Bitcoin set to gain 10% as Russians look for alternative means of pay

- Bitcoin price is behaving very well this stormy Monday morning as global markets are under pressure from sanctions against Russia.

- BTC sees elevated interest as people in Russia dive into Bitcoin as an alternative method of payment.

- Expect this interest to add to more popularity for Bitcoin as long as the current sanctions are imposed on Russia and its ruble.

Bitcoin (BTC) is holding it together all-in-all quite well as price action dipped lower over the weekend but is back up for the day as Bitcoin sees an uptick in demand at the start of the week. That demand comes from Russian people using Bitcoin as an alternative method of payment as the local currency has devalued considerably, and several sanctions are making it impossible to use FX alternatives. With this renewed interest, expect to see BTC price action rise towards $39,780, holding a 10% profit potential.

Bitcoin regains the needed attention it deserves

Over the weekend, price action got rejected to the downside and saw a 7% devaluation. Yet with the introduction of several sanctions onRussia, significant demand is being seen for Bitcoin as Russians seek alternative payment methods as their own currency has devalued sharply by 20% on Monday morning, and foreign currencies are forbidden as a form of payment.

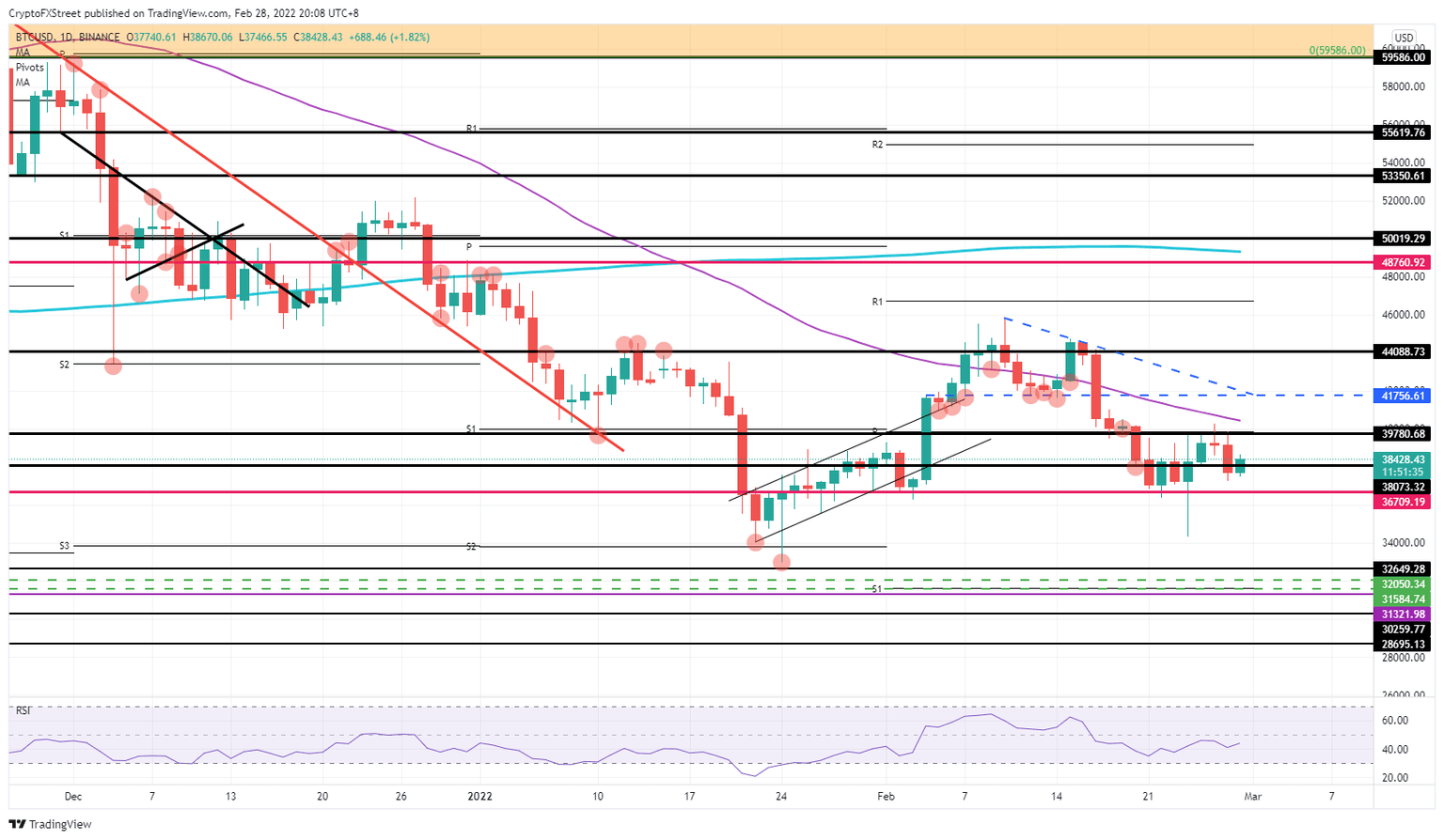

This is the perfect background for Bitcoin and other major cryptocurrencies to get renewed positive attention. Several Russians will be opening a crypto wallet and buying into Bitcoin price action, which could propel price action towards $39,780 in the first phase.once Bitcoin becomes the standard form of payment in Russia, and as the Relative Strength Index still has plenty of room to go, expect to see a further move to the upside, hitting $41,756 in the near term.

BTC/USD daily chart

Depending on the current peace talks underway this afternoon between Russia and Ukraine, expect to see a possible dip back towards $38,073 or even $36,709 as the supportive baseline in these past few days. Should the situation deteriorate again and see renewed attacks – and even the use of Russian nuclear weapons – expect to see a sharp nosedive move towards $32,650, nearing the distribution zone from a few months ago. With that move, the Relative Strength Index will have entered the oversold area, however, suggesting an increased likelihood of an eventual recovery.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.