Bitcoin Stalls while Longs Make a new Peak

Cryptocurrencies have recovered slightly, although you don’t see much strength in buyers. There are exceptions, though. Tezos gains 15.12%, VET rises 9%, Qtum grows 6.23%, and Atom has gained 6.64%. In the Ethereum token sub-sector, there are lots of tokens moving up with strength, such as SNX (+6.68%), FTT* (+9.57%), KNC( +21%), and OCEAN(+22%).

FIg 1 - 24H Crypto Heat Map

The capitalization of the crypto market went up 0.71% to $196.635 billion, that with a traded 24H volume of $22.587 billion (-4.6%). Bitcoin dominance keeps steady at 66.4%.

FIg 2 - 24H Crypto Market Capitalization and Traded Volume

Hot news

US Insurance giant Anthem is planning to use blockchain technology to give its customers secure access to their patient records. The company is pilot-testing the system in a small group, who can instantly provide access to their EPR to healthcare providers using a QR code.

ING plans to offer custodial services to its customers, although, currently, they didn't provide many details about this service.

Christine Lagarde, president of the ECB, said on Thursday during her first press conference that she sees an increased interest by several central banks in digital currencies, and that she very much like to see the ECB take the lead in this matter. She also said that the ECB plan to establish the objectives for the project by mid-2020.

