Bitcoin Technical Analysis: BTC/USD bulls finally cross $7,000. Is $8,000 achievable? – Confluence Detector

- After repeated attempts, BTC/USD finally managed to cross the critical $7,000 psychological level.

- There are no key resistance levels on the path back to $8,000, as per the daily confluence detector.

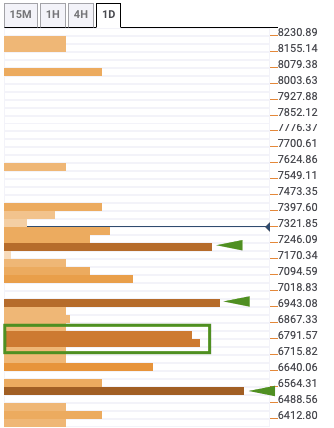

BTC/USD daily confluence detector

BTC/USD bulls took charge this Monday and were finally able to break past the critical $7,000 psychological level. The price has gone up from $6,775.54 to $7,292.40 so far. The bulls have previously repeatedly tried and failed to break past the $7,000-level. The daily confluence detector shows a distinct lack of strong resistance levels on the upside. As such, the bulls will want to continue the upward momentum and reach as close to the $8,000 level as they possibly could.

On the downside, they have four strong support levels/stacks at $7,200, $7,000, $6,750-$6,825 and $6,525. $7.200 has the one-hour SMA 10, one-hour Previous Low, 4-hour Bollinger band upper curve and one-month Fibonacci 61.8% retracement level. $7,00 has the one-day Previous High, one-week Fibonacci 23.6% retracement level, 4-hour SMA 10, one-hour SMA 50 and 15-min SMA 200. The stack between $6,750-$6,825 has the one-day Fibonacci 23.6% retracement level, one-week Fibonacci 38.2% retracement level,one-day SMA 5 and 4-hour SMA 200. Finally, $6,525 has the one-day SMA 10 and 4-hour SMA 100.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.