Bitcoin's huge price surge in January has meant that 64% of Bitcoin investors are in profit, according to data from IntoTheBlock.

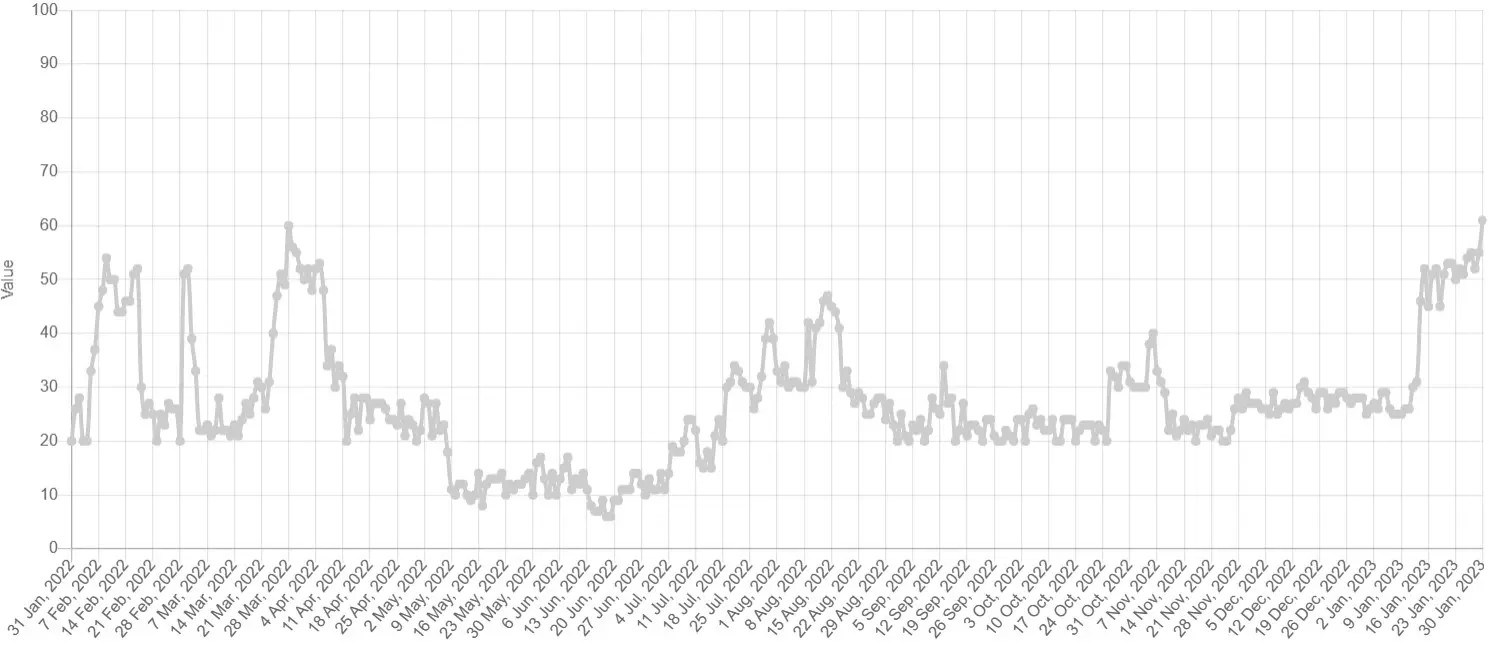

Bitcoin (BTC) has just clocked its 11th consecutive day outside the “Fear” zone in the Crypto Fear and Greed Index, cementing its longest streak out of fear since March 2022.

It comes as Bitcoin hit $23,955 at 8:10 pm UTC time on Jan. 29, becoming this year’s newest all-time high. Though it has since come back down slightly to $23,687 at the time of writing.

Meanwhile, Bitcoin sentiment is currently sitting firmly in the “Greed” zone with a score of 61, which hasn’t been seen since the height of the bull run around Nov. 16, 2021, when the price was about $65,000.

