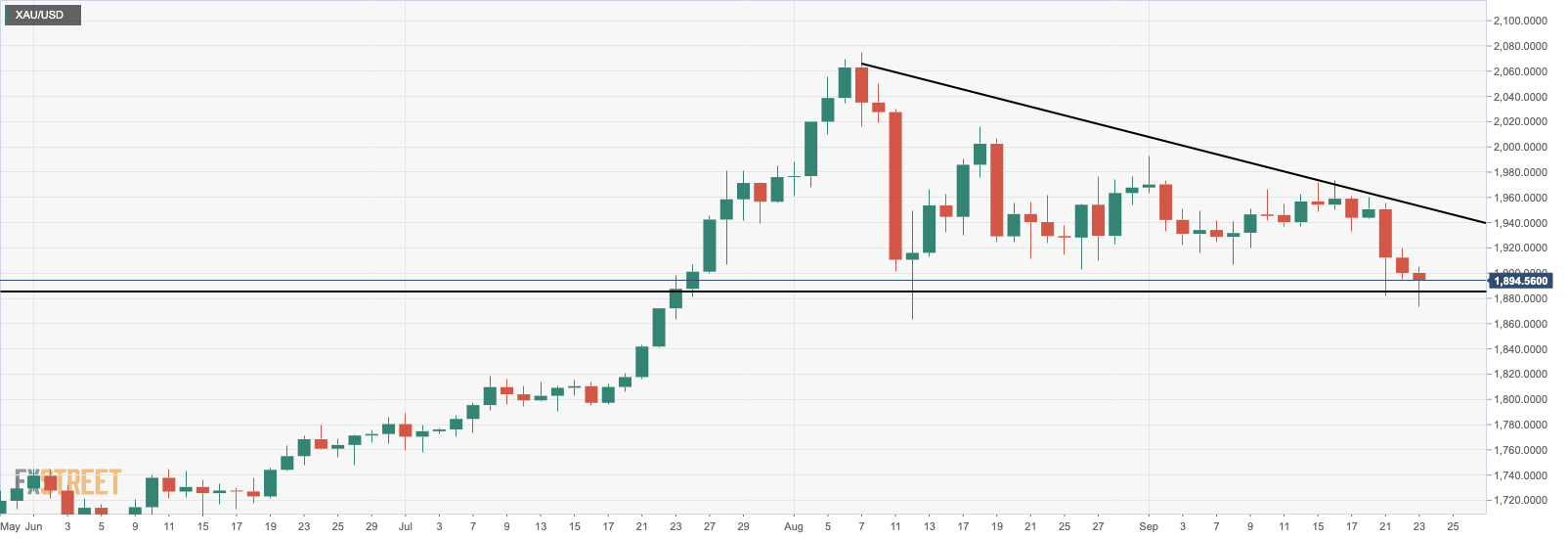

Despite a recovery attempt from deeply oversold levels, the global stock markets are still on track to have their first bearish monthly close since March, while gold is trading below $1,900 for the first time since the beginning of August.

Investors desperately need some positive economic news and less dovish commentaries from Fed officials to decide whether the stocks reached the floor in September and may be ready for a sustainable recovery.

Federal Reserve Chairman Jerome Powell and other policymakers speak later in Washington and may provide the markets with the breathing space. However, the analysts warn that the turbulence will be violent until the US presidential elections are over.

Bitcoin and gold correlation

Bitcoin is often regarded as a safe-haven asset and a hedge against inflation, positively correlated with gold. However, this statement works only when investors seek to protect their wealth from devaluation and other economic risks.

Meanwhile, the escalating geopolitical tensions and growing global uncertainties move Bitcoin to the camp of risk assets and make it correlated with stocks. Now investors have plenty of reasons to panic:

- Europe is on the verge of a new lockdown, with 40,000 to 50,000 new coronavirus cases registered daily. Some countries have already imposed restrictions, while Britain is considering the full-fledged quarantine again.

- The US is in total turmoil ahead of the election. The death of Supreme Court Justice Ruth Bader Ginsburg added fuel to the presidential election fight between President Donald Trump and nominee Joe Biden as the Senate controlled by the Republicans seems to be eager to push through another Justice before the elections.

- The conflict between China and the US is raging on as the Chinese state media denounced the TikTok deal as “an American trap” and a “dirty and underhanded trick.”

