Bitcoin price targets the $49,000 level as analysts predict approval of BTC spot ETFs by SEC

- Bitcoin analysts at Bloomberg believe that the SEC could approve all spot Bitcoin ETFs within an eight day period.

- Bitcoin price crossed the $36,400 level, analysts believe this confirms the BTC bull market.

- Spot Bitcoin ETF approval is expected to push BTC price higher, Bitcoin price could hit $49,000 target.

Bitcoin price rally to its bullish target of $49,000 relies largely on spot BTC Exchange Traded Fund (ETF) approval by the US financial regulator, Securities and Exchange Commission (SEC).

According to a Cointelegraph report, the window for approval of the first spot Bitcoin ETF opens today, a key event that market participants are watching closely.

The series of events that led to the impending approval of Bitcoin spot ETFs started with Grayscale’s landmark victory against the SEC. In the DC Court of Appeals, Grayscale’s victory meant that the SEC can no longer deny spot bitcoin ETFs under reasons it has given in the past.

Grayscale’s victory laid the foundation for a spot Bitcoin ETF approval, however industry watchers note that the probability of approval by the regulator is 90%, on or before the January 10 deadline.

Also read: Bitcoin price trends above $35,000 after BTC survives sell off by miners

Daily Digest Market Movers: Bitcoin spot ETF approval window opens today, BTC price eyes $49,000 target

- Bitcoin price is $36,564 on Binance, early on Thursday. The largest asset by market capitalization crossed the barrier at the $36,400 level, confirming a BTC bull run in the ongoing cycle.

- Bloomberg’s research analyst, James Seyffart identified two paths that need to be completed for a spot Bitcoin ETF launch. SEC Form 19b-4, used by self-regulatory organizations (SROs) to record a rule change with the regulator needs approval.

- The second step is a sign off from the Division of Corporate Finance.

- Seyffart notes that it could take weeks or months between approval and launch, in his recent tweet on X.

What Scott said: There are TWO paths that need to be completed for an ETF launch. Even if 19b-4 is approved, S-1s still need sign off from division of Corp Fin. No sign that's done yet. Possible and even likely that there could be weeks or even months between approval & launch https://t.co/LZSdutmlT8 pic.twitter.com/7OLj5HjSDy

— James Seyffart (@JSeyff) November 8, 2023

- Scott Johnsson, VP of Van Buren Capital notes that there is a minimum a month and probably a couple months before an actual spot Bitcoin ETF launch. Applications are still under review.

If theres a hypothetical approval this week, there's probably MINIMUM a month (and probably a couple) before any ETF actually launches. S-1s still under review and no real hard deadline for that process. Though I consider it more a formality at that stage. Would be a wild period.

— Scott Johnsson (@SGJohnsson) November 8, 2023

- According to a Cointelegraph report, the agency’s first window to approve all 12 spot Bitcoin ETFs begins today.

- BTC price crossed the crucial $36,400 level and Bloomberg analysts believe that an eight day window, between November 9 and 17, where all spot Bitcoin ETFs could be approved by the regulator.

Technical analysis: Bitcoin price eyes $49,000 target

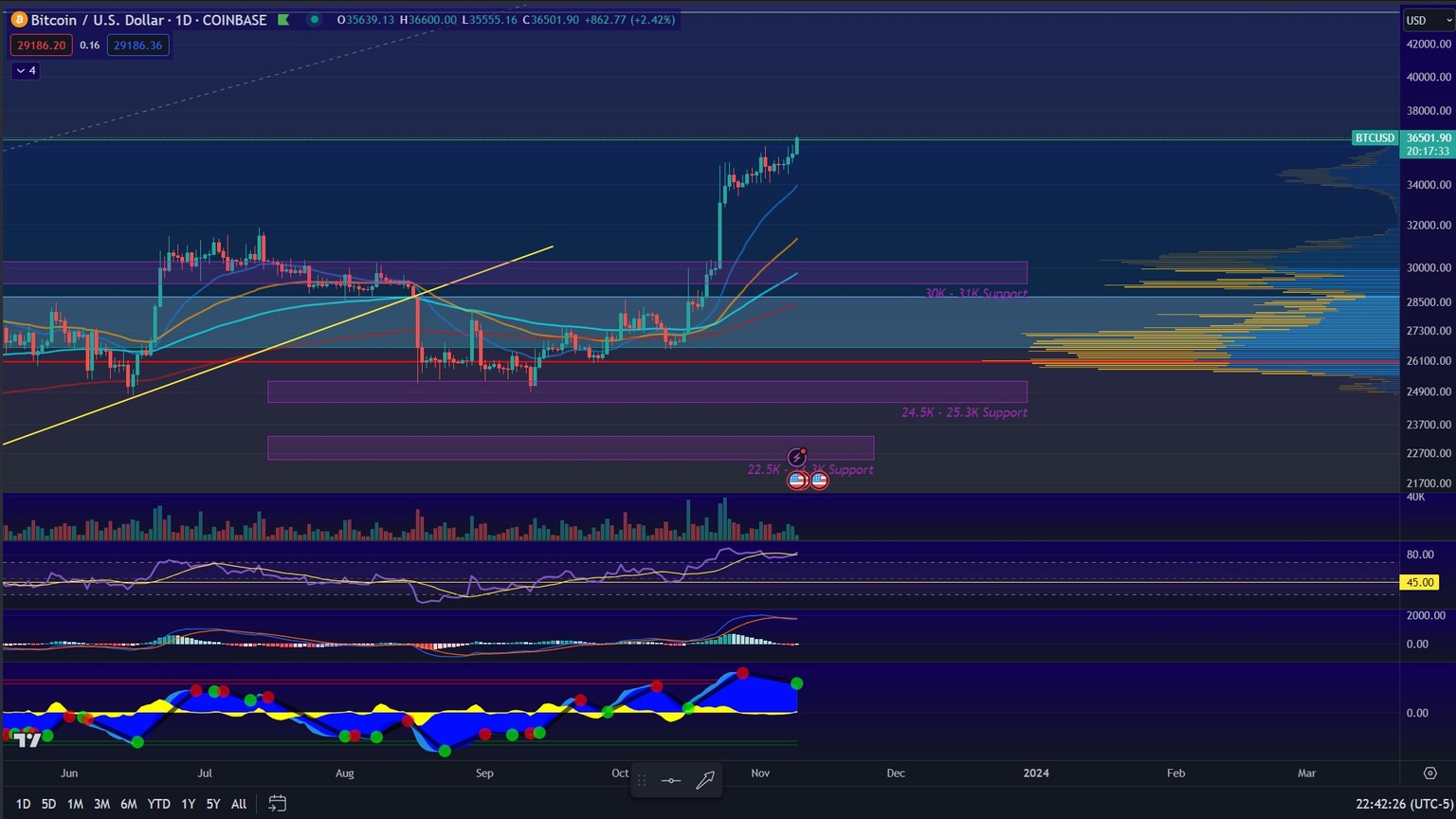

Bitcoin price crossed the $36,400 crucial level that analysts have been tracking to identify whether the bull market is official. Analyst behind the X handle @crypto_div believes Bitcoin price hit the $36,400 level earlier than expected. In the event of a retracement in Bitcoin price, the 200-day Exponential Moving Average (EMA) at $34,000 could act as support.

BTC/USD 1-day chart

Technical analyst CryptoKaleo has set a $49,000 target for Bitcoin price. The analyst notes that the current price action is a reminder of where BTC price was in December 2020 before the early 2021 rally kicked off. A break above $37,000 could therefore send Bitcoin price to $49,000, as seen in the chart below.

BTC/USD 4-hour chart

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rate affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.