Bitcoin sustains $57K despite August CPI report

- US August CPI data revealed a slight increase in the monthly inflation rate, rising by 0.2%.

- The crypto market remained steady despite the inflation report, as predictions favor the possibility of a 25 bps rate cut.

- Bitcoin has experienced sharp declines in trading activity among centralized exchanges, per Glassnode's monthly data.

The crypto market saw slight declines after the US monthly inflation data came in at a 0.2% increase on Wednesday. The steady prices suggest that investors are not panicking at the possibility of a 25 basis point (bps) rate cut as opposed to earlier anticipation of a 50 bps cut.

Crypto market unfazed by low inflation data

US Consumer Price Index (CPI) data for August came in lower than expected, declining 2.5% against July's 2.9% on a yearly basis. At the same time, the annual core CPI stood at 3.2%, matching expectations. Notably, monthly CPI data increased 0.2% while core CPI rose 0.3%, per FXStreet inflation data report on Wednesday.

The increase in the monthly CPI data suggests that the possibility of a 50 bps interest rate cut in September by the Federal Reserve (Fed) may not be forthcoming. According to @KobeissiLetter, the likelihood of a 50 bps rate cut dropped to 8% after the CPI data release, meaning a 25 bps cut is more likely. A 25 bps cut should not positively impact risk assets like cryptocurrencies.

Despite the changes it brought, the CPI data has yet to have heavy effects on the crypto market as Bitcoin has held the $57K price steady in the past few hours. Hence, the Federal Open Market Committee (FOMC) meeting slated for September 18 may prove vital for the future of the crypto market.

Meanwhile, Glassnode's weekly report suggests that mining activity among Bitcoin miners shows their resilience despite declining revenues. The mining hashrate for Bitcoin is approaching all-time highs, just behind by 1%. The present number of hashes required to mine a block is 338k exahash, which, the report notes, is the second-largest difficulty in the asset's history.

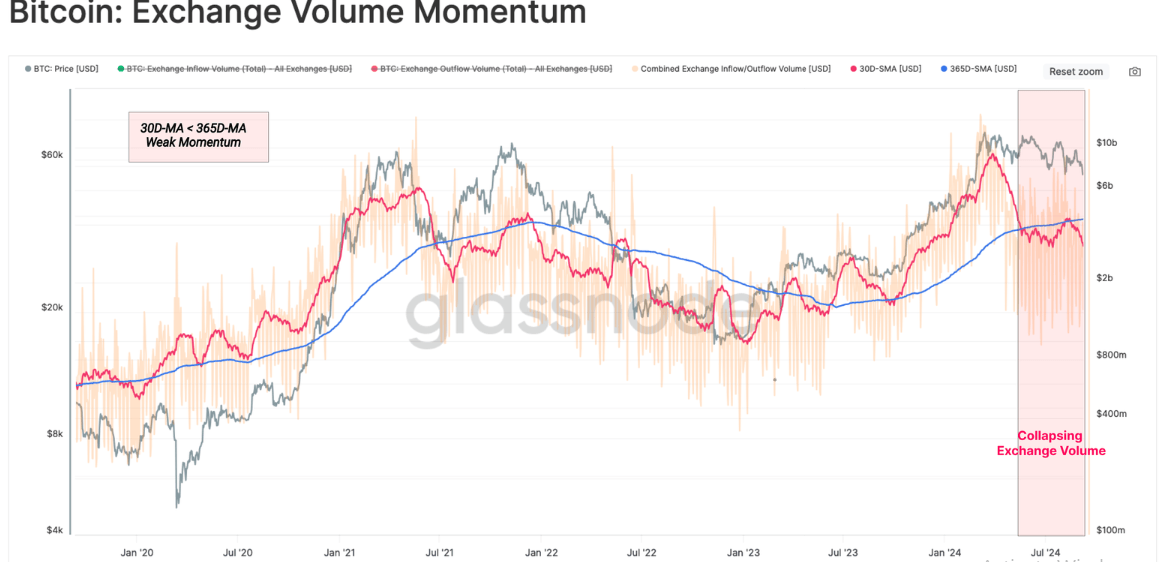

However, traders aren't displaying similar convictions as Bitcoin exchange volume has steadily declined since July.

Bitcoin Exchange Volume Momentum

Notably, the exchange spot trading volume has fallen over the past 90 days, adding "more weight to the idea that there has been a notable decline in trade activity over the last quarter.

Furthermore, the CVD metric —a tool that measures the net balance between market buying and selling in a spot market — revealed that selling pressures have grown among investors over the last 90 days.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi