Bitcoin suffers its worst month ever, while these Web3/DeFi tokens shine out

The value of Bitcoin fell by 38% in June, the worst month since the flagship cryptocurrency became available on exchanges in 2010.

Meanwhile, the world's second-largest cryptocurrency by market capitalization, Ethereum, ended June down 45%.

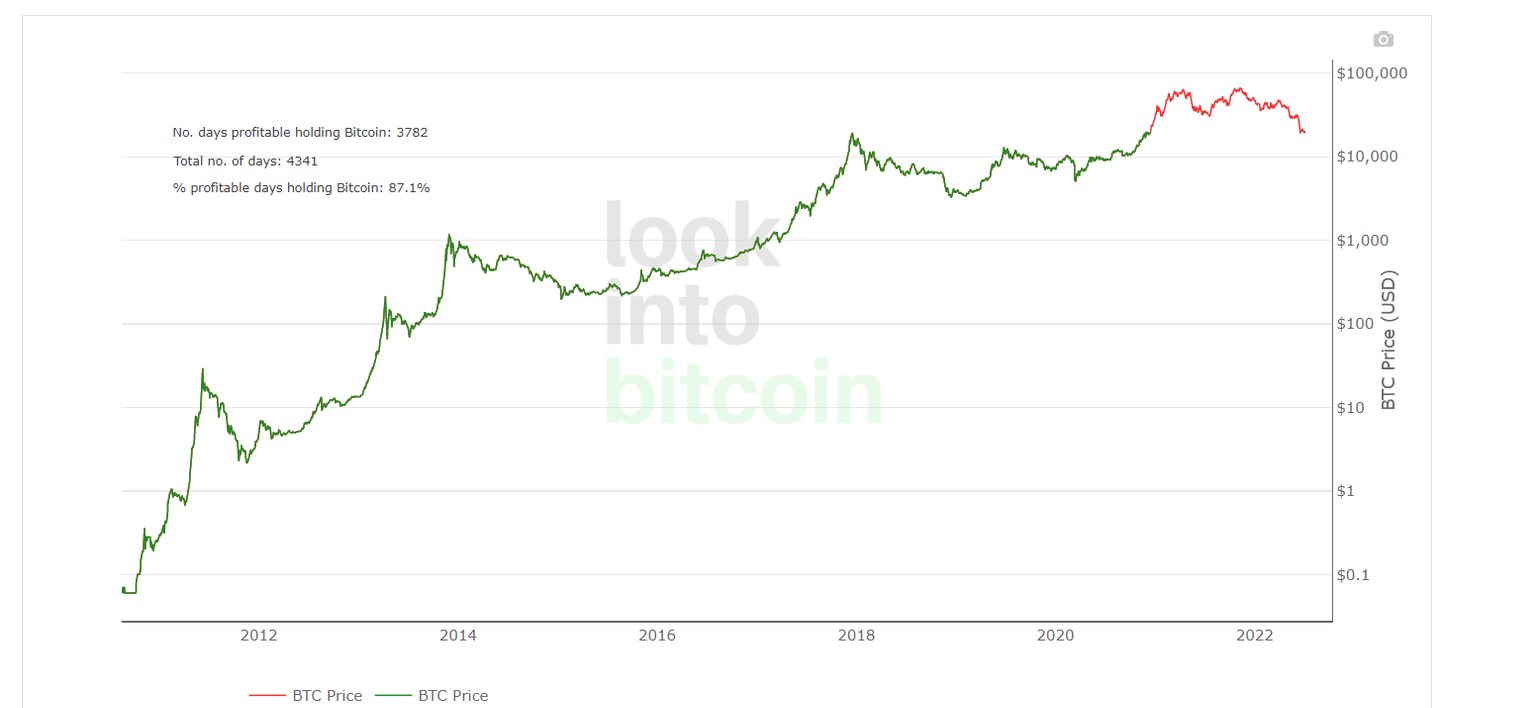

The crypto market has been wiped out by $2 trillion in a matter of months. However, extreme price volatility is a natural part of the digital asset market. During the last decade, Bitcoin prices went through two extended bear markets. In the previous cryptocurrency winter in 2018, Bitcoin lost over 80% of its value before gaining it back and reaching an all-time high of about $69K in November 2021. Right now, BTC is 71.8% away from this milestone.

Bitcoin Profitable Days. The number of days in Bitcoin's history when holding it was profitable in comparison to today's price.

Source: LookIntoBitcoin

This drastic decline has spooked many people, with Bank of America reporting that the number of active US crypto users fell by more than half from 1 million in November 2021 to less than 500K in May.

Some, however, view this as an opportunity to stockpile Bitcoin, in memory of its recent triumphant rise. MicroStrategy's Michael Saylor announced that the company had purchased an additional 480 BTC for about $10 million, bringing MicroStrategy's total holdings of Bitcoin to around $4 billion. El Salvador’s President Nayib, who is a huge fan of the number one cryptocurrency, announced that the country’s Bitcoin reserves had been replenished with 80 more bitcoins for a total of $1.52 million, tweeting: "Bitcoin is the future. Thank you for selling cheap.”

Bitcoin could be a hedge against monetary inflation

In spite of once being regarded as a hedge against consumer inflation, which then proved to be wrong, there is a case for Bitcoin to act as a hedge against monetary inflation.

M2 Money supply vs. Bitcoin Price

Source: FRED

A monetary aggregate M2 includes all currency in circulation, operational deposits in a central bank, money in current accounts, savings accounts, money market deposits and small certificates of deposit.