Bitcoin Fear and Greed Index over the last 12 months. Source: Crypto Fear and Greed Index.

However, despite Bitcoin’s strong resurgence in recent weeks, market participants continue to debate whether the recent price surge is part of a bull trap or whether there is a real chance for a bull run.

Regardless, the current rally has pushed a lot more BTC holders back into the green.

According to data from blockchain intelligence platform IntoTheBlock, 64% of Bitcoin investors are now in profit.

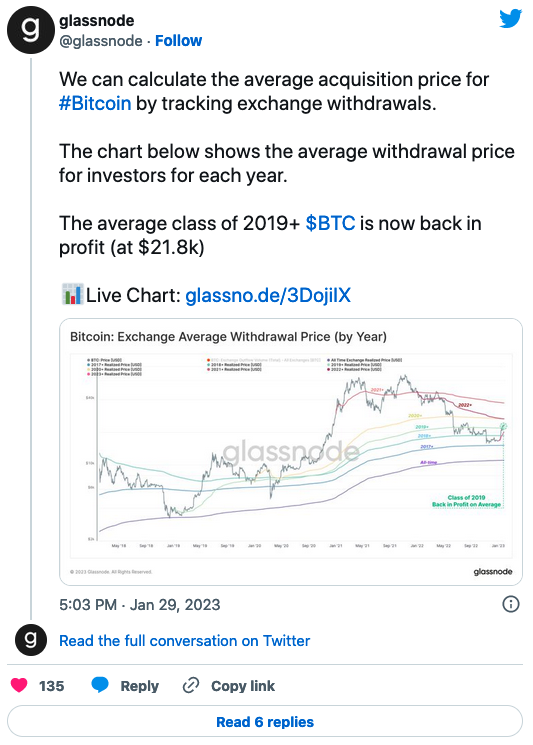

Those who first bought BTC back in 2019 are now — on average — back in profit too, according to on-chain analytics platform Glassnode.

The average first time buy price for BTC investors in 2019 was $21,800, which means those investors are, on average, up about 9% with today’s current price of $23,687.

Meanwhile, a Jan. 29 poll from crypto market platform CoinGecko has revealed that 57.7% of 3,725 voters believe BTC will exceed $25,000 this week, while only 21.2% of voters believe BTC is primed for a pullback below $22,000.

A CoinGecko poll on BTC price prediction for the upcoming week. Source: CoinGecko.

Founder and CEO of Vailshire Capital Dr. Jeff Ross also provided a technical analysis of his own on Jan. 29, suggesting that a price surge towards $25,000 in the short term may be on the cards:

Other analysts have called for excited investors to taper some of their expectations, however.

Head analyst Joe Burnett of Bitcoin mining company Blockware told his 43,900 Twitter followers on Jan. 29 that BTC won’t reach and surpass its all time high (ATH) of $69,000 until after the next Bitcoin halving event, which is expected to take place in March of 2024:

Macroeconomist and investment adviser Lyn Alden also recently told Cointelegraph that there may be “considerable danger ahead” with potentially risky liquidity conditions expected to shake the market in the second half of 2023.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin falls below $94,000 as over $568 million outflows from ETFs

Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot ETFs recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand.

Altcoins Tron and Toncoin Price Prediction: TRX and TON show signs of weakness

Tron and Toncoin prices extend the decline on Thursday after falling more than 6% this week. TRX and TON face rejection from key levels, suggesting double-digit cash ahead. Traders should be cautious as both altcoins show signs of weakness in momentum indicators.

BNB Price Forecast: Poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) show bearish signals.

Ripple's XRP eyes recovery following executives' dinner with Donald Trump

Ripple's XRP is up 2% on Wednesday following positive sentiments surrounding its CEO Brad Garlinghouse's recent dinner with incoming US President Donald Trump. If the recent recovery sentiment prevails, XRP could stage a breakout above the upper boundary line of a bullish pennant pattern.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.