Technical Analysis - Bitcoin

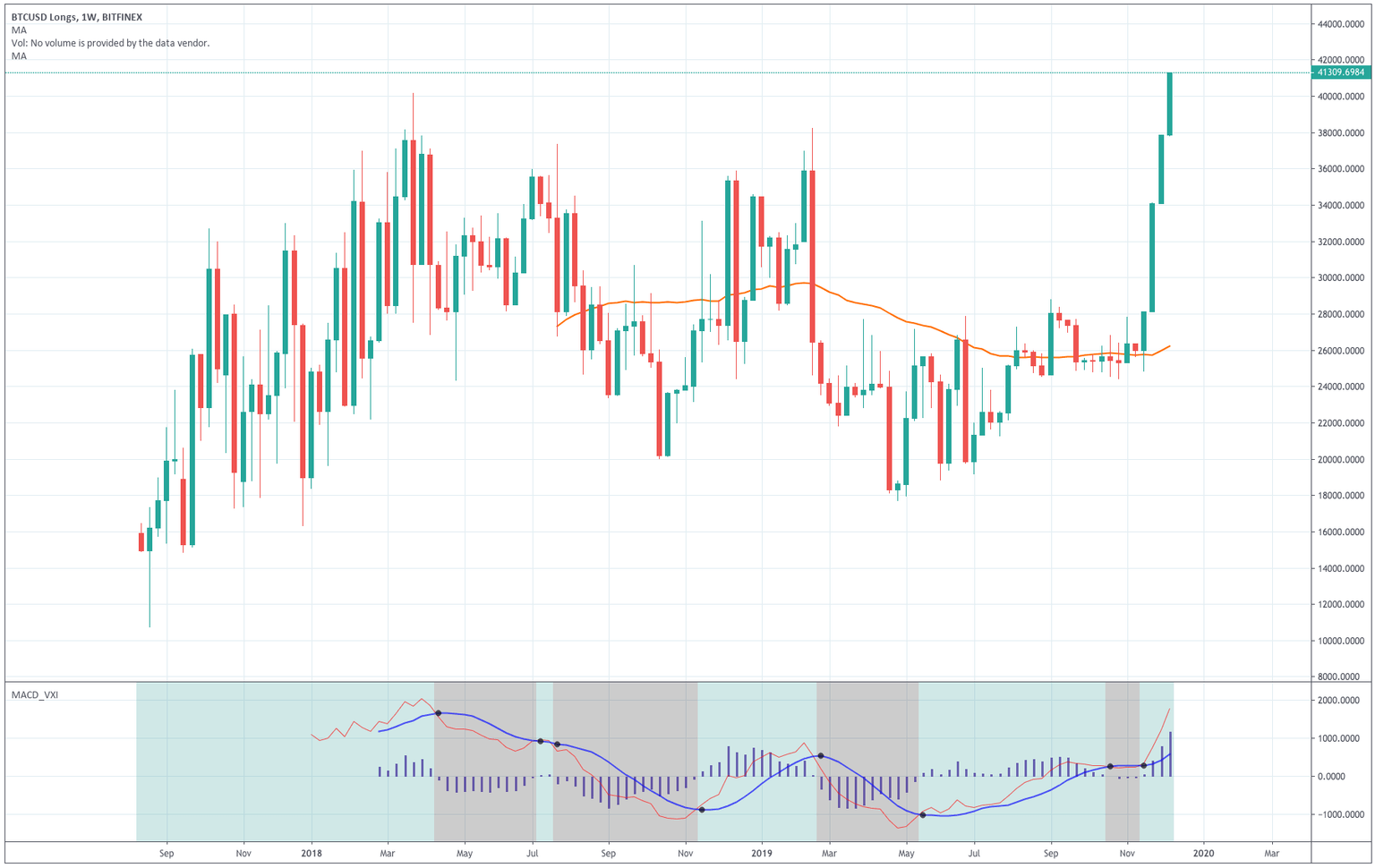

Chart 1 - Bitcoin Longs weekly chart.

Bitcoin longs continue climbing to new highs. The current situation of the Bitcoin price, not being able to create a bullish sentiment in the market, is in contrast with the steep climb of the BTCUSD longs provided by Bitfinex. The weekly chart sees a steady rise for its fourth consecutive week and is now at its peak for the last two years.

Chart 2- Bitcoin 4H Chart

The Price of Bitcoin has been climbing steadily, although slowly from its $7,126 support zone, and now is touching the mid-Bollinger line. At the same time, the MACD made a bullish crossover. This is positive for the cryptocurrency, although it does not wipe out its bearish sentiment yet. A convincing sentiment shift would require at least a strong closing above $7,340.

|

SUPPORT |

PIVOT POINT |

RESISTANCES |

|

7,126 |

7,184 |

7,340 |

|

7,000 |

7,400 | |

|

6,880 |

7,530 |

Ripple

Chart 3 - Ripple 4H Chart

Ripple continues moving below its -1SD Bollinger line, and the MACD still in its bearish phase. The price is currently below the $0.22 level, although traded with a very tiny volume. The level to keep to the upside is 0.2188, while a climb above 0.223 would bring buyers back to life.

|

SUPPORT |

PIVOT POINT |

RESISTANCES |

|

0.2180 |

0.2200 |

0.2230 |

|

0.2140 |

0.2260 | |

|

0.2100 |

0.2290 |

Ethereum

Chart 4 - Ethereum 4H chart

Ethereum made a couple of strong candlesticks yesterday, and its price moved up above $144, but then, the price found resistance at $146 and is retracing some of its gains. The $144 level is key to continue seeing an upward progression on this cryptocurrency, and a close above $146 would confirm an upward leg. MACD is still bullish, so our outlook on this coin is slightly positive.