During the first half of 2020, the percentage change in the M2 increased rapidly within a short period of time. The percentage change in Bitcoin's price year-over-year followed with a delay. Bitcoin's price hit new heights after the flash crash of that year, and M2 reached new highs as well. Year-over-year growth in M2 peaked at the end of February 2021; the Bitcoin price peaked shortly after in mid-March 2021. In other words, Bitcoin's price has acted as a lagging indicator for M2 money supply in the past two years. In this case, Bitcoin can function as a hedge against monetary inflation.

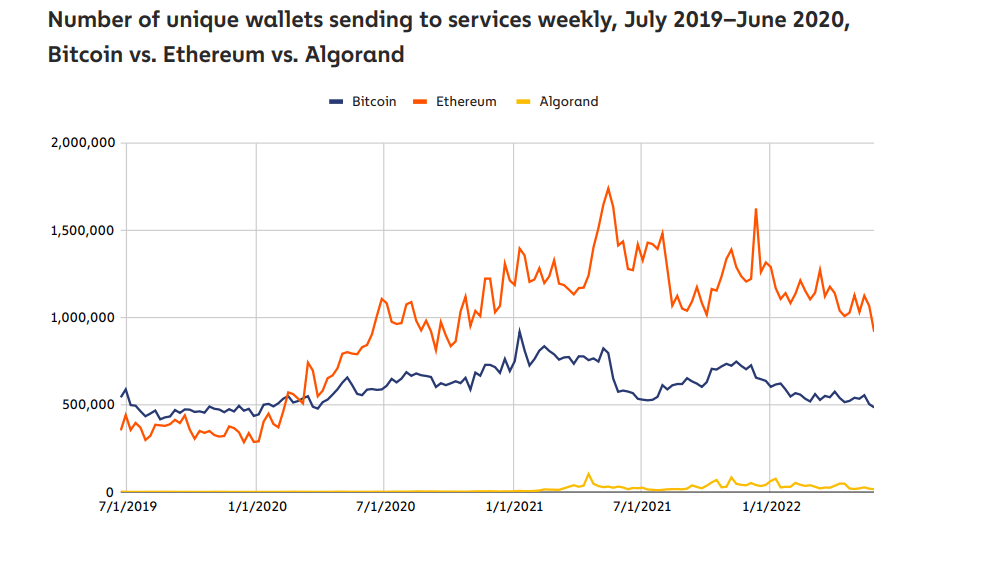

Bitcoin is no longer the most popular blockchain

As the Chainalysis report charts the number of unique wallets sending each currency to services over time, it appears that Bitcoin led in terms of unique users until March 2020, when Ethereum surpassed it. It's logical that this growth corresponds with DeFi's growth, as the rise of DeFi led to the creation of many services that accept Ethereum and other tokens built on its blockchain.

Source: The Chainalysis State of Web3 Report

Bitcoin used to dominate the total transaction volume, but it is now dominated by a multitude of smart contract-enabled coins such as Ethereum.

Share of total transaction volume by currency type, 2010–2022

Source: The Chainalysis State of Web3 Report

So far in 2022, BTC has represented just over 10% of total crypto transaction volume. Much of that is from stablecoins, but 45% is now coming from Web3 and DeFi cryptocurrencies.

The most promising web3 and DeFi coins

With that in mind, let's take a closer look at Web3 and DeFi and coins that are currently demonstrating strong performance or that could rally in the near future.

Stratis (STRAX)

Over the past two weeks, the price of STRAX, the native token of Stratis' blockchain, has risen over 50.5% as the project's most appealing initiatives have been announced, including the launch of a stablecoin pegged to GBP. Stratis-backed Sky Dream Mall, a metaverse powered by the Stratis blockchain, is also slated to launch soon.

The firm is collaborating with Price Waterhouse Coopers (PwC) to secure the necessary licenses from the Financial Conduct Authority (FCA). Stratis is also developing a ticketing system that will create non-fungible tokens (NFT) that will be used to validate entrances to various events and venues.

Source: CoinGecko

The project is intended to provide C# and .NET (Microsoft) developers with a suite of products and solutions to help them adopt blockchain technology and migrate their existing applications, so it appears to have a solid foothold in the market.

Cypherium (CPH)

Cypherium is another Web3-ready blockchain that bridges CBDC, DeFI and Web3 through protocol interoperability. It’s a hybrid consensus system that maximizes both decentralization and scalability without sacrificing one over the other through its Proof-of-Work andHotStuff consensus mechanisms.

Developers can build groundbreaking apps using Cypherium's comprehensive platform to shape the future of business, law, and enterprise solutions.

With its FedNow Service Provider status, Cypherium will continue to work with financial regulators to develop CBDC applications and regulated DeFi projects, which places it among other promising projects.

A significant increase in the context of overall market declines, CPH token grew by 49.6% over the past two weeks and 29% month-over-month.

Source: CoinGecko

Spell (SPELL)

Spell Token (SPELL) is part of the abracadabra.money lending platform, under which interest-bearing tokens (ibTKNs) are used as collateral for borrowing the USD-pegged stablecoin, Magic Internet Money (MIM). Thanks to SushiSwap's Kashi Lending Technology, Abracadabra's isolated lending markets have fueled decentralized finance (DeFi) innovation. In isolated lending markets, risk is not shared. In the event that a currency pair loses its liquidity or anything goes wrong with the smart contract, only that pair is affected, not the platform as a whole. In this way, Abracadabra can offer a wide range of pairs that are not supported by most other decentralized exchanges (DEXs).

Source: CoinGecko

During the past two weeks, SPELL was up 22%. It was up 116.6% on a year-over-year basis – a highly impressive gain in the current market environment.

Author

Mike Ermolaev

Independent Analyst

Mike Ermolaev is the founder of Outset PR. The agency helps tech companies, especially blockchain and Web3 projects, get the desired recognition thanks to its wealth of media connections.