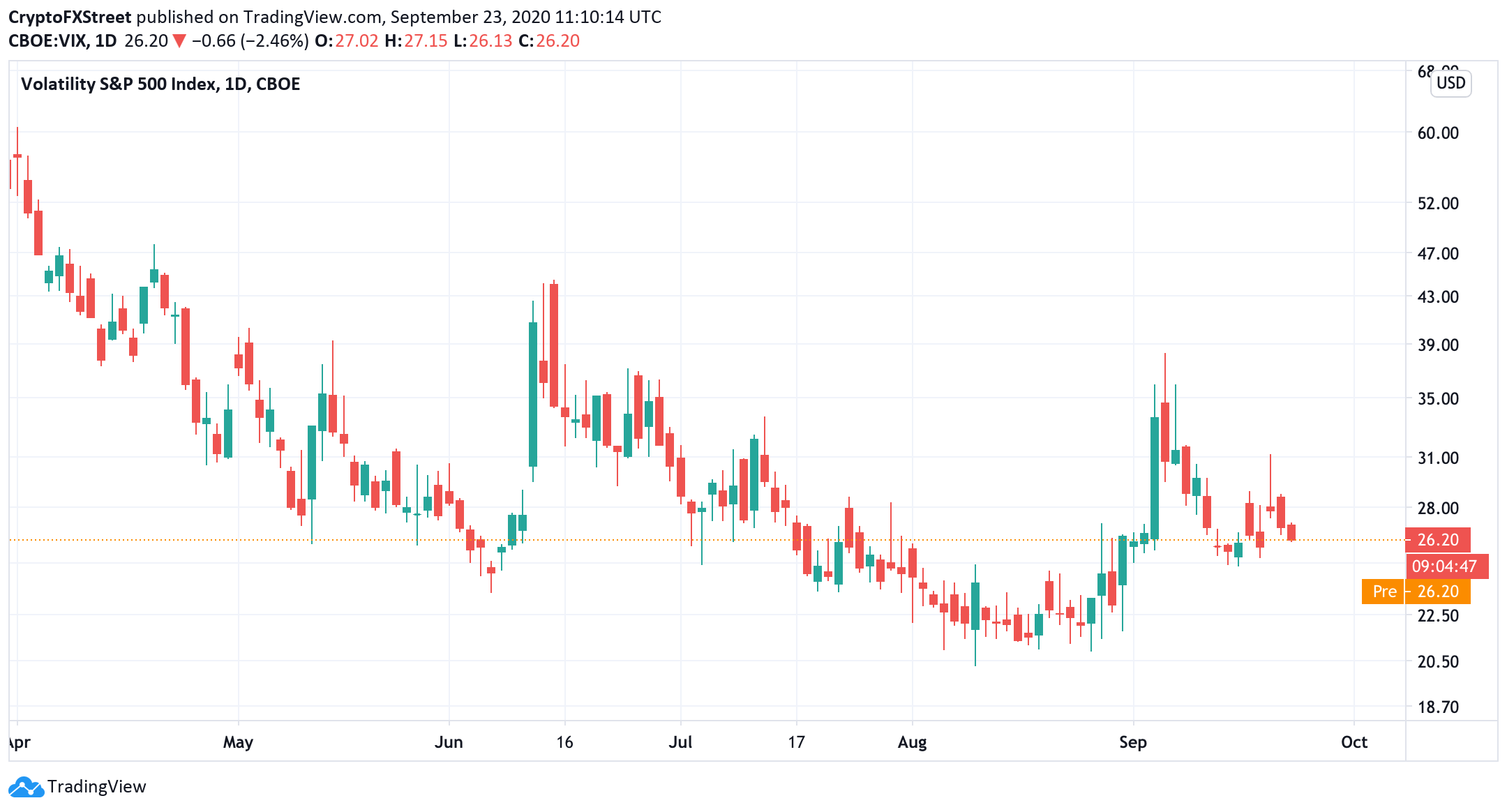

The Volatility Index (VIX) that measures implied volatility in the S&P 500 went wild, rising above $30 for the second time in September. The index usually goes that high during the shocking events like wars and terrorist attacks and trades under $20 when everything is calm.

It rose above $30 for the second time this month as the markets continue to plunge. During times of calm, the VIX index usually trades under $20, while $30 acts as the upper limit for world-shocking events like wars or terrorist attacks.

CBOE VIX index

Source: TradingView

Where from here

Considering the above, Bitcoin may be vulnerable for further sell-off as long as the markets are plagued by high volatility and uncertainty levels. The pioneer digital asset will go down amid the flight to fiat across the board and start recovering once things calm down.

As Charles Edwards from Capriole Fund mentioned in the recent tweet, Bitcoin tends to be volatile ahead of the US elections and calm down afterward.

The 3 months prior to US elections has been "rocky" for Bitcoin in the past.

— Charles Edwards (@caprioleio) September 22, 2020

But the halving + post election "clarity" has been very solid.

Note: sample size ~2.5 pic.twitter.com/uzlyuVR1s6

The time of panic distorts the correlation patterns, meaning that the parallels between Bitcoin and gold, stocks, or any other assets are pointless. The market sells everything to get cash as the most liquid asset and the primary medium of exchange.

The advantages of digital money over fiat may be obvious, but cash is still the king in the short run.

From the technical point of view, BTC/USD needs to regain ground above $11,000 to gain the upside momentum and retest the next psychological Barrier of $12,000. Meanwhile, a failure to stay above $10,400 will bring more sellers to the market and allow for a deeper correction with the first focus on $10,000 and $9,800. Get more details on the technical outlook in our article.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.