- The Bitcoin Spot ETF approval by the US financial regulator on Wednesday ignites fee wars between issuers.

- Crypto expert Vijay Boyapati said that BlackRock, Fidelity, and Grayscale are likely to emerge as survivors in the long term.

- Bitcoin price is up nearly 9% on the week, with gains capped below $48,000.

The Bitcoin spot Exchange-Traded Fund (ETF) was approved by the US Securities and Exchange Commission (SEC) on Wednesday, marking January 10 as a historic moment for BTC holders after years of anticipation. The approval has triggered fee wars among the 11 issuers, and experts weigh in on who is likely to survive in the long term by offering near-zero fees to market participants.

Bitcoin price increased slightly after the announcement, but these gains were quickly erased.

Also read: Bitcoin ETF finally approved by SEC

Daily digest market movers: Bitcoin ETFs receive SEC greenlight

- The Bitcoin ETF approval marked the end of an era of anticipation among market participants. The next catalyst for BTC price is the upcoming halving event, which is scheduled for April.

- The approval ushered in competition among issuers to offer the lowest fee and capture the largest market share.

- Vijay Boyapati, a crypto expert and author, shared his views on issuers that are likely to survive in the long term, and offer near-zero fees on Bitcoin Spot ETFs. Boyapati named BlackRock, Fidelity and Grayscale’s Bitcoin ETF products as the most likely to gain market share.

- According to the expert, asset management giant Blackrock is big enough to handle almost-zero margin indefinitely, Fidelity has a large enough client base, and Grayscale is likely to differentiate itself with the largest volume of Assets Under Management (AUM).

The #Bitcoin ETF fee war has begun in earnest, driving margins toward zero. My view is that only three survive long term:

— Vijay Boyapati (@real_vijay) January 11, 2024

- Blackrock: big enough to handle zero margin indefinitely

- Fidelity: large enough client base

- Grayscale: Largest AUM pic.twitter.com/SngMYWT4uR

- Approved Bitcoin ETFs and their reported fees are as follows:

Grayscale (GBTC): 1.5%

Hashdex (DEFI): 0.9%

Valkyrie (BRRR): 0.49%

Invesco (BTCO): 0.39%

Wisdom Tree (BTCW): 0.3%

Franklin (EZBC): 0.29%

Blackrock (IBIT): 0.25%

Fidelity (FBTC): 0.25%

Vaneck (HODL): 0.25%

Ark 21 (ARKB): 0.21%

Bitwise (BITB): 0.2%

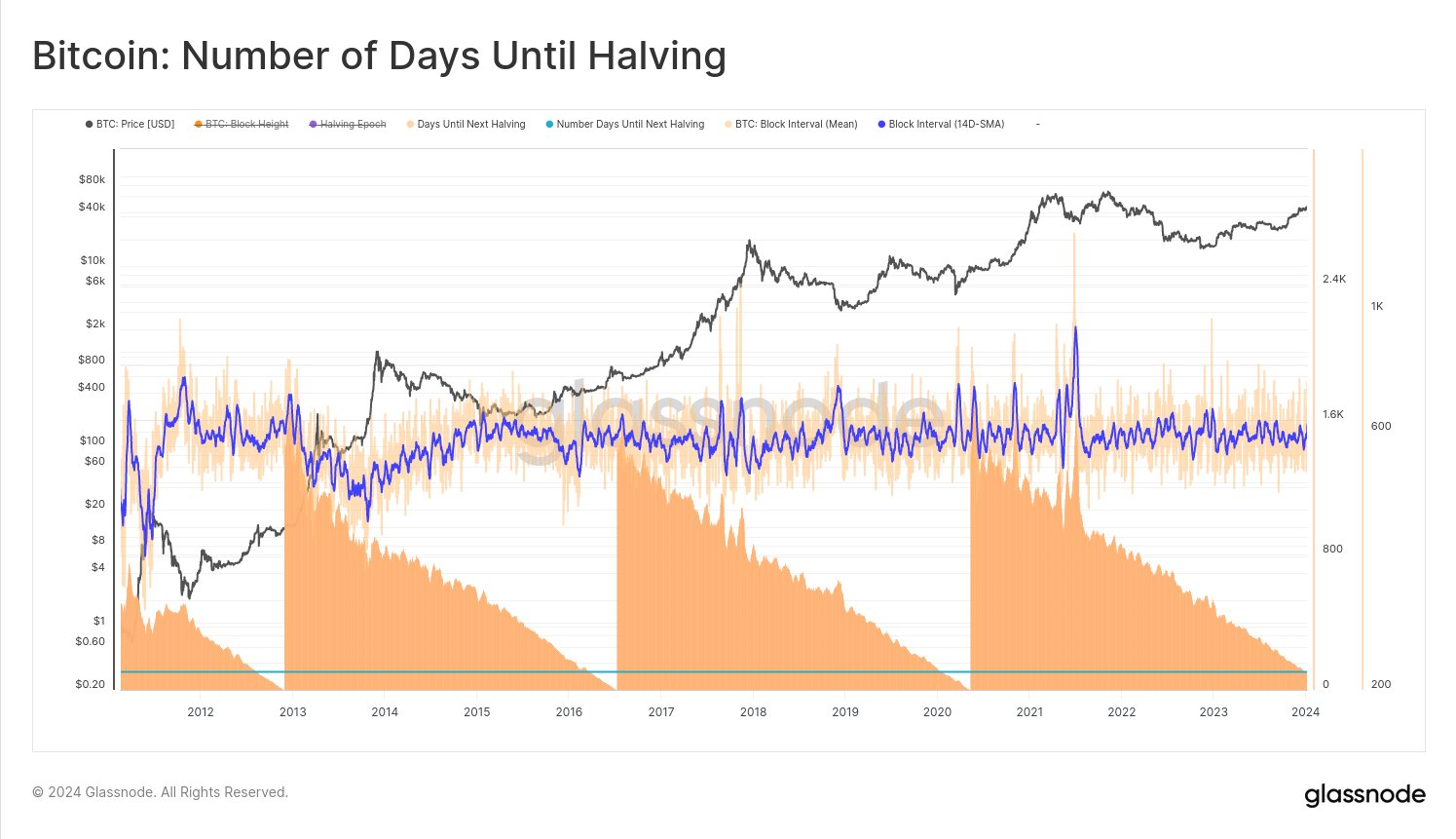

- The upcoming Bitcoin halving event could act as a catalyst for BTC price. The halving is less than 100 days away, and historically BTC price has rallied after the halving.

Bitcoin Number of Days until Halving. Source: Glassnode

Technical Analysis: Bitcoin price finds strong support at $45,000,

Bitcoin price rallied in response to the optimism from the BTC Spot ETF approval by the US financial regulator. There are two key catalysts: Spot ETF approval, and the halving, that were expected to drive gains in BTC. Whether BTC price rallies once Spot ETFs start trading remains to be seen.

The announcement showed that Bitcoin’s upside is capped below $48,000. Bitcoin price increased slightly to $47,690 after the SEC’s approval, but fell later to around $46,000 on Thursday.

Analysts at Skew @52kskew said that as long as Bitcoin price holds above $44,700, BTC is in an uptrend. The asset faces resistance between $47,000 and $48,000 on a high time frame.

BTC/USDT 4-hour chart Source:Skew tweet on X

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.