Bitcoin Sentiment Forecast: The $1 billion Bitcoin futures expiry scenario on Friday

- Bitcoin spot price expected to react to the expiring futures contracts on Friday.

- Bitcoin futures contracts with a value of around $1 billion set to stop trading on Friday.

- Options traders tend to pin the spot price in their favor in order to manage the risk of losses.

Bitcoin bulls have in the last 24 hours been battered significantly by the widespread selling pressure across the cryptocurrency market. Earlier this week the granddaddy of cryptocurrencies embarked on a gains accrual exercise, where the resistance at $9,800 was tested but not broken.

The surge was attributed to excitement following the rumor that PayPal, a significant player in the payments market, was considering support for cryptocurrencies. It seems that the breakout was not fundamentally nor technically supported as Bitcoin plunged, hitting lows marginally below $9,000 on Thursday.

The drop to $8,988 (intraday low) comes less than a day to the expiry of longer-term Bitcoin futures contacts. Over 114,000 futures contracts with a value of $1 billion will stop trading on June 26 on several exchanges such as Deribit, CME, Bakkt, LegerX and OKEx.

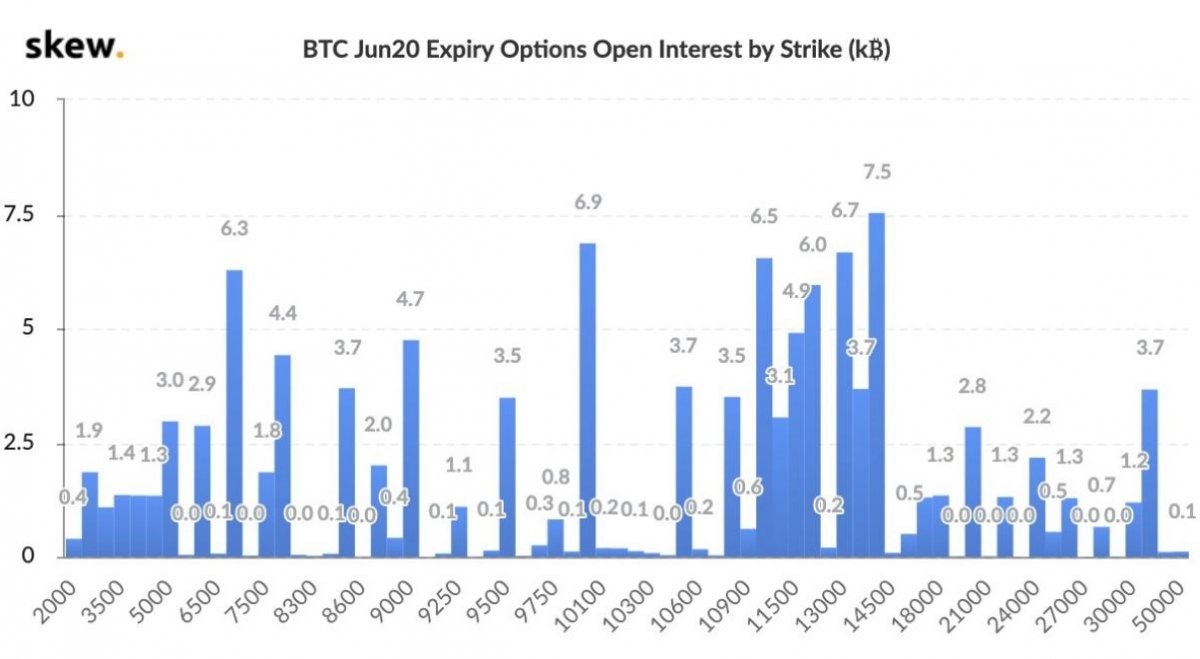

Futures contracts allow traders to long or short cryptocurrency assets without having to buy the underlying assets. The derivative are executed over a period of time where sellers either bet on the price increasing or falling. According to Vishal Shah, a trader in the options market, “this is definitely the largest BTC option expiry by a country mile.” The CEO of Skew, an on-chain data analysis firm, Emmanuel Goh:

With big quarterly expiry, you tend to see some pinning and then the market moving post-expiry.

It is believed that in a way, options traders influence the general direction of the asset’s price in a process referred to as “pinning.” In other words, the traders in the futures market work to sway the spot price of an asset (Bitcoin) in order to avert sharp losses. As Shah explains:

Depending on where the open interest [open positions] is scattered, you could be in the game to pin strikes. The bulk of distribution of OI [open interest] in general is skewed slightly higher.

At the time of writing, Bitcoin is trading at $9,150 after a 1.48% loss on the day. The price slipped marginally under $9,000 after hitting a wall at $9,300. $10,000 remains the ultimate resistance in the medium term. If recovery fails to materialize significantly, a dive towards $8,000 is likely to come into the picture following the expiry of the futures on Friday.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren