Bitcoin to be used for imports in Iran, according to a new law

- Iran will allow imports to be funded through cryptocurrencies like Bitcoin.

- A report states that cryptocurrencies mined in Iran can only be exchangeable if they are used to finance imports from other countries.

Iran will allow national imports to be funded through cryptocurrencies, according to a report from the Central Bank of Iran (CBI) and the Ministry of Energy. The country has amended legislation on digital assets, which also means that legally mined cryptocurrencies in Iran can only be exchangeable if they are used to finance imports from other countries.

Back on April 22, 2018, the Central Bank of Iran announced that handlings cryptocurrencies by financial institutions would be illegal. Laws in Iran regarding cryptos have changed drastically over the years.

In 2018, the mining of cryptocurrencies became legal. Unfortunately, in 2019, Iran's government shut down all the mining operations using industrial electricity and made it illegal again. Eventually, the country did recognize cryptocurrency mining as an industry within its borders.

Iran becomes the first country to use cryptocurrencies at a state level

Bitcoin miners in Iran will have a legal cap for the number of coins they can mine depending on the amount of subsidized energy. Further instructions will be published by the Ministry of Energy. The report by the CBI and the Ministry of Energy stated:

The miners are supposed to supply the original cryptocurrency directly and within the authorized limit to the channels introduced by the CBI

Iran Daily, the official newspaper of Iran's government, suggested that a +1.55% change on Bitcoin should be used for import payments to avoid sanctions on Iran's access to the dollar.

#phase5

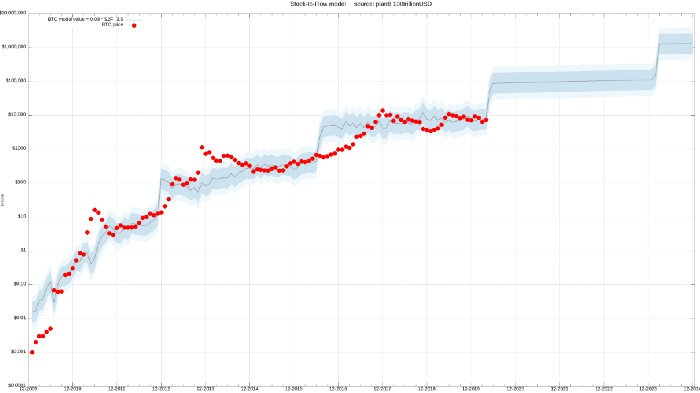

— PlanB (@100trillionUSD) October 29, 2020

"[Iran][..] turning to #bitcoin, the 1st country to do so at a state level, with the famous bitcoin volatility less of a consideration here because the situation is desperate."https://t.co/bEXxWZq7i9

Bitcoin 'Phase 5' ready?

This is an example of how Bitcoin adoption is growing, both from particulars and organizations (public and private), which is seen as a positive fundamental for the price.

PlanB, a famous cryptocurrency analyst and creator of the infamous Bitcoin Stock-to-Flow Cross Asset Model, stated that Bitcoin' Phase 5' is ready. The analyst has referenced these Bitcoin phases several times in the past.

#Bitcoin S2FX Phases

1: Pizza, GPU miner, Silk Road, MtGox

2: >$1, Wikileaks, Satoshi Dice, Coinbase, Halving1

3: >$100, Cyprus, Bitstamp, Ulbricht arrest, MtGox default, XT fork, Halving2

4: >$1000, JPN&AUS legalize BTC, Altcoins/ICO, BCH/SV forks, Segwit/LN, Futures, Halving3

Bitcoin S2F model

It seems that each phase now is a x10 jump on Bitcoin's price, with Phase 4 at $1,000 and Phase 5 at $10,000. The model would suggest that BTC is on its way to $100,000, which would be the next phase and big jump on the S2F model.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.