Bitcoin: The $75,000 zone bounce — Upside thrust and halt?

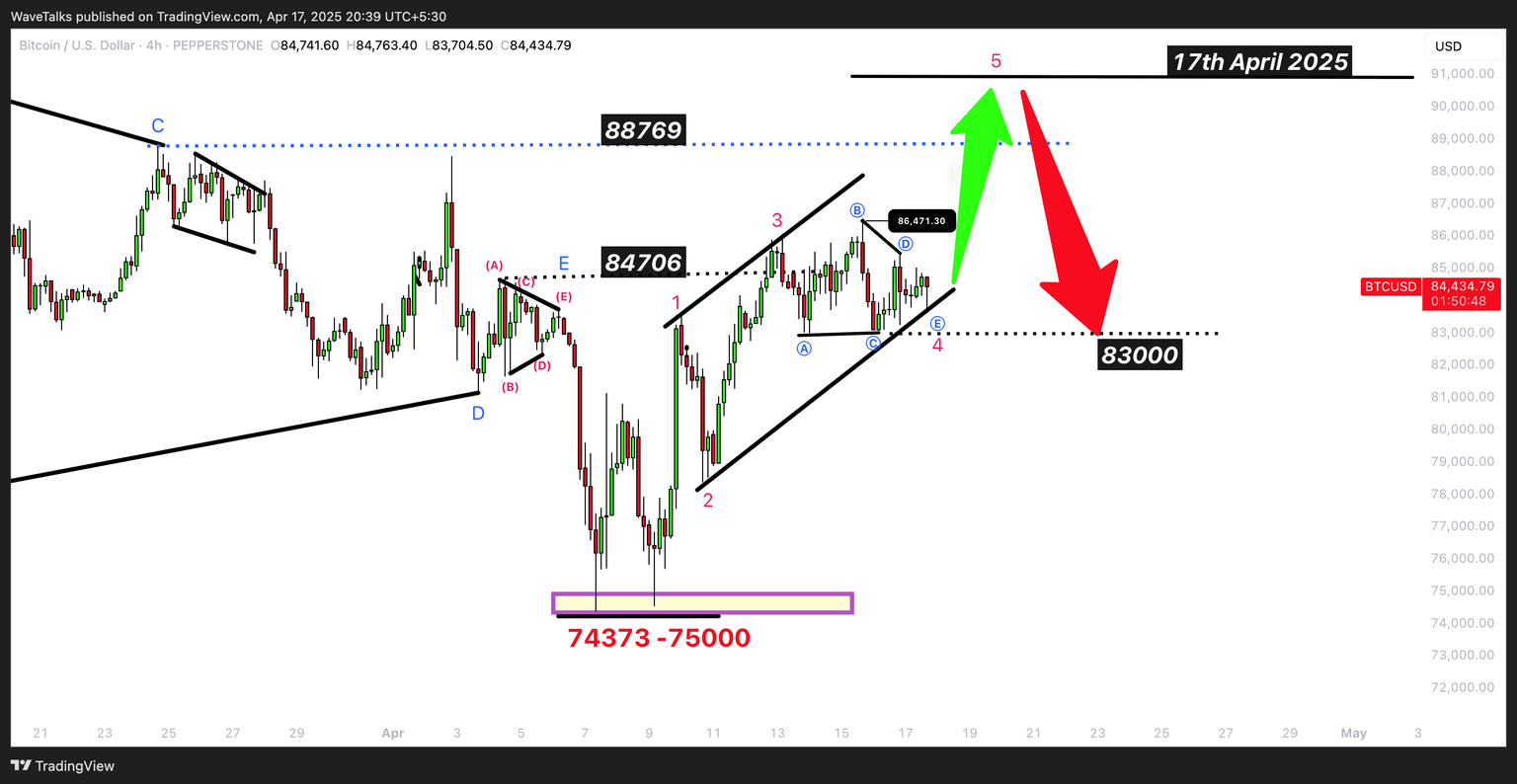

The price action for Bitcoin between 74K and 75K has been discussed extensively in recent WaveTalks updates, and now it seems that the market is unfolding as anticipated. This zone, marked as a double bottom, is playing a crucial role in the current market structure. It has shaped up as proposed rising wedge or a leading diagonal, and we’re currently expecting Wave 5 thrust upside. Once completed, the target range for Bitcoin could be between 88,000 to 90,500.

But here's the catch...

Once the Wave 5 is completed in the near term, Bitcoin may enter a sideways phase—This could result in range-bound, choppy price action before it eventually breaks through 88K–90K zone later once again.

Why is the sideways move critical?

In the sideways move expected after the completion of Wave 5 in the proposed leading diagonal pattern, Bitcoin may retrace almost 80-90% of the rally from the 74K–75K zone to the 88K–90K zone, where wave 5 of the proposed leading diagonal could be ending next. This is a typical behavior to expect during such structures & real waves unfolding has to be evaluated later for educational discussion & case study in future. However, as a trader, you need to be cautious. A break below the 74K–75K zone would indicate a violation of the pattern and could trigger a shift in sentiment.

Holding the 74K–75K double bottom zone

If the 74K–75K zone holds as a base, Bitcoin will remain bullish and set up for an upward move toward 99-100K zone post crossing above 90K. A break above this range could propel Bitcoin even higher towards 109K and potentially open for a new all time high above 109K. In fact, if the rally continues, Bitcoin could be targeting fresh all-time highs towards 120K.

Important levels to watch:

- 74K–75K Zone: Key & Critical support for Bitcoin’s bullish move.

- 82K–83K Zone: First support, a point where Bitcoin may see bulls coming back once fall starts from 88-90K zone, where proposed wave 5 is expected to complete next.

- 82K–83K Zone: This is 50% retracement zone for the higher degree wave starting from 74-75K Zone & ending in 88-90K Zone & the most important zone.

- 99K to 100K Zone: If Bitcoin crosses this range, we may see a new all time highs of 120K

Conclusion: Time for caution and patience?

With the completion of the proposed Wave 5 in the leading diagonal in 88-90K Zone, Bitcoin will be at inflection point.

So, for the time being, Bitcoin may thrust upside to complete wave 5 of the proposed leading diagonal or a rising wedge structure in 88-90K Zone and trade sideways or retrace 50% of the whole structure which comes in 82-83K zone as a next logical support, before gearing up for the next big move. Remember, as a trader, always be prepared for both scenarios like a violation of 74-75 K zone which will invalidate the structure.

Author

Abhishek H. Singh

WaveTalks

Abhishek is a seasoned financial analyst with over a decade of experience specializing in Elliott Wave Theory.