|

SUPPORT |

PIVOT POINT |

RESISTANCES |

|

140.00 |

143.00 |

146.00 |

|

136.40 |

147.30 | |

|

134.00 |

150.00 |

Litecoin

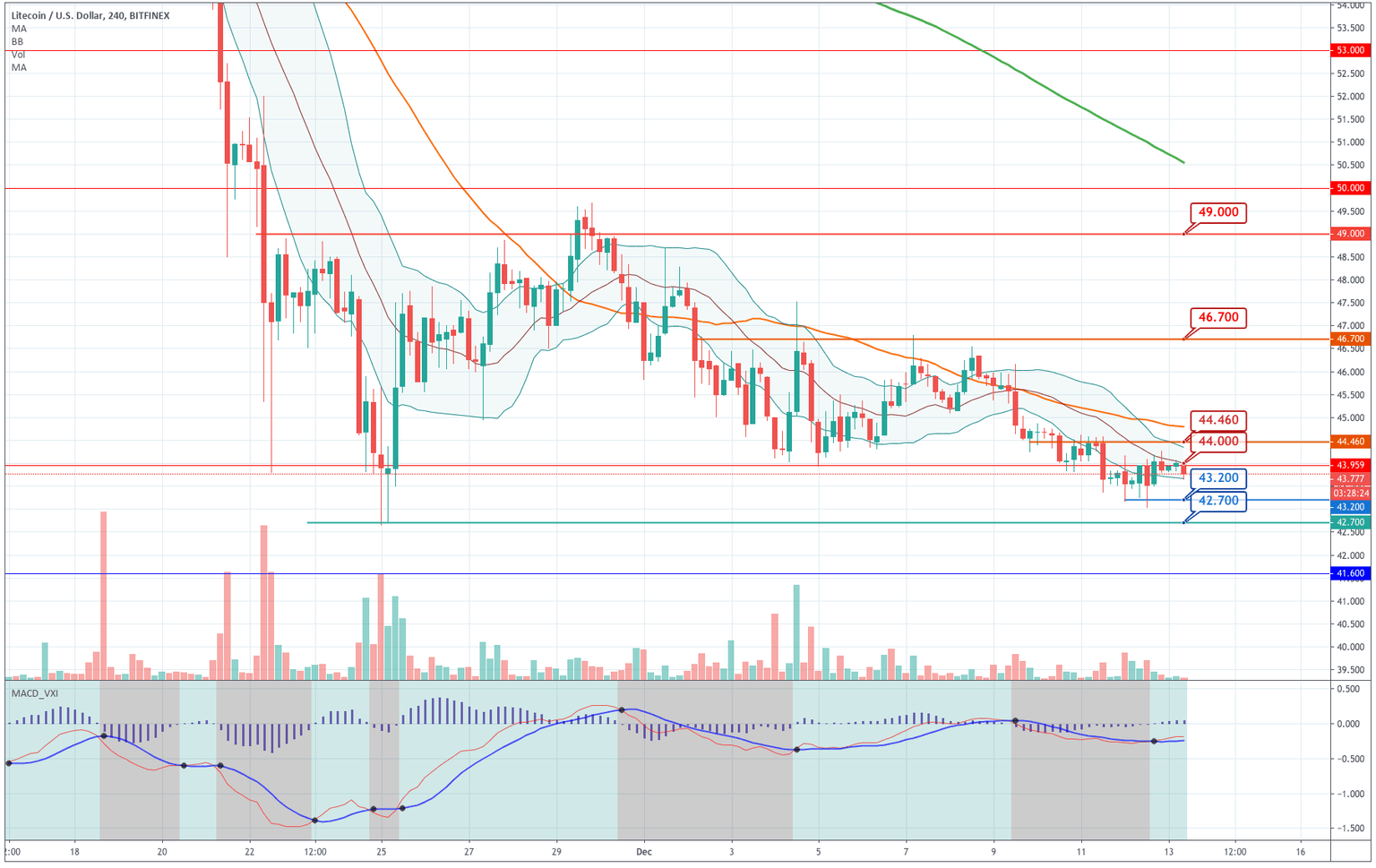

Chart 5 - Litecoin 4H Chart

Litecoin is moving sideways since yesterday, and its situation hasn't changed much, except for the price now close to the mid-Bollinger mean line and the MACD turning bullish. Currently, the altcoin is not suitable for savvy traders, as the volatility is tiny, and there is no current price direction. The levels to keep an eye on are $43.2 for a downside move and $ 44.46 for the upside run.

|

SUPPORT |

PIVOT POINT |

RESISTANCES |

|

43.20 |

43.70 |

44.50 |

|

42.70 |

45.20 | |

|

42.00 |

45.70 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and