Almost 10,000 Bitcoin (BTC) left major United States-based exchange Coinbase on Dec. 30 in a sign that investor appetite is returning to the sphere.

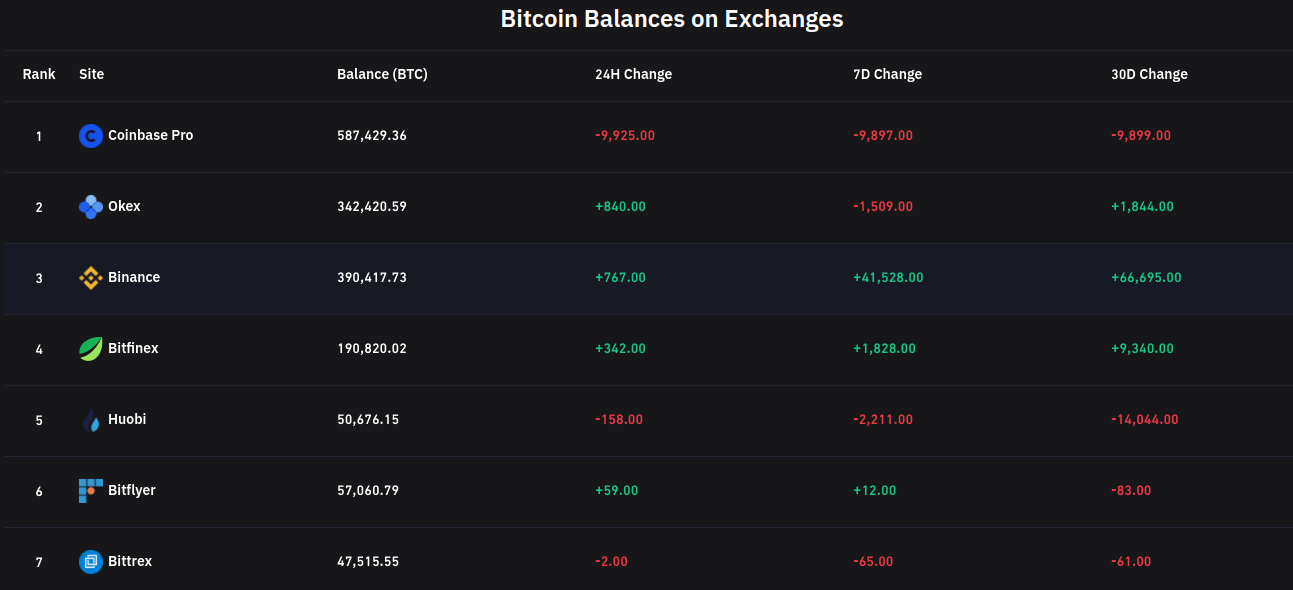

Data from on-chain monitoring resource Coinglass shows Coinbase’s professional trading arm, Coinbase Pro, shedding 9,925 BTC in the 24 hours to New Year’s Eve.

Binance adds 66,000 BTC in December

The buy-in, which runs in contrast to rising or flat balances on other major exchanges, marks a conspicuous short-term trend shift.

The latter half of December has been characterized by platforms such as Binance and OKEx seeing increased inflows of BTC – something commentators feared could be a forewarning of a sell-off.

While such a mass sale of BTC has not yet occurred, not everyone believes that it will stay that way.

At the same time, the exodus of registered Chinese users from exchange Huobi Global could be triggering a reorganization of funds, a more recent theory suggests.

According to Coinglass, Binance is up 840 BTC as of Friday, while OKEx has seen 767 BTC inflows. Huobi has lost a mere 158 BTC, but in December as a whole, a giant 14,044 BTC has left its books, hinting at the extent of the Chinese user exodus.

On the monthly view, Binance easily wins in terms of inflows, now up over 66,000 BTC versus the end of November.

Nonetheless, it was Coinbase attracting pundits as 2021 drew to a close.

“Coinbase buying has been pretty nonstop today,” popular Twitter trader Ryan Clark summarized.

Bitcoin exchange BTC balance summary as of Dec. 31. Source: Coinglass

An institutional “flippening” is coming

Beginning in early January after the holiday period, institutions are predicted to reenter the limelight when it comes to BTC ownership.

In its end-of-year summary and 2022 forecast report, “Just Crypto,” trading firm QCP Capital announced a “flippening” in the investor sphere from retail to institutional.

“In 2022, the first thing we expect to see is a major flippening of crypto ownership from primarily retail to institutional players, with institutions having a much larger participation,” it stated.

Such an event would see big players unfazed by recent price action, with BTC spot allocations still outperforming assets such as crypto stocks in 2021.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.